Bangladesh: Imported Scrap Market Observes Limited Trades

However buying remains subdued as buyers remain holding back on still sluggish local finish steel market and on upcoming elections.

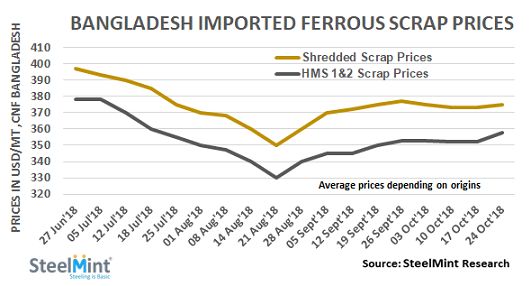

Limited offers for containerized Shredded 211 of UK/Europe origin heard at around USD 375/MT, CFR with slight uptick as against USD 370-375/MT levels last week.

Few buyers were looking for P&S scrap with buying interest in the range of USD 375-380/MT, CFR. Very limited offers are available at the moment at around USD 380/MT levels in the market. Moreover, no bulk inquiry and movement heard.

In recent trades heard, HMS 1 scrap was traded in the range of USD 360-365/MT, CFR Chittagong from leading suppliers like South Africa, Hong Kong and Chile. Offers for HMS (80:20) assessed at USD 345/MT, CFR basis.

Indian sponge export offers to Bangladesh surged by USD 10/MT W-o-W on improving domestic prices. Sponge export offers heard at USD 360-365/MT CFR Chittagong, up against USD 350-355/MT CFR levels last week. Few scrap importers remain waiting for more clarity on global scrap prices and pick up in Indian and Pakistan’s buying.

Bangladesh local scrap prices move down marginally - Local scrap prices heard at around BDT 34,500-35,000/MT (USD 412-418) while local ship yard melting scrap heard at around BDT 34,000-34,300/MT, down BDT 500/MT as against last weeks' report inclusive local taxes.

Local rebar market continued to observe slow movement amid sluggish demand for finish steel. Dull sentiments continue but prices stand stable. Rebar prices assessed at BDT 57,000-58,000/MT for medium scale producers inclusive of taxes.

Local ship cutting plate prices turn down W-o-W - Ship cutting plate prices moved down by BDT 600/MT (USD 7) on weekly basis. Latest plate prices assessed for 16 mm at BDT 41,700/MT as against BDT 42,300/MT last week, for 12 mm plate at BDT 40,700/MT and at around BDT 42,700-43,000/MT for plate thickness 20 mm & above.

Ship breaking market observes flurry of activities - Chittagong’s ship cutting market continued to dominate the overall purchasing trend in Asian region with several containers sales confirmed this week. Ship cutting prices moved up by USD 5-10/MT pushing the assessment at USD 445/LDT for general dry bulk cargo, at USD 455/LDT for tanker cargo and at USD 465/LDT for containers on CNF Bangladesh basis.

Five sales comprising of 4 containers of total volume 42,505 LDT and 1 tanker of 19,456 LDT have been reported last week. These sales fetched very good prices and turned market sentiments positive in Chittagong’s market. With Pakistan restricting cutting activities after recent tanker accident and India still trailing on levels, the Bangladesh buyers may witness some high-priced sales in upcoming days.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million