Imported Scrap Prices Edge Down; Limited Trades Reported

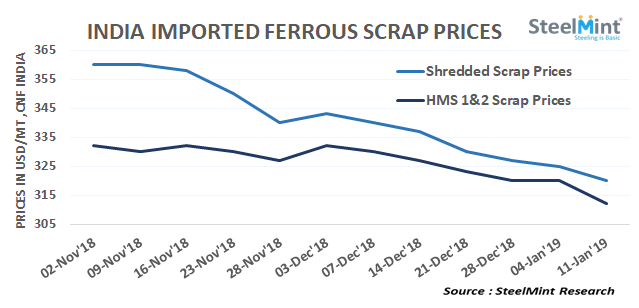

SteelMint’s assessment for containerized Shredded from the UK and Europe moved down in the range USD 315-320/MT, CFR Nhava Sheva, down USD 4-5/MT on W-o-W basis. Suppliers keep quoting Shredded scrap offers at around USD 320/MT, CFR Nhava Sheva however, buyers expectation remained mostly at USD 314-315/MT, CFR.

A few trades for Containerized Shredded scrap heard concluded at around USD 314-315/MT, CFR and Turnings scrap sold in the range USD 285-290/MT, CFR Nhava Sheva.

Sheared HMS containing a minor impurity, from UK/Europe also reported to have booked at around USD 287-290/MT, CFR levels, down USD 8-10/MT on W-o-W basis.

Dubai based containerized HMS booked at around USD 308-310/MT, CFR Nhava Sheva. While offers from the Middle East for HMS remained volatile in the range of USD 310-320/MT, CFR depending on quality.

South African HMS 1&2 scrap traded at USD 318/MT, CFR down USD 10-12/MT against the last assessment at around USD 330/MT, CFR. While very limited offers heard for West African HMS 1&2 scrap this week. HMS 1&2 (80:20) from Europe and UK assessed at around USD 310-315/MT, CFR Nhava Sheva.

Indian domestic scrap prices exhibit a mixed trend on W-o-W basis - Local HMS scrap prices in all major regions have shown mixed trends on a weekly basis in India. Price assessment for HMS 1&2 (80:20) stands at INR 25,100-25,300/MT (USD 356-359), ex- Mumbai, stable on a weekly basis. Chennai based local HMS (80:20) prices stand at around INR 24,300/MT, ex- Chennai, stable W-o-W, 18% GST extra.

Ship plate prices stand at around INR 29,700-29,900/MT, ex-Alang levels for 16 mm plate today, down INR 200-300/MT against last week W-o-W.

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

NextSource soars on Mitsubishi Chemical offtake deal

Uzbek gold miner said to eye $20 billion value in dual listing

Australia weighs price floor for critical minerals, boosting rare earth miners

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF