Indian Sponge Makers Prefers Iron ore Over Pellets

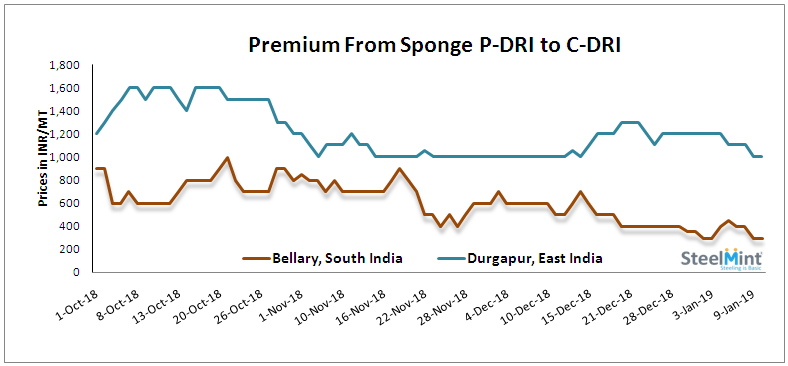

This has led to improved supply of sponge iron (C-DRI) in merchant market, there by narrowing down in premium from P-DRI to C-DRI and the sharp fall in prices. In a month, sponge prices were down by INR 1,200-1,500/MT & premium fell by INR 300-500/MT to INR 1,000/MT in eastern India.

Further as per assessment, in last couple of month's Iron ore prices dropped by 30-35%, while pellets by 25-30% in domestic market.

SteelMint analysis shows that the landed cost of size ore (Iron ore) is cheaper by INR 300-500/MT compared with pellets in Central & Eastern India. Also the producers are fetching premium of INR 1,000/MT on sponge lumps. Hence Iron ore is more preferred than pellets.

The iron pellet manufacturers being confirmed poor buying interest at current offers and if there are inquiries it is on lower price by INR 300-500/MT than the floating offers.

Also it should be noted that, the sponge manufacturers was quite active to book Ore in recent reduce prices by Odisha's 2nd largest miner - Serrajuddin Mines. As per reports, the miner booked close to 1 lakh metric tone lumps on reduced prices by INR 500/MT (USD 7) in couple of days.

The current offers for Fe 63% pellets hovering at INR 5,600-5,700/MT in Durgapur & INR 6,000/MT ex-Raipur, excluding GST. Meanwhile the Iron ore prices in Odisha (5-18 MM, Fe 63%) hovering at INR 3,800-4,000/MT, inclusive of royalty, DMF & NMET. GST @ 5% extra.

Market believes domestic sponge prices to remain volatile on strong supply amid good margins. Also pellet prices to come down on piled up stock with the producers.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Copper price collapses by 20% as US excludes refined metal from tariffs

Gold price rebounds nearly 2% on US payrolls data

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

B2Gold gets Mali nod to start underground mining at Fekola

Copper price posts second weekly drop after Trump’s tariff surprise

Goldman told clients to go long copper a day before price plunge

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project