Iron Ore self-sufficiency as an advantage of Iranian Steel Exporters

Metal Expert announces 2nd meeting for MENA billet market insiders on April 13, 2016 in Dubai,UAE.

Steel companies in the MENA region have for a long time been focusing on the re-rolling capacities, such as rebar mills, which has resulted in a huge deficit of in-house steelmaking capacities and the growth of billet import. In 2014, MENA imported around 9 million t of billets. In 2016, MENA's deficit of square billet capacity will increase by around 1.5-2.5 million t, analysts expect, which will lead to a big redistribution of local trade flows.

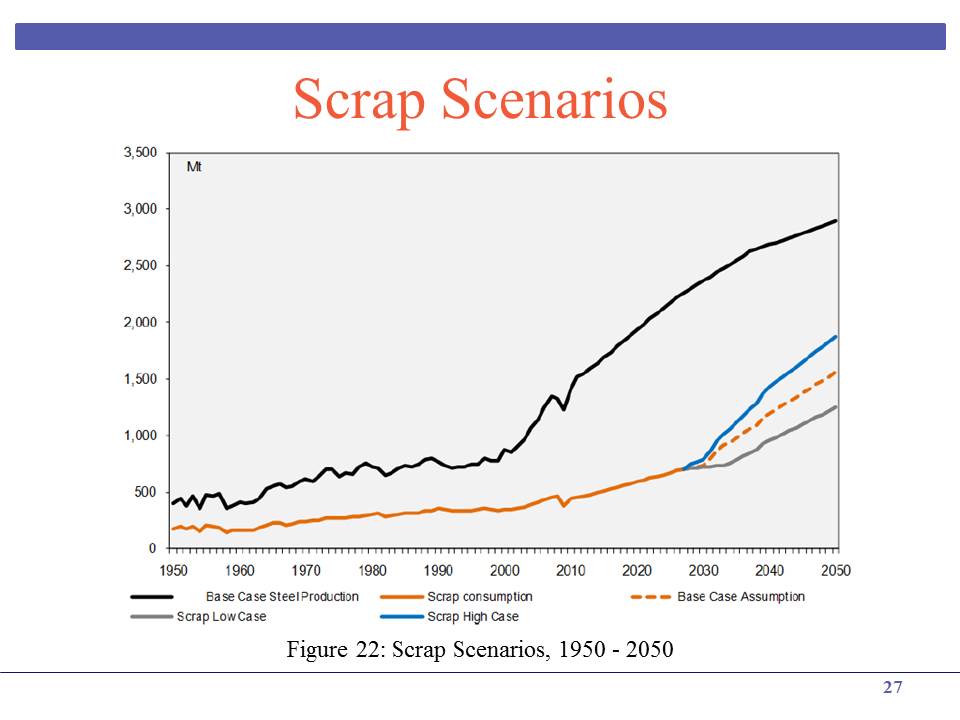

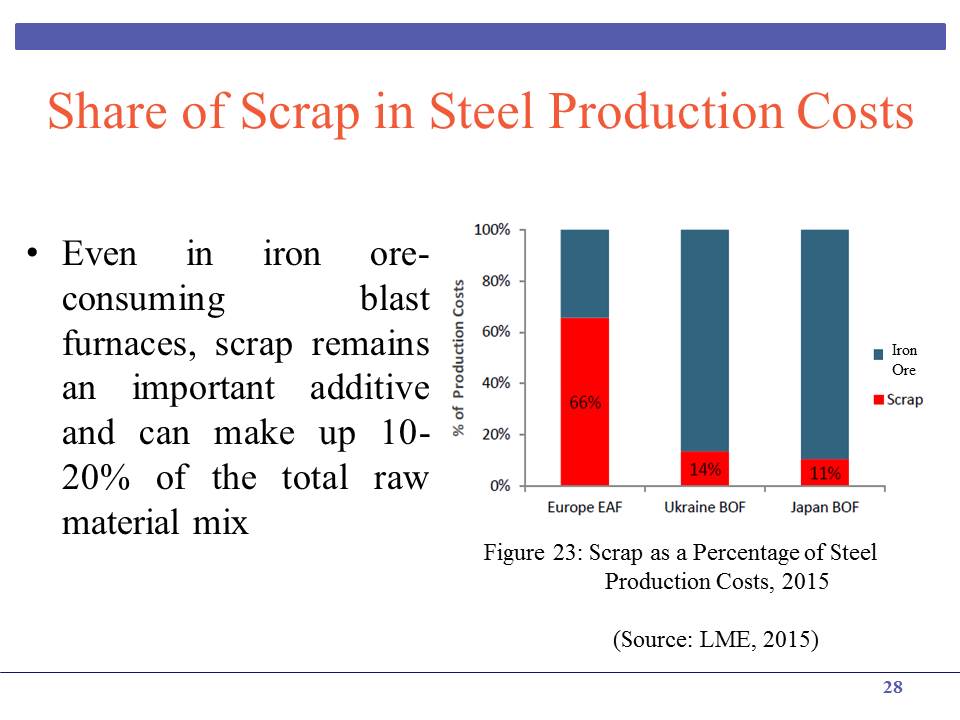

Overpriced ferrous scrap is making re-rolling business profitable again in MENA, and in some cases this is the only way for regional companies to stay in the business. That is why billet import into Turkey, for example, may expand by 1.2-1.7 million t in 2016.

Despite great optimism about Egypt, which is also among the largest billet consumers in the region, there are no positive trends at the moment, as political instability remains and investors are losing their confidence.

Saudi Arabia remains the largest billet consumer among the GCC countries. Falling oil prices are curbing the growth of the government investment activities in construction, which, in turn, is hampering steel demand. MEED‘s GCC Projects index is still increasing this year, but the growth rate is slowing down.

The military conflicts remain one of the most important problems in the region. Iraq’s long products consumption decreased by 800,000 t in 2014, and continues to decline now. Combined consumption in Yemen and Libya went down by 800,000 t.

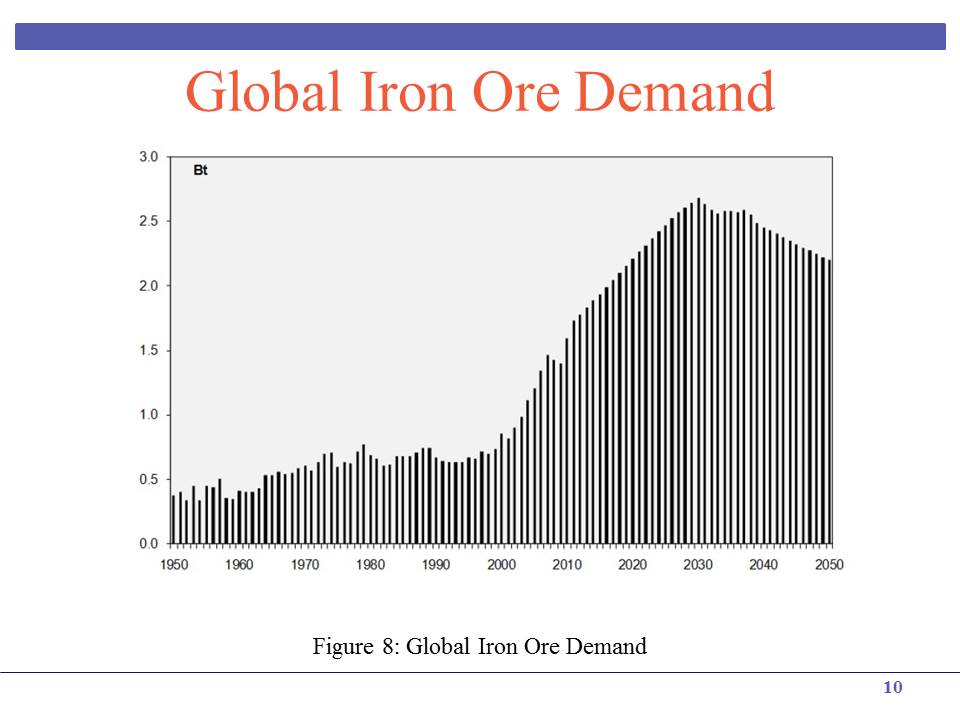

The growing export from China has directly impacted MENA. Last year, MENA's import of Chinese long products and billets more than doubled, increasing by 2.5 million t. This year, Chinese import is expected to stay in the range of 3.5-4.5 million t. Meanwhile, total import into MENA in 2014 went up by merely 0.5 million t. Thus, China was not only responsible for the total growth, but displaced traditional rebar suppliers, like Turkey.

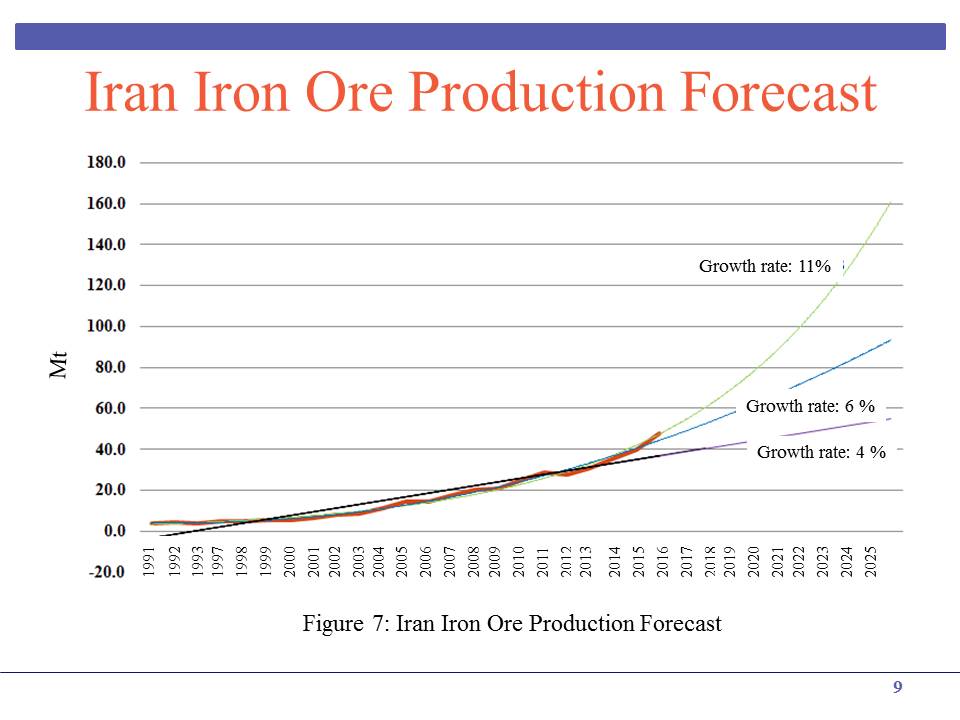

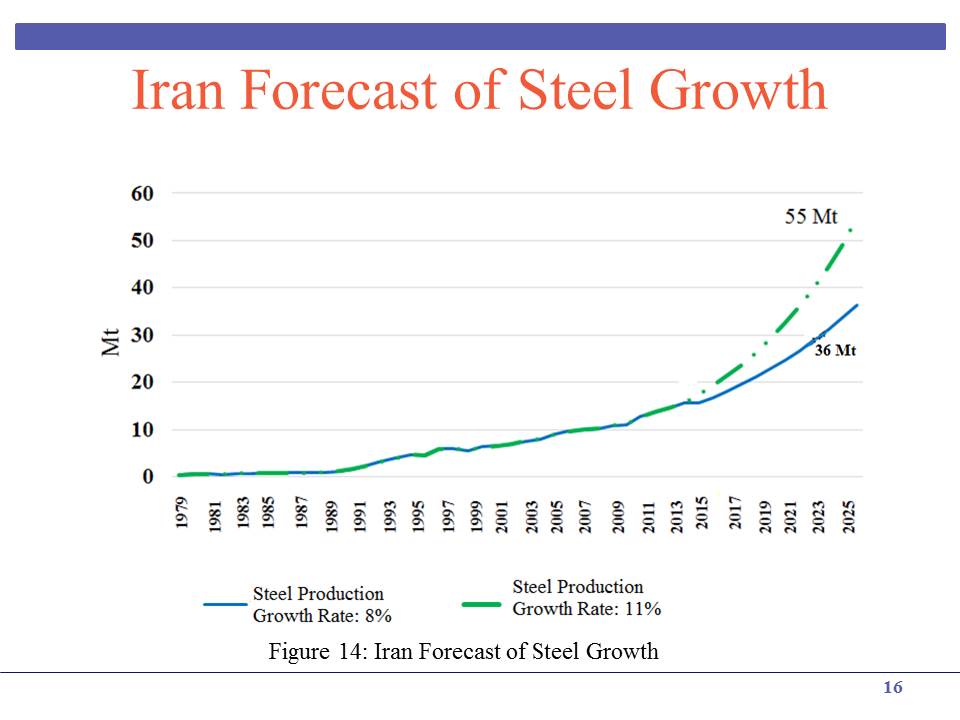

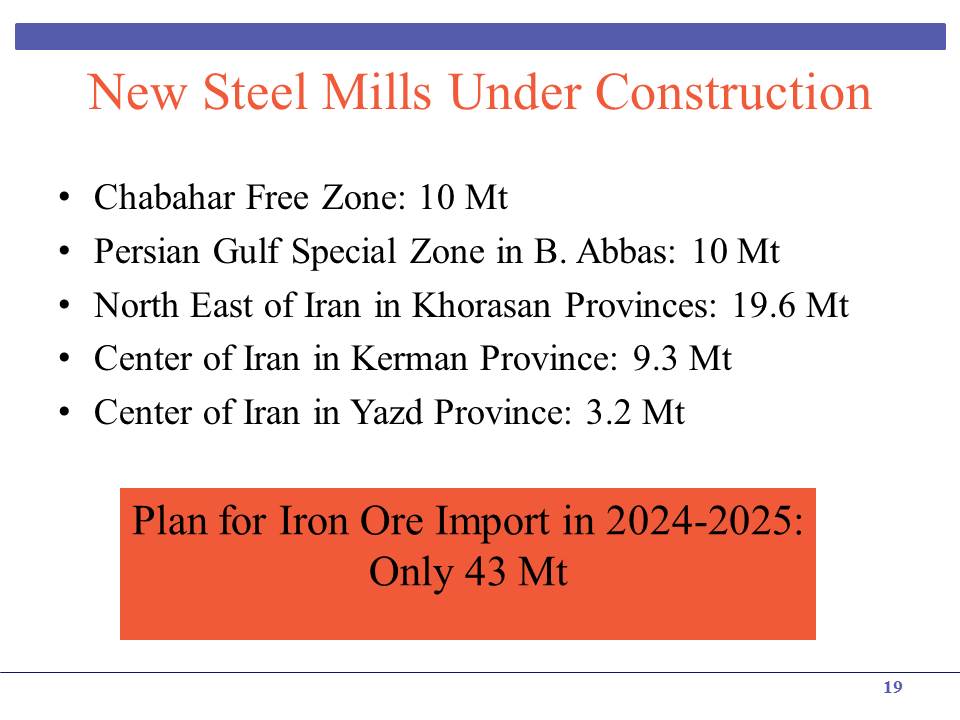

There are new projects in Iran, for which low energy prices, raw materials availability and advantages in logistics may become important drivers to expand billet export. However, many of them are idle at the moment amid low demand and investments inside Iran. However, after sanctions removal, billets export may become a great opportunity for Iranian steel companies to enter regional markets.

