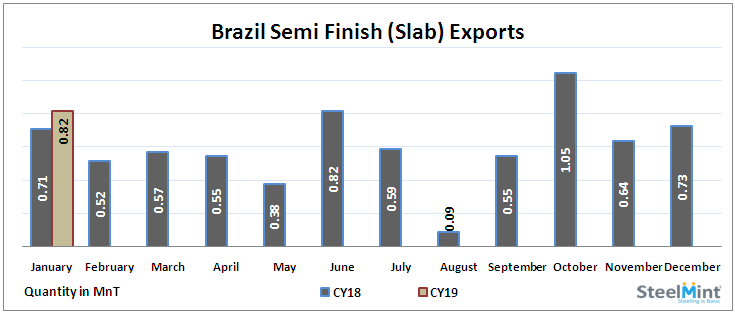

Brazil Slab Exports Up 11% in January 2019

As per recent released data by Brazilian customs - in Jan’19, Slab export rise by 11.48 % M-o-M as against 731,507 MT in Dec’18 & recorded 2 month high, While on yearly basis, exports surge by 14.58% against 711,707 MT in Jan’18.

During Jan’19, United States has imported approximately 48% (390,961 MT) Slabs & continues to remain the largest Slab buyer of Brazil. And it was noticed that Slab export to US rise by 56.35% in Jan’19 as against 250,041 MT in Dec’18. Inline the other largest importer of Brazilian originated Slab in Jan’19 was Italy (134,927 MT), Germany (62,866 MT) & Belgium (50,589 MT).

During April to January’19, the most favourable export destination of Brazilian Slab was - United States (3,402,783 MT), Canada (373,201 MT) & Dominican Republic (321,600 MT).

In January, the major export of Slabs were from the ports of Vitoria (325,858 MT), Fortaleza Porto (291,391 MT) & Itaguai (197,833 MT). While approximately 40% of exports were done from the port of Vitoria in Jan’19.

-- During Dec’18, the crude steel production of Brazil was around 2,644,228 MT and in CY18 (Jan-Dec) it was approximately 34,558,843 MT & 34,396,100 MT in CY17, according to the World Steel Association.

-- Brazil Iron ore & pellet export decline slightly in Jan'19 & stood at 33,160,673 MT as against 33,202,915 MT in Dec'18

-- The export offers of 150*150 IS 2830 grade billet are currently at USD 425-435/MT FoB India, 150*150 Q235 are at USD 460-470/MT FoB China & 125*125 3sp at USD 435-445/MT FoB Ukraine.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Copper price collapses by 20% as US excludes refined metal from tariffs

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Goldman told clients to go long copper a day before price plunge

Copper price posts second weekly drop after Trump’s tariff surprise

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge