Indian Steel Market Weekly Snapshot

Hence, following subdued demand & healthy supply, the price range narrowed down in major markets.

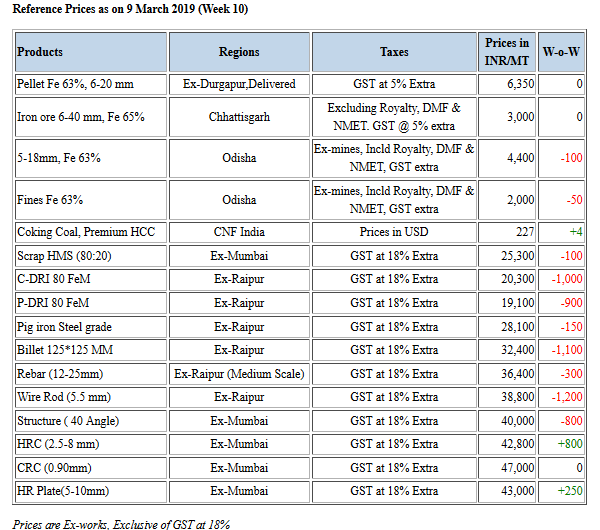

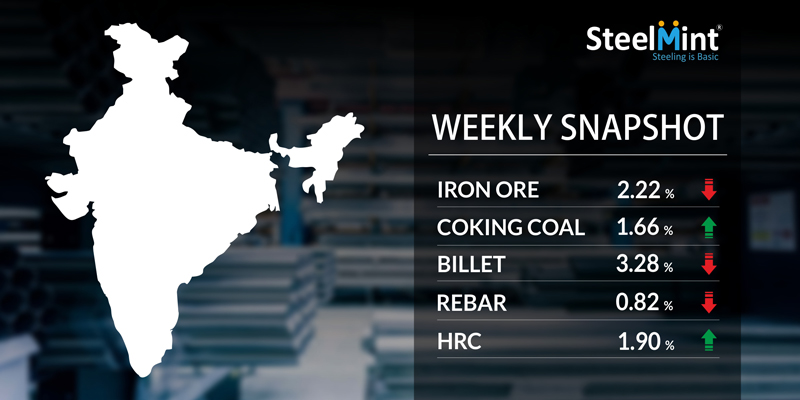

As per SteelMint's assessment, in these days the prices of Semis products - Sponge iron declined by INR 700-1,000/MT(USD 10-14), while Billet upto INR 1,300/MT (USD 19). In line with Finished Long steel, it registered fall of INR 300-1,200/MT (USD 4-17) through the mid sized mills.

However the Flat steel prices continued strong and this week increased by INR 1,000-1,500/MT (USD 14-22) through the traders end.

Iron ore and Pellets

Odisha merchant miners iron ore prices remain unchanged for this week despite prices declined by Essel mining end of last month. OMC Iron Ore Fines E-auction receives good response; 81% material got booked.

-- Indian pellet offers have remained unmoved this week against the previous week’s offer amid low trades and limited inquiries except in Raipur where pellet makers slashed prices. Raipur (central India) based pellet manufacturers reduced offers mid of this week to INR 6,700/MT as against last offer of INR 7,200/MT ex-plant & excluding GST. Southern India (Bellary) pellet offers for Fe 63% grade stable this week at INR 7,300-7,400/MT ex-plant & excluding GST.

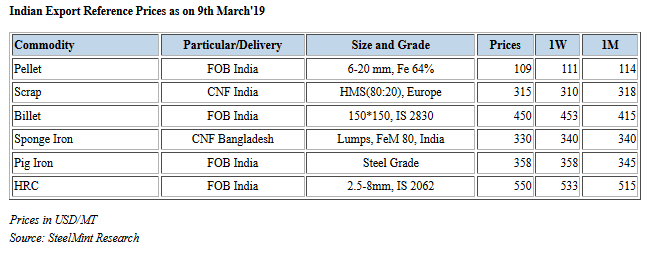

-- Southern India based pellet maker - KIOCL has concluded two pellet export deal this week for 50,000 MT each of Fe 64% content and less than 2% alumina. As per the sources, both the deal were concluded at around USD 116.5/MT, FoB India.

-- MMTC, a leading international trading company in India and one of the major global players in minerals trade inviting tender for supply of 225,000 MT low-grade iron ore fines. The due date for submitting the offer is 14 Mar’19 at 15:00 Hrs.

Coal

Seaborne metallurgical coal prices were mostly stable over the past two weeks, on hushed trading activity in the Chinese market, although demand for April-delivered premium cargoes was observed.

Nevertheless, prices for seaborne coking coal have remained firm as of late, primarily because of persistent tight supply of Australian Premium Low Vol coal, in particular. Meanwhile, certain sellers were heard unwilling to offer cargoes as they awaited the result of a buy tender issued by a major China-based steel mill seeking 85,000 MT of Premium Low Vol Saraji or Peak Downs with April laycan. Market sources expect that there could be restocking demand in the near term as more steelmakers would return to fully restock, after their weeklong absence during the Chinese New Year holidays.

-- Latest offers for the Premium HCC grade are assessed at around USD 227.20/MT. CNF India.

Scrap

Indian imported scrap market observed less trades this week amid disparity between bids and offers. Prices rebound by USD 5-8/MT W-o-W following strengthening global prices after last week’s fall, it is anticipated that prices may remain high in the near term on strong demand.

-- SteelMint’s assessment for containerized Shredded stands at around USD 335/MT CFR Nhava Sheva. HMS 1 from Dubai and South Africa assessed at around USD 325/MT CFR, with buyers expectation at USD 320/MT CFR, while West African HMS assessed around USD 310-315/MT CFR Goa & Chennai.

-- After witnessing recovery domestic scrap prices showed correction this week by INR 300-500/MT on demand concerns in Semi-Finish market.

Semi Finished

Indian Semis market reported limited trade activities as Billet prices fall by around INR 400-1,300/MT and major slide seen in central & western India following price corrections in finished products. Inline Sponge iron marked price fall of INR 700-1,000/MT in across major markets.

Meanwhile pig iron observed slight fall and in a week recorded down by INR 100-200/MT in central & eastern regions.

-- SAIL’s Rourkela Steel Plant (RSP) tender held on 5th Mar'19 to sell about 10,550 MT steel grade pig iron & has received weak response. The base price for the tender was quoted by RSP at INR 27,400/MT (ex-plant) and near about 88-90% remained unsold.

-- Indian mid sized mils export offers to Nepal stood at USD 450-550/MT for Billet (100*100mm) & USD 520-525/MT for Wire rod (5.5 mm) ex-mill at Durgapur, Eastern India. Freight cost to Nepal at around USD 30/MT CNF Raxaul border.

-- Jindal Steel has reduced pig iron prices by INR 200/MT and offered steel grade at INR 27,800/MT as against last week at INR 28,000/MT ex-plant, Raigarh, Central India.

-- Indian Sponge iron export offers to Bangladesh unchanged this week and as per exporters demand improved at the price of USD 310/MT CPT Benapole (dry port of India & Bangladesh) & USD 330/MT CFR Chittagong, Bangladesh.

-- Neelachal Ispat Nigam Ltd (NINL)- India’s largest and state-owned steel grade pig iron manufacturer & exporter has roll-over steel grade pig iron prices at INR 26,750-27,150/MT ex-plant, Cuttack, Eastern India

-- SteelMint's Pig iron export price assessment stood at USD 355-360/MT FoB India, USD 330-340/MT FoB Brazil & USD 335-345/MT FoB Black sea.

Finish Long

Indian Finish Long steel market remained dull since the beginning of week and prices registered fall of INR 1,200-1,400/MT in Rebar & Structures amid weak sentiments surroundings in most of the regions.

However, price range has been slightly improved in last couple of days and strengthening stock level is now close to average basis, as per sources.

Further, Re-rollers Association in specified regions has taken the steps to prevent narrowed conversion spread from Billet to Rebar and following changes have taken placed.

-- Central region Chhattisgarh (Raipur) based Re-rollers Association has increased rebar guage parity by INR 300/MT to INR 2,500/MT (12-25 mm) w.e.f. 05th Mar'19 and basic size considered as 28 mm.

-- West region Maharashtra (Mumbai) based Association has increased rebar guage parity by INR 300/MT to INR 4,000/MT (8 mm) & INR 3,500/MT (32 mm) w.e.f. 09th Mar'19.

-- Current trade reference rebar prices (12-25 mm) assessed at INR 38,600-39,000/MT Ex-Jalna & INR 36,200-36,500/MT Ex-Raipur; basic & excluding GST.

-- During the week, central region based heavy structure manufacturers have maintained trade discount at around INR 200-400/MT and current trade reference prices at INR 40,500-40,800/MT (200 Angle) ex-work.

-- Few Indian large mills have increased rebar offers up to INR 1,500/MT towards the beginning of month for March deliveries. However after that no further price revision in the current week. Presently, rebar offers by large mills stood at close to INR 41,500-42,000/MT ex-Mumbai, 12 mm & excluding 18% GST.

Flat Steel

This week Indian HRC prices witnessed slight increase in traders market after announcement of sharp price hike by INR 1,000-1,500/MT by major Indian steel mills last week for March deliveries. However dull trades and lowered automobile sales restricted surge in prices in trade segment this week.

-- Current trade reference prices in traders market for HRC (IS2062) 2.5 mm-8 mm is around INR 42,500-43,000/MT ex-Mumbai, INR 43,000/MT ex-Delhi & INR 44,500-45,000/MT ex-Chennai. The prices are basic, excluding GST on cash payment basis.

-- Meanwhile trade reference prices for CRC (IS513) 0.9 mm is hovering in the range of INR 46,500-47,000/MT ex-Mumbai, INR 47,500-49,000/MT ex-Delhi & INR 50,500-51,000/MT ex-Chennai. The prices are basic, excluding GST on cash payment basis.

-- HRC export offers from few mills in India are assessed around USD 560/MT CFR Vietnam, up by USD 5-10/MT. It is expected that offers may increase further.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Goldman told clients to go long copper a day before price plunge

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge