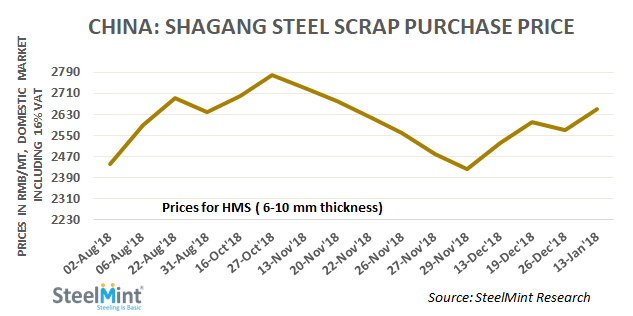

China's Shagang Steel Lifts Scrap Purchase Price by USD 12

After witnessing a price cut by RMB 30/MT on 26th Dec, the company might have lifted scrap prices amid tight availability and concerns of heavy smog in the domestic market.

Consequently, Shagang Steel is paying RMB 2,650/MT (USD 393) inclusive of 16% VAT for HMS (6-10 mm thickness) delivered to headquarter works situated in Zhangjiagang north of Shanghai in China, up RMB 80/MT against the last report of RMB 2,570/MT on 26th Dec’18.

Following Shagang’s lead, many other leading scrap consumers like Maanshan steel, Nanjing Steel, Zenith Steel and Yonggang raised scrap purchase prices by RMB 30-80/MT in eastern China.

Shagang Steel rolled over finish long prices for mid-January shipment - The mill is selling its HRB400 16-25 mm dia rebar at RMB 3,880/MT (USD 573) over the December 11-20 period, stable against the last set of prices for early-Jan’19 shipments. While that for HPB 300 6.5 mm dia wire rod holds at RMB 3,980/MT (USD 594) over the same period. All prices are on an ex-works basis, including 16% VAT.

Shanghai rebar prices stand almost steady in the range RMB 3,740-3,780/t ex-warehouse as demand is sluggish ahead of the Lunar New Year holiday. Worsening pollution in north China cities such as Beijing may prompt the government to restrict steel-making in the near-term, said market participants.

Today, rebar prices in China's domestic market increased slightly amid a hike in futures.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million