SE Asia: Imported Scrap Market Observes Limited Trades

Vietnam steel mills eye drop in offers, few deals reported - According to sources, Vietnam steelmakers have observed some conclusions however overall sentiments remained slow. Offers for bulk HMS (80:20) was assessed around USD 335-340/MT, CFR from US and USD 340/MT, CFR from Australia. Offers remain around USD 330-335/MT, CFR South Korea however, very limited inquiries heard.

In recent trades, a northern region based steel mill booked Hong Kong origin HMS 1&2 (50:50) scrap in bulk volume at around USD 339-340/MT, CFR. A bulk cargo comprising Japanese premium scrap heard to have booked at around USD 375/MT, CFR Vietnam.

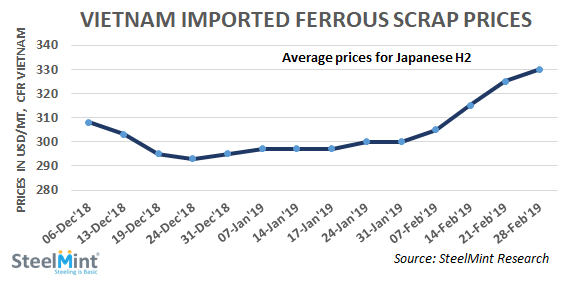

Buying interest for Japanese scrap remains weak - According to sources, some bids for Japanese H2 reported at around USD 330-332/MT, CFR Vietnam in bulk cargoes. Japanese H2 offers remain in the range JPY 33,000-34,000/MT, FoB Japan while domestic scrap price stands at JPY 34,000/MT at Utsunomiya works of Tokyo Steel.

South Korean scrap demand remained subdued - Amid high inventories, Hyundai Steel hasn’t presented open bids for Japanese scrap since past one month, and also stopped purchases of higher grade scrap from Japan.

As per SteelMint’s Statistics -

-- Japan’s exports to Vietnam fell sharply by 73% M-o-M to 46,956 MT ferrous scrap against 174,962 MT in Dec’18.

-- Thailand’s ferrous scrap imports recorded at 101,990 MT in Jan’19, down 2% M-o-M against 104,491 MT in Dec’18 and down 43% Y-o-Y against 178,698 MT in Jan’18.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Fortuna rises on improved resource estimate for Senegal gold project

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Copper price slips as unwinding of tariff trade boosts LME stockpiles

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Fresnillo lifts gold forecast on strong first-half surge

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

What’s next for the USGS critical mineral list

South Africa looks to join international diamond marketing push

Copper price gains on Chinese demand, Chilean supply risks

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

South Africa looks to join international diamond marketing push

Copper price gains on Chinese demand, Chilean supply risks

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations