Vietnam’s Steel Imports Fall, Exports Surge in 2018

The major steel importing countries for Vietnam are China, Japan, and South Korea.

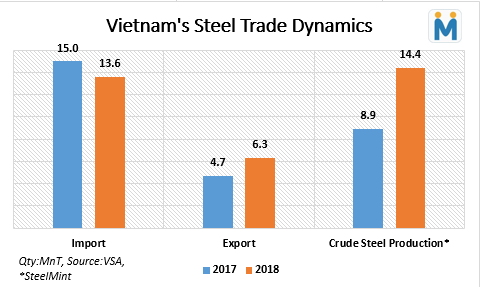

In terms of overseas sales, the country exported 6.3 MnT of steel in 2018 up by 34% against exports in 2017. Vietnam reaped about USD 4.6 billion from exports, an increase of 45% y-o-y basis. The key countries for Vietnam’s steel and iron exports in 2018 were U.S, Japan, Cambodia, and Thailand.

MoIT advises exporters to follow origin regulations

Recently Vietnam’s Ministry of Industry and Trade (MoIT) has advised Vietnamese exporters to strictly abide by regulations related to products’ origin. This comes as many members of the World Trade Organisation (WTO) have strengthened trade safeguard tools to protect their domestic industries.

As of December 2018, 19 investigations were launched on export products from Vietnam with majority investigations being launched on steel. The US Department of Commerce initiated an anti-dumping investigation and countervailing duties on corrosion-resistant steel products imported from Vietnam due to suspicion of tax evasion.

The Canadian Border Service Agency (CBSA) also initiated a dumping investigation on a number of carbon welded steel pipe products originating or imported from Pakistan, the Philippines, Turkey, and Vietnam.

|

The Ministry of Industry and International Trade Malaysia (MITI) initiated a dumping investigation on a number of alloyed or non-alloyed flat iron or galvanised steel products originating from or imported from Vietnam.

Apart from this EU (European Union) has imposed temporary safeguard measures on steel imports that includes Vietnam’s cold-rolled and non-alloy steel; sheet metal and cold rolled stainless steel sheets and bars.

MoIT and VCCI (Vietnam Chamber of Commerce and Industry) have sought to tighten the issuance of origin certificate in case of exports as U.S. and some other countries allow importers to declare and self-certify the origin of goods resulting in the issuance of fake-Vietnamese origin export certificates.

The MoIT has also worked with the Ministry of Finance to watch for abnormal signs in exports to some markets to avoid damaging Vietnam’s prestige and the interests of exporters.

According to SteelMint data, Vietnam’s crude steel production in 2018 has increased by 60% against the previous year from 8.94 MnT in 2017 to 14.4 MnT in 2018.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift