FLASHBACK: Gold price fat finger – 56 tonnes gone in 60 seconds

The stock quickly recovered and traders immediately pointed to the most likely reason for the strange dealings – a fat finger.

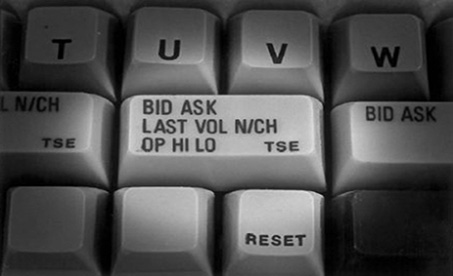

Fat finger trades are human errors – more often than not pressing the wrong buttons SGX later on Thursday said fat fingers or a technical glitch were not to blame and that the trades were orderly (albeit baffling).

In June 2017, the Comex gold market in New York also fell victim to a fat finger that saw a trade executed at some 100 times usual size resulting in a 1.6% drop in the price (the metal also recovered later in the day).

This was MINING.com's report at the time:

Ross Norman, CEO of gold trader Sharps Pixley, ascribes the sharp decline to a 60 second 56 tonne (1.8m ounces) trade executed at 9am in London:

"This bears the hallmarks of a fat finger 'muppet' – a trade of 18,149 ounces would be a very typical trade, but a trade of 18,149 lots of a futures contract (which is 100 times bigger) would not be… it leaves us wondering if a junior had got confused between "ounces" and "lots"… or maybe an incorrectly programmed algo ahead of options expiry on COMEX … we just don't

know."

Norman points out that if the trade, which may also have been carried out by a central bank or a large-scale speculator opening a short position, was indeed an error, the gold price bear who made the move is nursing a $36 million loss at this point:

"The big take-away though from all this is that the gold market absorbed a massive $2.2 billion in gold sales in less than a minute and during a period of illiquidity … and it ONLY moved the needle 1% lower."

On Thursday gold was trading at $1,279 an ounce in New York, down $4.30 on an uneventful day with 218,101 lots traded by mid-afternoon.

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project