Indian Steel Market Weekly Snapshot

The suppliers were in hurry, although buyers were cautious to take positions on assumptions of further decline.

Further the mid sized mills in major markets reported that rising inventories may keep prices under pressure in near term, if demand remains poor.

However Indian mills have raised flat steel prices sharply amid high raw material cost.

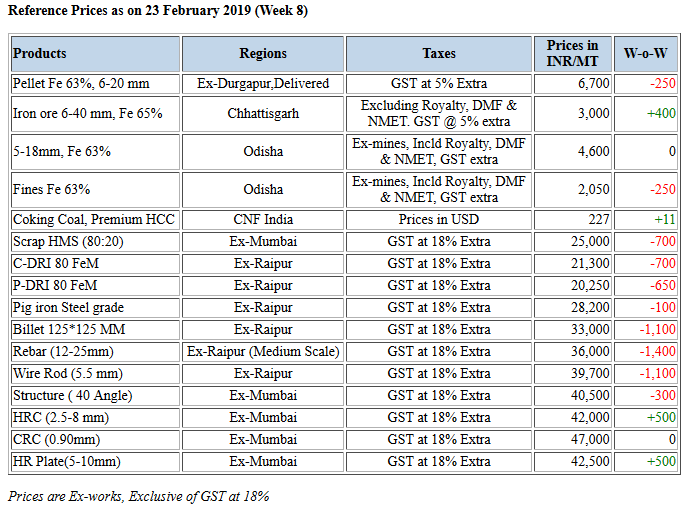

As per SteelMint's assessment, in these days prices of Semis products (Billet & Sponge iron) have declined by INR 500-1,500/MT (upto USD 21) & Finished long steel upto INR 1,700/MT. Meanwhile, Finished flat steel prices surge by INR 500-1,000/MT.

Iron ore and Pellets

NMDC Ltd, India's biggest iron ore producer, has raised prices of the mineral from its CG mines up to INR 490/MT (upto 17%).

Few Odisha based major merchant miners are heard to have increased offers on bulk quantity purchase of fines against the last offer. Current trade prices for fines (Fe 63%) for bulk bookings is around INR 2,000-2,100/MT (ex-mines, including Royalty, DMF & NMET), down against last week's assessment of INR 2,300/MT.

-- Durgapur pellet offers have further declined towards the end of the week at INR 6,700/MT against the assessment made earlier this week at INR 7,000/MT. Raipur (Central India) based pellet manufacturers have reduced offers to INR 7,600/MT as against last offers INR 8,000/MT (ex-Raipur, GST extra). Buyers are eyeing for further drop in pellet offers looking at the decline in P-DRI prices.

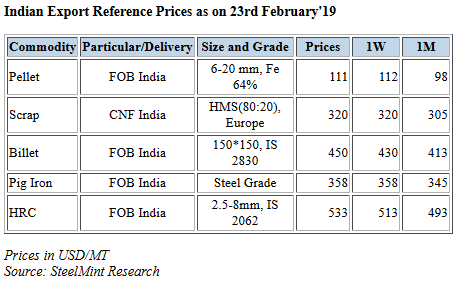

-- Chinese mills have lowered inquiries for pellets and high grade ore amid shrinking steel margins. Although no fresh deals were reported but indications for buying interest of Indian pellet export prices was heard around USD 115-120/MT, CFR China for 3% Alumina pellets.

Coal

Seaborne metallurgical coal prices are gradually trending up with Chinese buyers slowly returning to the market although trading activity appears thin due to lack of urgent demand from end-users. However, seller sources expect restocking activities to take place in the near term, amid limited supply of cargoes with March and April laycan. Meanwhile, there are still lingering concerns regarding Australian coking coal arriving in China.

-- Latest offers for the Premium HCC grade are assessed at around USD 215/MT FOB Australia & USD 226.50/MT on CNF India basis, for delivery by Panamax vessel.

Scrap

SteelMint’s assessment for containerised Shredded from the USA and UK stands at around USD 335-340/MT, CFR Nhava Sheva, down by USD 5/MT against the last report. Offers from suppliers were being quoted at USD 340/MT, CFR, but hardly any major deal was reported, as buyers kept waiting for further decline in offers.

-- South African HMS 1&2 prices was assessed USD 330/MT, while trades in 20-21 MT containers for West African HMS 1&2 scrap reported in the range of USD 310-315/MT, CFR India, lower by USD 5-10/MT against previous week. HMS offers from Dubai were reported around USD 330-335/MT, CFR Nhava Sheva. Domestic scrap prices in India have come down sharply making it more competitive over imported scrap.

Semi Finished

As per SteelMint assessment, domestic Sponge iron & Billet prices have declined by INR 500-1,500/MT (USD 7-21). In this period major fall in Sponge & Billet seen in Durgapur by INR 1,300-1,500/MT due to limited domestic & exports enquiries.

-- Jindal Steel has reduced pig iron prices & offering steel grade at INR 28,000-28,200/MT as compared to last week at INR 28,300-28,500/MT ex-plant, Raigarh, Central India.

-- Medium mills export offers to Nepal fall sharply this week by USD 25-30/MT on declining domestic prices. Price assessment stood at USD 440/MT for Billet (100*100 mm) & USD 515-520/MT for Wire rod (5.5 mm), ex-mill at Durgapur.

-- RINL has invited tender for export of 8,127 MT Billets to Nepal. Interested bidders can submit their bids till 26 Feb’19 at 15:00 hrs.

-- NINL extended domestic Pig iron price circular due date to 27th as against earlier on 22nd Feb'19. The company's offer for Steel (N1) grade hovering at INR 26,750-27,150/MT; ex-Cuttack, East India.

-- MMTC- India’s largest trading house, has floated export tender of 30,000 MT Pig Iron on behalf of NINL. The due date for submission of bids is 07 Mar’19.

-- Indian sponge iron export offers reduced by USD 15/MT W-o-W, price assessment for 80 FeM sponge lumps are at USD 320/MT CPT Benapole (dry land port of Bangladesh & India) and USD 340/MT CFR Chittagong, Bangladesh.

-- In the initial days of week - SAIL's IISCO (Burnpur based plant) has sold basic grade pig iron at around INR 26,800-27,000/MT for couple of rakes (5,200-5,400 MT) in the local market.

-- SAIL has floated the export tender for 16,200 MT billets from its Durgapur Steel Plant. The due date for bid submission was on 19 Feb’19. While another export tender of 24,300 MT Billets floated on 16th Feb’19 which is valid till 25th Feb’19.

-- SteelMint's Pig iron export price assessment stood at USD 355-360/MT FoB India, USD 330-340/MT FoB Brazil & USD 335-345/MT FoB Black sea.

Finish Long

Finish long steel market remain depressed amid weak sentiments and thin trade volume, resulted fall in price range up to INR 1,700/MT in Rebar & INR 1,600/MT in Structures, W-o-W.

Further, Central region mills are operating about 75% production levels & Western region based few mills have adjusted production level, according to market requirement.

Current trade reference Rebar prices (12-25 mm) assessed at INR 38,400-38,700/MT Ex- Jalna & INR 35,800-36,000/MT Ex- Raipur. All prices mentioned above are basic & excluding GST.

During the week, Central region based heavy structure manufacturers have slashed trade discount to INR 100-200/MT against earlier of INR 800-1,000/MT and current trade reference prices at INR 41,600-41,800/MT (200 Angle), ex-work.

-- Large mills have not increased prices further in long product in the current week. Earlier in the month, all major mills has increased prices in Rebar by INR 500-2,000/MT; SAIL and JSW steel hike rebar prices twice in Feb'19 by about INR 1,000/MT and INR 2,000/MT, respectively.

-- Currently trade reference prices for 12 mm Rebar is hovering at INR 41,000/MT ex-Mumbai, excluding GST.

-- A large mill based in Southern India has also exported Rebar at around 37,000 MT so far in the month from Chennai port, as per our custom data.

-- Blast furnace grade wire rod (5.5-6.0 mm) offers in Jharkhand (Bokaro) is hovering at INR 42,000/MT ex-mill and for exports at around USD 570-575/MT CNF Nepal (Raxaul border).

-- JSPL has been awarded an additional order for supply of 30,000 tonnes from Indian Railways under global tender. The additional order enhances the order size by over 30%, with the overall order size now estimated at around INR 650 crore.

Finish Flat

In the beginning of week major Indian steel manufacturers have further raised HRC & CRC prices by INR 500-1,000/MT for domestic buyers.This is 2nd price hike by Indian steel mills during Feb'19.

Towards the beginning of month Indian steelmakers have also announced price hike of INR 750-1,000/MT in flat steel for Feb deliveries in anticipation of higher steel prices in global market post Chinese New Year holidays.

Indian steel mills are constantly raising flat steel prices amid higher raw material costs and restocking demand in domestic market.

-- After increase, the trade reference prices in traders market for HRC (IS2062) 2.5 mm-8 mm is around INR 42,000/MT ex-Mumbai & INR 42,000-42,500/MT ex-Delhi. Meanwhile the prices for CRC (IS513) 0.9 mm is hovering at INR 47,000 /MT ex-Mumbai & INR 47,500-48,250/MT ex-Delhi. The prices mentioned above are basic, excluding GST@18% on cash payment basis.

-- Indian steel mill increases HRC export offers for Vietnam by USD 5-10/MT for March shipments & assessed around USD 545-550/MT against last week trades at USD 540/MT; CFR.

-- India has extended a compliance deadline by another two months on tougher import rules for some grades of steel that are used in the auto sector. Compliance for the new rules that had been earlier set for 17 Feb’19 have been extended till 17 Apr’19-Reports The grades of steel that have received the deadline are (all the grades of) steel available in Indian Standards IS: 4454 (Part I): 2001, IS: 4454 (Part II): 2001, IS: 1169 (Part I): 1984 & IS: 6603: 2001, IS 6527: 1995 & IS 6528: 1995.

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

What’s next for the USGS critical mineral list

South Africa looks to join international diamond marketing push

Copper price gains on Chinese demand, Chilean supply risks

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

South Africa looks to join international diamond marketing push

Copper price gains on Chinese demand, Chilean supply risks

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations