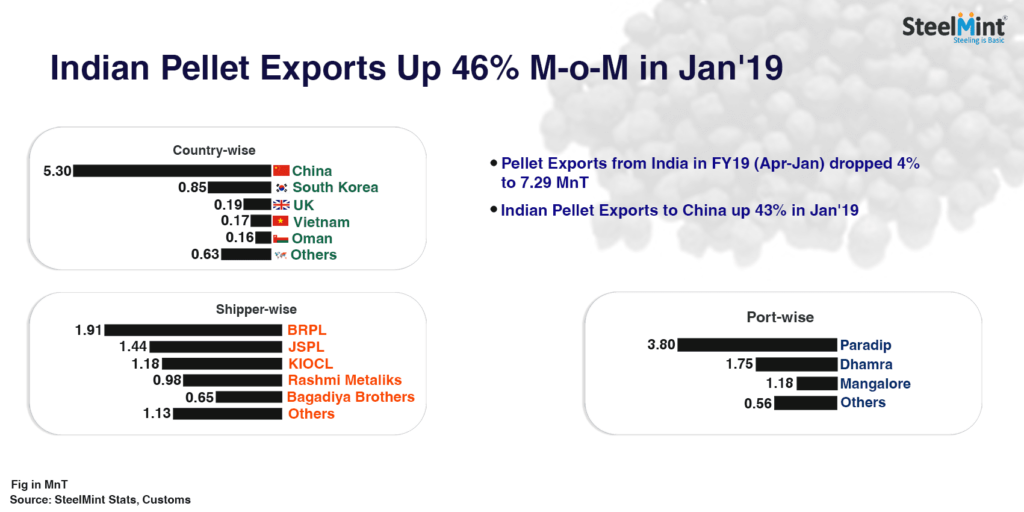

Indian Pellet Exports Up 46% in Jan'19

For FY19 (Apr-Jan) the total pellet exports recorded at 7.29 MnT as against 7.63 MnT for same duration FY18 (Apr-Jan). The exports for the year witnessed on lower side due to less stringent regulations in China resulting in shift to lower and medium grade fines.

Why Indian Pellet Export volumes increase in Jan'19?

Restocking ahead of Lunar New Year Holidays: Indian pellet exports to China in Jan'19 picked up amidst rising restocking demand by Chinese mills due to Lunar New Year holidays (5th Feb-19th Feb).

SteelMint's pellet export price assessment stood at USD 101 MT, FoB India in Jan'19 against 100 USD/MT in Dec'18.

China's pellet import from India up 43% in Jan'19

China continues to be the largest importer of Indian pellet in Jan'19 with imports of 0.70MnT, up by 43% as against 0.49 MnT in Dec'18. Oman stood the second largest importer at 0.16 MnT, followed by Turkey at 0.07 MnT and South Korea at 0.06 MnT.

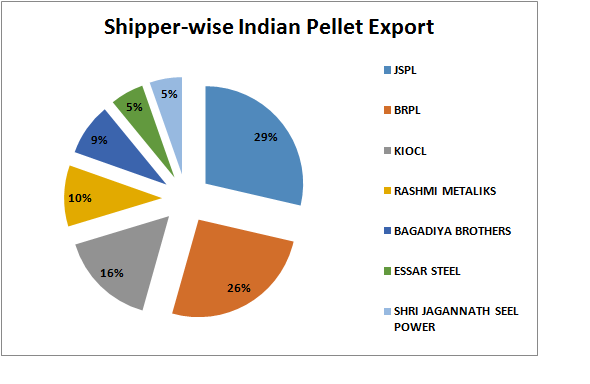

JSPL exports up significantly in Jan'19

JSPL stood the largest exporter for Jan'19 with exports at 0.29 MnT up significantly as against 0.05 MnT in Dec'18. BRPL recorded pellet exports at 0.26 MnT (up 18% M-o-M), followed by KIOCL at 0.16 MnT and Rashmi Metaliks at 0.10 MnT.

Paradip port contributed 60% of pellet export in Jan'19

Pellet exports from Paradip port recorded at 0.62 MnT, followed by Dhamra port at 0.24 MnT and Mangalore port at 0.16 MnT.

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Barrick’s Reko Diq in line for $410M ADB backing

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Pan American locks in $2.1B takeover of MAG Silver

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Gold price gains 1% as Powell gives dovish signal

Nevada army depot to serve as base for first US strategic minerals stockpile

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook