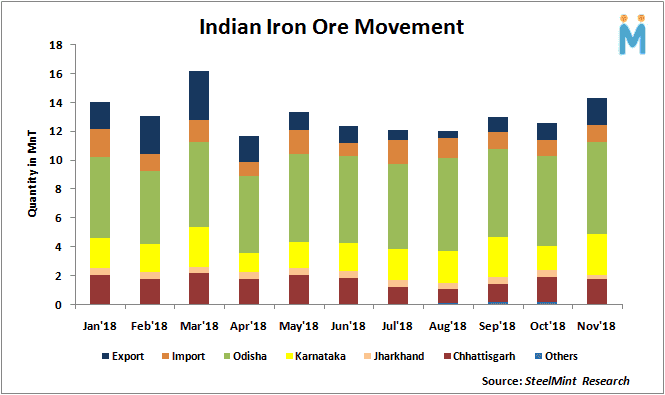

Indian Iron Ore Movement Up 11% in Nov’18

The figures are compiled on the basis of movements made via railways, trucks, and Karnataka and import data as per customs. The figures exclude the captive iron ore movement of SAIL & Tata Steel and movement for exports.

State-wise iron ore movement analysis:

Odisha Iron ore dispatches up marginally on monthly basis

Iron ore dispatches from Odisha in Nov'18 witnessed at 6.39 MnT, up slightly as against Oct’18 dispatches at 6.22 MnT.

Odisha based merchant miners were facing narrowed buying interest following which major miners have reduced iron ore prices in Nov’18. SteelMint also heard that miners have increased discounts on bulk quantity purchase further over announced listed offers.

Rungta Mines recorded highest dispatch in Nov'18 at 1.31 MnT, down 22% as against 1.68 MnT in Oct'18, followed by OMC at 0.94 MnT (up 19% M-o-M) and Serajuddin at 0.61 MnT (down 3% M-o-M).

NMDC (C.G) Iron ore dispatches down 7% in Nov'18

India's largest iron ore miner, NMDC supplied 330 rakes of iron ore in Nov’18, down 7% on monthly basis, against 355 rakes in Oct’18.

The total exports by the miner recorded at 67 rakes in Nov’18, up sharply by 72% on monthly basis as against 39 rakes a month before. The miner resumed exports in Sep’18 after a gap of five months (since Mar’18). Post resumption, the miner recorded rising exports every successive month.

Karnataka iron ore e-auction sales up 70% in Nov’18

Karnataka e-auction sales recorded at 2.79 MnT in Nov'18, increased sharply by 70% M-o-M compared to 1.64 MnT in Oct’18.

NMDC's iron ore sales increased by 49% M-o-M to 1.01 MnT in Nov'18 compared to 0.68 MnT in Oct'18. NMDC sold all its iron ore from its Kumaraswamy mines recorded a sharp increase in its sales volume by almost double to 1.01 MnT in Nov'18 compared to 0.51 MnT in Oct'18.

India's largest iron ore mine has approached the Karnataka High Court for an urgent hearing on NMDC Donimalai lease renewal pending decision on the representation by the Karnataka Govt. Court will hear the matter on Jan 10, 2019. Iron ore operations are still on hold at NMDC’s Donimalai mine which was recently renewed lease. On 3rd Nov’18 NMDC lease got expired and was later renewed for the next 20 years.

Indian iron ore imports up 8% in Nov'18

Indian iron ore imports in Nov'18 recorded at 1.11 MnT rises of 8% as against 1.02 MnT in Oct'18. The increase is attributed to high prices in Odisha and NMDC accompanied with production halt at NMDC Donimalai mines.

On yearly basis, imports depicted significant rise by 63% as compared to Nov'17 imports at 0.68 MnT.

JSW Steel continued to remain largest importer of iron ore for the month of Nov'18 at 0.91 MnT JSW Steel imported 0.57 MnT iron ore from Australia (Up three folds against 0.19 MnT in Oct'18) and 0.33 MnT from Brazil.

Vedanta stood second largest importer and imported 0.08 MnT iron ore lumps from Australia at Mormugao port. The miner recorded first ever import shipment in Nov'18. Post mining ban in Goa in March 2018, the miners were inhibited from further exploration, following which the Goa miners, have started to import material.

India Iron ore export Hit 7 month high in Nov’18

Indian iron ore export doubled in Nov'18 and was recorded at 0.83 MnT as against 0.42 MnT in Oct'18. On yearly basis, the exports increased by 9% as against 0.76 MnT in Nov'17. The figures have hit 7-month high as in the month of Apr’18 at 1.18 MnT.

Amidst reduced production cuts in Chinese market compared to last year, Chinese mills depicted preference for fines. Besides, post monsoon, production at Odisha increased for the month and NMDC increased exports.

Indian pellet export up 10% in Nov’18

Indian pellet exports for the month of Nov'18 witnessed an increase of 10% M-o-M to1.04 MnT, as against 0.74 MnT MnT in a month before in Oct’18. However, Indian pellet export price decreased sharply to USD 99/MT, FoB India against a month before at USD 117/MT, FoB.

Indian pellet export volumes are likely to come down as demand from China has softened on relaxation of environmental norms over which mills have shifted towards usage of low-grade fines.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

China limits supply of critical minerals to US defense sector: WSJ

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift