Iron Ore Prices Seen Stagnant on Rising Supplies, Asia Demand to Support

The trigger for price falls has come from the largest steel producer China that is facing a slower economic growth and is modernizing its industry to cut pollution. Large stocks of steel scrap available for recycling is also damping the outlook for iron ore.

However, the second largest steel producer – India -- where a spate of M&As has brought large metal producers to shore, is promising large-scale expansion of steel capacities and as a result, a rising appetite for iron ore.

“In India, the supply-demand situation may remain pretty tight. But otherwise, globally, supply is copious so prices won’t be affected,” said Amit Dixit, associate vice president at Edelweiss Financial Services.

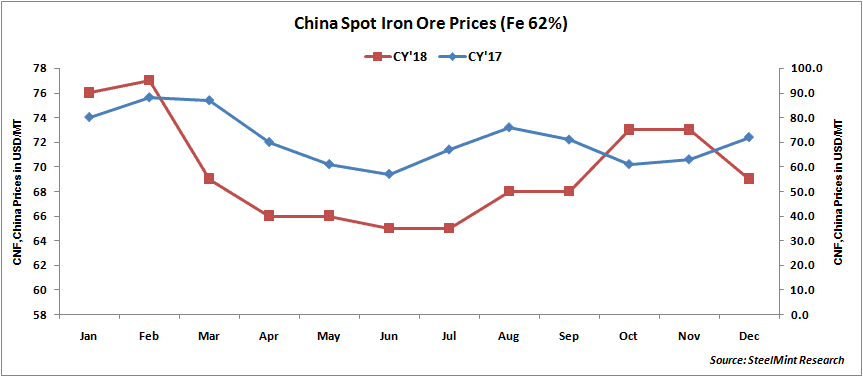

According to Edelweiss, global iron ore is seen at $65 a tonne (62% iron content, FOB) in 2019, a notch down from $66.1/ tonne in 2018.

The company sees the downward pressure continuing, resulting in a dip to $62/tonne in 2020.

“Few years ago, new mines came up in Australia and Brazil which are now working at optimum capacity,” said Hitesh Avachat, group head – corporate ratings at Care Ratings Ltd. “So, iron ore production is matching the rise in demand from the steel sector.”

Like Dixit, Avachat also predicted nearly similar prices of iron ore this year. Avachat said average global prices are unlikely to fall below $60/tonne. He attributed the US shutdown and uncertainty on account of upcoming Indian general elections to have prompted the recent plunge in iron ore prices.

The World Steel Association has forecast that the global steel production will rise by 1.4% to reach 1,681.2 million tones this year. In India and other Asian countries, the growth is expected to be much higher.

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

China quietly issues 2025 rare earth quotas

BHP delays Jansen potash mine, blows budget by 30%

BHP, Lundin JV extends useful life of Argentina copper mine

Gold price eases after Trump downplays clash with Fed chair Powell

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

KoBold signs Congo deal to boost US mineral supply

Spring Valley gold project in Nevada gets federal approval

Copper price pulls back sharply ahead of US tariff deadline

Teck approves $2.4B expansion of Highland Valley Copper

Titan Mining targets Q4 2025 to become only integrated US graphite producer

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

Copper price hits new record as tariff deadline looms

Glencore workers brace for layoffs on looming Mount Isa shutdown

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Titan Mining targets Q4 2025 to become only integrated US graphite producer

Energy Fuels surges to 3-year high as it begins heavy rare earth production

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

Copper price hits new record as tariff deadline looms

Glencore workers brace for layoffs on looming Mount Isa shutdown

Resolute publishes initial resource for satellite deposit near Senegal mine

Brazil producers look to halt pig iron output as US tariff threat crimps demand

US targets mine waste to boost local critical minerals supply

Gold price eases after Trump downplays clash with Fed chair Powell