Russian Ferrous Scrap Exports Down 21% in August on Falling Turkish Imports

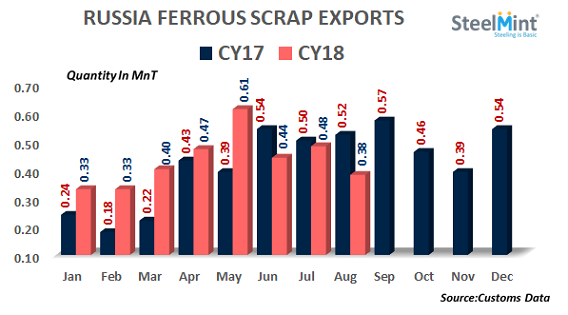

Russia, world’s fourth largest scrap exporter after EU-28, USA and Japan has witnessed considerable fall of 21% M-o-M in its scrap exports in Aug’18 as against exports recorded in Jul’18. As per recent customs data, the country exported 383,190 MT ferrous scrap in Aug’18 as against 483,464 MT in Jul’18. On the yearly premises, exports fell down 27% Y-o-Y as against 520,865 MT in Aug’17.

Russian government has imposed the 6 months ban on ferrous scrap exports effective from July’18 to Jan’19 for the exports activities subjected to the 9 far Eastern ports due to lack of infrastructure and facilities. Further it has also banned exports from black sea ports to enhance domestic use of scrap. However, not much significant impact has been observed on global supply trends until now.

Port wise - In Aug’18, St. Petersburg port in Russia remained the largest port for scrap shipping activities occupying 37% share (141,437 MT) out of total scrap exports. Followed by other major ports like Pskov region (62,290 MT), Leningrad region (54,502 MT), Primorye Territory (17,800 MT), Rostov region (15,450 MT) and Khabarovsk territory (15,800 MT) respectively.

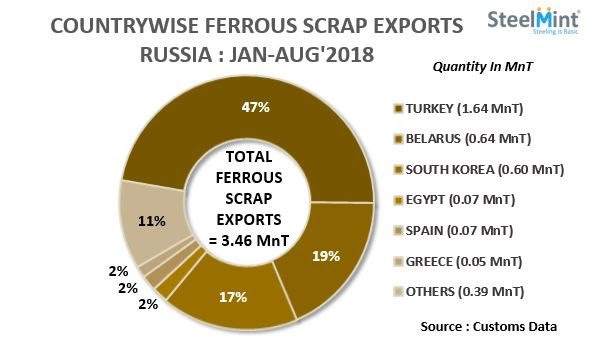

Belarus remained largest importer of Russian scrap in Aug'18 - Turkey imported 128,200 MT ferrous scrap in Aug’18, down 41% M-o-M as against 216,523 MT in July. Belarus stepped up at the largest importer position occupying the equal share of 33% as of Turkey from Russia. Belarus imported 128,516 MT in Aug’18, up 93% M-o-M as against 66,667 MT in Jul’18.

Third largest importer South Korea imported 47,353 MT ferrous scrap down 58% M-o-M in Aug’18, Followed by Egypt (30,222 MT) and Greece (9,931 MT).

Amid comparatively lower global scrap prices as compared to Russian prices, the demand for Russian scrap remained dull however, South Korean importers turned active again for Russian A3 grade amid high Japanese scrap prices in Sept-Oct’18. Also, the country observed increased local scrap consumption amid rising EAF crude steel production.

Russian scrap exports increased 15% Y-o-Y during Jan-Aug’18 - Russia exported 3.46 MnT ferrous scrap during first eight months of CY18 as against 3.02 MnT ferrous scrap exports during Jan-Aug’17. It was expected earlier that Russian scrap exports could climb above 5.5 MnT in 2018 as against 4.98 MnT in 2017 however, ongoing ban may affect the supply of 60,000-70,000 MT till the end of CY18.

According to World Steel Association, Russia’s crude steel production recorded at 54.23 MnT during first three quarters of 2018 as against 47.23 MnT crude steel produced during same period last year. During first half of 2018 country’s ferrous scrap consumption stood at 11.40 MnT, up 11% Y-o-Y against 10.26 MnT during H1-2017.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million