Pakistan Steel Makers Await Govt Announcement on Projects; Prices Stable

Demand for finish steel remains moderate as corporate and residential projects are running but government own projects haven’t started yet due to holding of funds from the new Government.

Offers for containerized Shredded scrap heard in the range of USD 360-365/MT, CFR Qasim for UK origin, which remains almost stable on W-o-W basis. While European Shredded scrap traded in minor quantities at USD 357-360/MT, CFR Qasim.

Offers from Dubai suppliers have come under pressure as demand remained subdued. Offers for HMS 1&2 scrap heard at USD 350/MT and HMS 1 at USD 355/MT, CFR Qasim. These prices corrected down by USD 3-5/MT W-o-W. However, few buyers seem actively looking for competitive prices on limited inventories in hand.

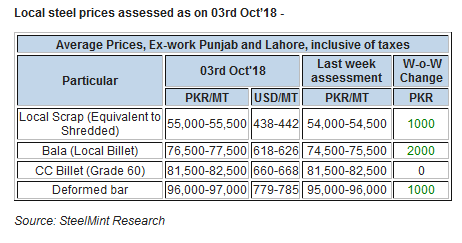

Local steel demand improves slowly - According to sources, domestic steel market is almost same as the last week. Demand for Bala billet improved this week with prices moved up by PKR 2000/MT W-o-W. However, sales of G-60 billet remained to lower side as compared with commercial billet holding its prices stable W-o-W. Rebar prices keep climbing up slowly by PKR 1000/MT on W-o-W with slow pick up in dispatches as compared to last week amid positive outlook for coming days.

Major steelmakers in Karachi observe rebar prices little higher side than other regions of the country. Commercial rebar assessed at PKR 94,000-95,000/MT, ex-works while G-60 rebar prices heard at PKR 99,000-101,000/MT, ex-works in Karachi. Another leading steel maker holds premium rebar prices in the Southern Pakistan at around PKR 104,000/MT, ex-works inclusive of taxes.

Local scrap prices increase further - Since past couple of weeks, local scrap which was cheaper over imported has observed surge in the prices to come in line with imported scrap now. Prices learned to have moved up by PKR 1000/MT on W-o-W basis. Local pure super toke scrap equivalent to Shredded is assessed at around PKR 55,000/MT (USD 446), ex-works and local HMS scrap assessed at PKR 49,500-50,500/MT, ex-works inclusive of taxes.

Ship breaking market observes few sales as buying resumes - Ship cutting steel plate prices move up by PKR 1000/MT W-o-W and assessed at PKR 76,000/MT (USD 614) while Gadani ship breaking market witnessed a sale of Bulker containing 10,215 LDT volumes at price of USD 363/LT LDT this week.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

China limits supply of critical minerals to US defense sector: WSJ

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift