Mirasol Resources expands in southern Argentina

In a press release, Mirasol explained that under the terms of the agreement, it can acquire 100% of the Marcelina claims from a privately-owned mining company by making staged option payments totaling $3.4 million over four years. The company would also have to invest at least $300,000 in exploration during the first three years of the option period and the claims would be subject to a 1.5% NSR royalty.

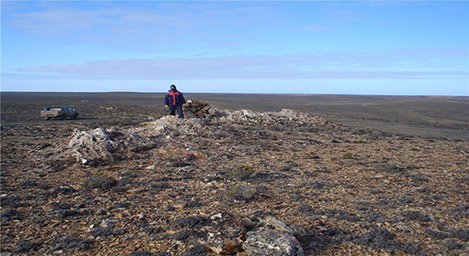

The consolidation would expand the Sascha – Marcelina project to 30,600 hectares. According to the Vancouver-based miner, the district has a footprint in excess of 65 square kilometres, as defined by anomalous Au+Ag rock chip samples and satellite-based alteration mapping.

In the media brief, Mirasol also said that multi-kilometre long Au+Ag vein and structural trends, which traverse and outcrop surrounding the Marcelina Silica Cap, display similarities in areal extent and geological setting to the Cerro Negro Silica Cap, where GoldCorp (TSX:G, NYSE:GG) operates the Vein Zone and Bajo Negro mines in the Cerro Negro Au+Ag mining district, located 100 kilometres to the north of Sascha-Marcelina.

“Rock chip samples from the Sascha-Marcelina district have assays ranging from weakly Au anomalous (10's ppb) in the area of the Silica Cap (above the mineralized epithermal interval), up to a peak assay of 160 g/t Au, (5.14 opt) and 780 g/t Ag (25.07 opt) at the Sascha Main prospect,” the company stated.

Mirasol said it is now mobilizing a field team to the Marcelina district to begin a program of systematic surface exploration to define drill targets.

“Consolidation of the very prospective Sascha and Marcelina projects into a large-scale district play has been a long-term objective of Mirasol. This agreement will allow the multiple underexplored prospects to be systematically explored utilizing the company's knowledge of large-zoned epithermal Au+Ag districts, gained through more than 15 years of successful exploration in Santa Cruz province,” President and CEO, Stephen Nano, said in the statement.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

Goldman told clients to go long copper a day before price plunge

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project