Pakistan: Ferrous Scrap Imports Hit 2 Year Low in October

Pakistan, one of the emerging ferrous scrap importers has witnessed third successive fall in scrap imports in October since Jul’18. According to major ports data maintained with SteelMint, the country imported 297,652 MT ferrous scrap in Oct’18, down 10% M-o-M as against 331,917 MT ferrous scrap in Sept’18.

Earlier to this, scrap imports recorded below 300,000 MT levels in Oct’2016 which was seen at 241,179 MT ferrous scrap. Thus, Pakistan scrap imports hit almost 24 months’ low in Oct’18.

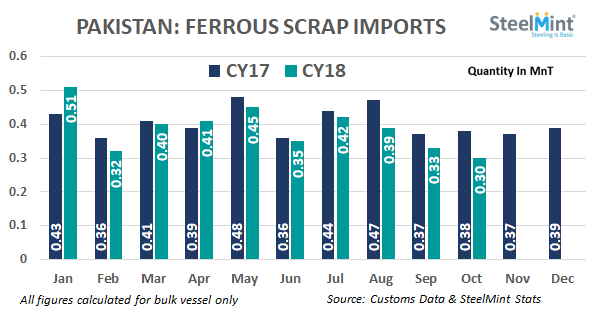

On yearly premises, scrap imports noted a fall by 22% Y-o-Y as against 383,870 MT ferrous scrap in Oct'17. The country has been witnessing considerable fall in its scrap imports in this fiscal on less supportive government policies, liquidity issues and domestic uncertainties.

United Kingdom remained the largest scrap supplier - United Kingdom supplied 59,155 MT ferrous scrap occupying highest 20% share in total Pakistan scrap imports in Oct’18, down sharply by 40% M-o-M as against 99,214 MT in Sept’18. Second largest supplier, UAE exported 53,620 MT ferrous scrap up 76% M-o-M followed by USA (33,489 MT, down 13% M-o-M), South Africa (14,394 MT, up 45% M-o-M) and European Union (14,642 MT) in Oct'18.

Pakistan ferrous scrap imports decline 14% in FY19 - Pakistan imported 1,437,681 MT ferrous scrap during Jul-Oct’18 so far in FY19, down 14% Y-o-Y as against 1,666,849 MT during the same period last year. While the country imported 3.87 MnT ferrous scrap during Jan-Oct’18. Total imports were at 4.86 MnT ferrous scrap in 2017.

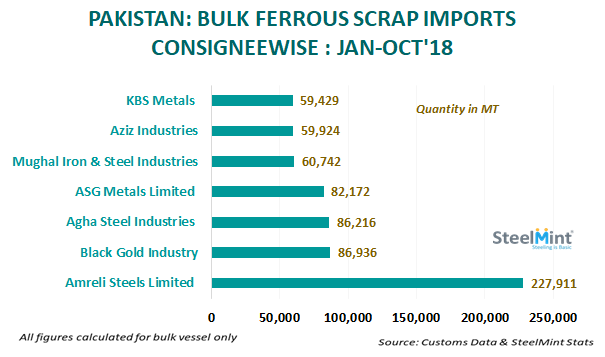

Amreli Steel remained the largest consignee - Amreli Steel remained the largest scrap importer of ferrous scrap in Pakistan. Amreli Steel imported 227,911 MT ferrous scrap occupying 6% share followed by other consignees as Black Gold Industry, Agha Steel industries, ASG metal limited, Mughal iron & Steel industries and Aziz industries so far in CY18.

Imported scrap prices remained stable in Sept-Oct'18 - Average Shredded scrap prices remained almost stable in the range USD 355-360/MT, CFR Qasim in Oct'18 which moved down to the range of USD 345-350/MT, CFR in Nov'18.

As per statistics released by the World Steel Association, Pakistan’s crude steel production stood at 4.23 MnT during Jan-Oct’18 which was recorded at 4.10 MnT same period last year. In Oct’18, crude steel production was 0.435 MnT as against 0.420 MnT in Sept’18.

Ship breaking volume down 41% in Nov'18 - As per reports data maintained with SteelMint, Pakistan observed a sharp fall in ship breaking volumes by 41% M-o-M in Nov’18. Ship breaking volume at Gadani market stood at 54,169 LDT in Nov’18 as against 91,306 LDT recorded in Oct’18.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million