Imported Scrap Prices Inch Up in Recent Deals

A Turkish steelmaker booked Baltic cargo comprising 28,000 MT of HMS 1&2 (80:20) at USD 280/MT, 5,000 MT of Shredded at USD 285/MT, 3000 MT of Bonus at USD 290/MT, CFR for February first-half delivery.

A 33,000 MT cargo was booked comprising 31,000 MT at HMS 1&2 (80:20) at USD 281.5/MT and 2,000 MT Bonus at USD 291.5/MT, CFR for January shipment.

Another steel mill booked a total 40,000 MT cargo comprising HMS 1&2 (80:20) at USD 280/MT, Shredded at USD 285/MT and Bonus at USD 290/MT, CFR Turkey.

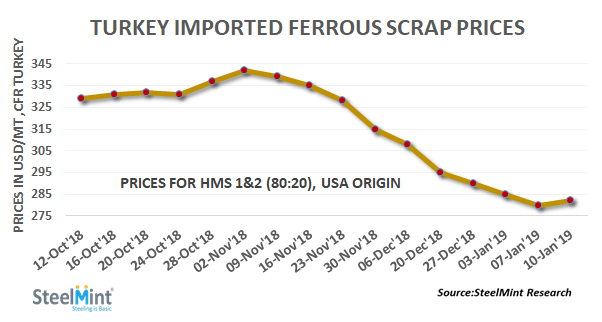

According to SteelMint’s price assessment, US origin HMS (80:20) scrap inched up to USD 281.5/MT, CFR Turkey as against USD 280/MT, CFR in the last report. While HMS 1&2 (80:20) of Europe origin at around USD 272-273/MT, CFR. A premium for US material over Northern European scrap stands at USD 8-9/MT.

Earlier to this, a Benelux merchant reported having sold two cargoes each for Prompt and February shipment. Marmara region based steel mill booked 20,000 MT HMS 1&2 (80:20) at USD 273/MT, CFR normalizing to USD 280/MT, CFR and another deal reported at similar price levels had indicated a supply tightness in the market.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million