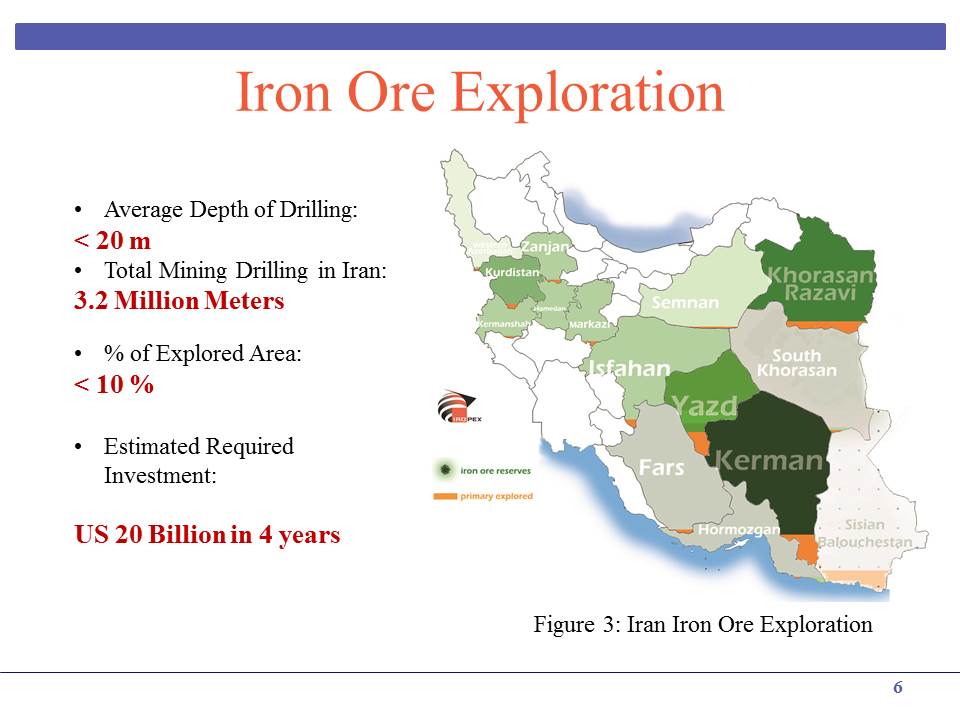

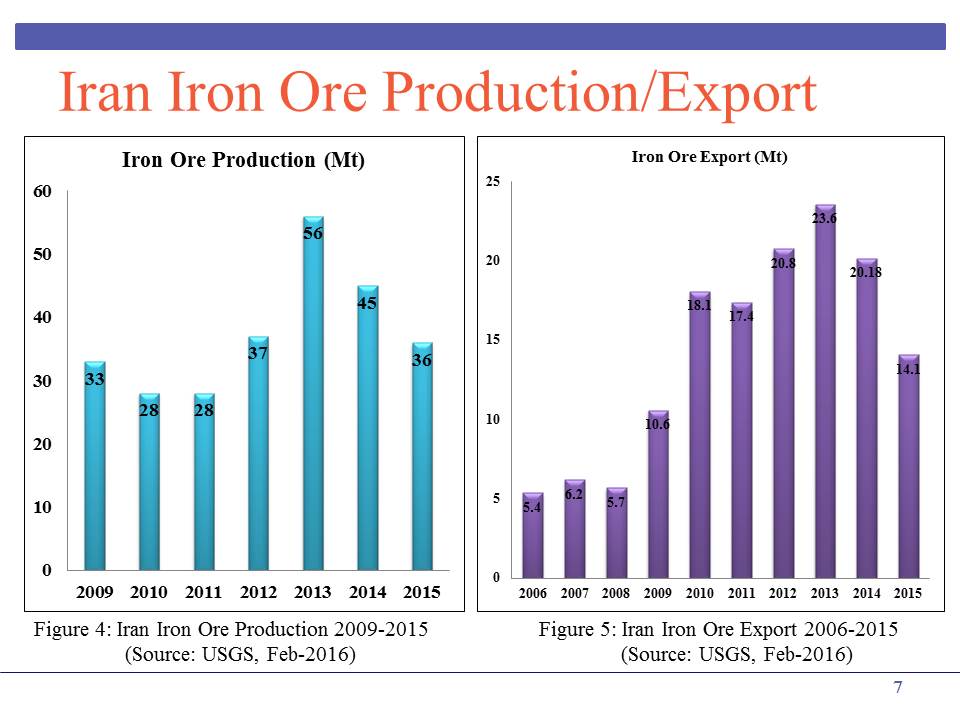

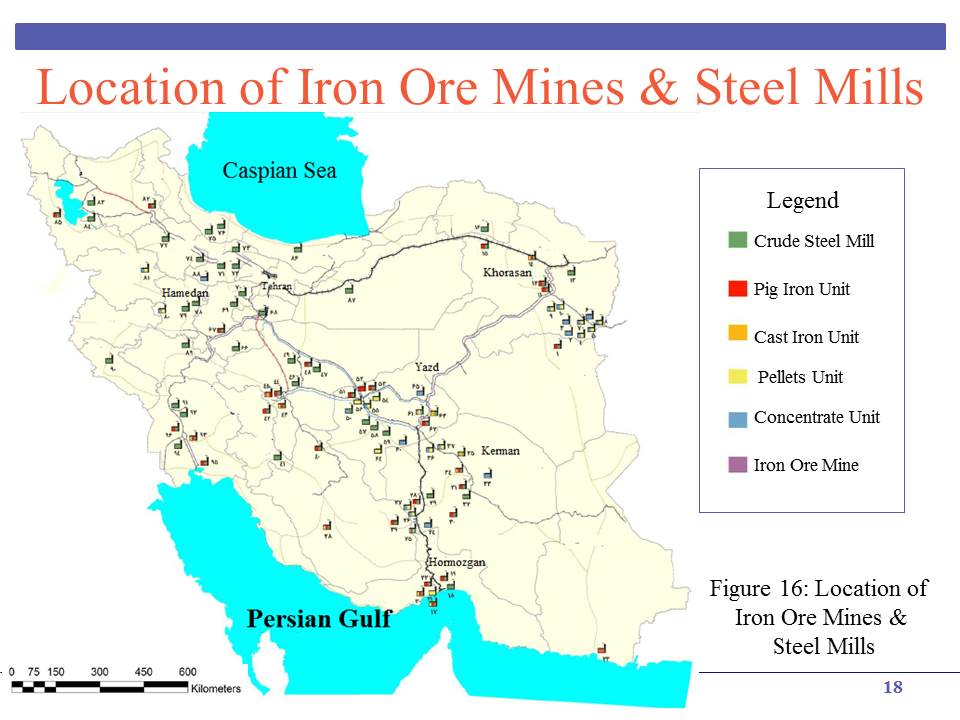

Prof. Keyvan Jafari Tehrani, Head of International Affairs , IROPEX, Iran - Iron ore self-sufficiency as an advantage of Iranian steel exporters :

http://www.telegram.me/me_metals

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Fortuna rises on improved resource estimate for Senegal gold project

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

Fresnillo lifts gold forecast on strong first-half surge

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Why did copper escape US tariffs when aluminum did not?

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

What’s next for the USGS critical mineral list

South Africa looks to join international diamond marketing push

Copper price gains on Chinese demand, Chilean supply risks

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

New research reveals source of world’s richest lithium deposits

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

De Beers strikes first kimberlite field in 30 years

Minera Alamos buys Equinox’s Nevada assets for $115M

OceanaGold hits new high on strong Q2 results

South Africa looks to join international diamond marketing push

Copper price gains on Chinese demand, Chilean supply risks

Gold exploration spend trending down despite higher prices – S&P Global

A global market based on gold bars shudders on tariff threat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations