Chinese Steel Market Highlights - Week 39, 2018

Chinese steel mills will be on week long holiday from 1st Oct-7th Oct ‘18 to mark country’s National day. Meanwhile country’s Ministry of Ecology & Environment recently instructed cities in northern China experiencing heavy pollution to initiate plans to curb emissions generated by industries including steel, oil and gas refining, coal-based electricity, chemicals and non-ferrous metals mining.The plans will come into effect from 1st Oct’18 till Mar’19.

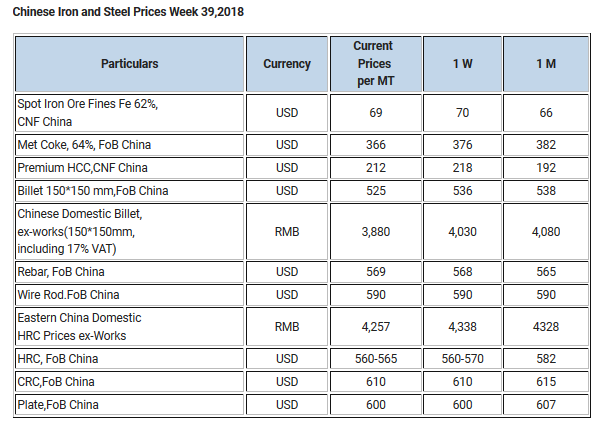

Thus flat steel export offer fell further over tedious demand. Rebar export offers continue to remain range bound.Billet export offers witness decline this week in line with falling domestic billet prices.Coking coal offers fell further this week and iron ore prices edged up towards weekend amid restocking.

Tsingshan Group has announced to raise its HC Ferro Chrome purchase price by RMB 300/MT (USD 43/MT) M-o-M for October delivery.

Chinese spot iron ore prices edge up towards weekend amid restocking- Chinese spot iron ore prices opened up this week at USD 68.8/MT,CFR China and increased to USD 69.5/MT, CFR China towards the week end.The prices witnessed rise amidst restocking ahead of the Chinese Golden week holiday from 1st Oct to 7th Oct.

Iron ore inventory at major Chinese ports have reduced sharply this week. The stocks witnessed fall of 3.4 MnT to 145.70 MnT, as against 149.10 MnT, last week. Spot lump premium has witnessed slight uptick this week at USD 0.3405/DMTU as against USD 0.3400/DMTU last week.

Spot pellet premium inched up:Spot pellet premium for Fe 65% grade pellets has witnessed slight increase this week and is assessed at USD 87.75/DMT, CFR China, up by USD 0.65/DMT W-o-W against USD 87.1/DMT a week before.

Owing to strict governmental regulations in China, steel mills prefer high-grade ore. However,demand for pellet is low compared to lump and fines and is likely to pick up after a week long holiday.

Coking coal offers fell further this week- Seaborne coking coal witness significant fall this week amid weak buying from steelmakers in China.Since Chinese steelmakers are anticipating further fall in coking coal prices.

Meanwhile in the beginning of the week trading activity remained dull after Mid Autumn holiday.

Currently Premium HCC prices inch down by USD 9/MT W-o-W basis and are assessed around USD 196/MT FoB Australia.Last week the offers was in range of USD 205.50/MT FoB basis.

Chinese domestic billet prices fall- Domestic billet prices in China have come down amid soft demand. Current spot price assessment is at around RMB 3,880/MT (including VAT) for 150*150mm billet Q235 against RMB 4,030/MT in last week. Chinese billet export price assessment fell marginally W-o-W at USD 520-530/MT, FoB basis.

Chinese HRC export offers decline further this week ahead of national day holiday- Chinese HRC export offers fell further owing to limited buying from overseas buyers.Meanwhile bearish sentiments amid national day holiday which is starting from 1st Oct along with winter production cuts lead to downward trend in flat steel prices from China.

Currently Chinese HRC export price assessment is heard around USD 565-570/MT, FoB China. Payment made on letter of credit basis for 1,000-10,000 MT. Last week the offers were hovering in range of USD 560-565/MT FoB China.

Meanwhile major mills are offering on higher side which is around USD 570-580/MT FoB China.

Domestic prices down by RMB 60-70/MT on W-o-W basis.Prices of HRC in the domestic market are gauged at RMB 4,220-4,250/MT (ex-works) in Eastern China and RMB 4,140-4,150 /MT in (Northern China).

Chinese Re-bar export offers remain range bound-This week Chinese rebar export offers remain range bound as the prices in domestic market started declining.Meanwhile market participants are expecting drop in demand after week long holidays along with winter production cuts starting from 1st Oct’18.

Currently,Chinese re-bar export offers are at USD 569/MT FoB China.Last week the offers was hovering in the range of USD 565-569/MT FoB basis.

Domestic prices witness fall by RMB 20/MT W-o-W basis. Domestic rebar prices stood at RMB 4,510-4,560/MT in (Eastern China) and RMB 4,310-4,350/MT in (Northern China).

First Quantum scores $1B streaming deal with Royal Gold

Newmont nets $100M payment related Akyem mine sale

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Goldman told clients to go long copper a day before price plunge

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Glencore warns of cobalt surplus amid DRC export ban

SSR Mining soars on Q2 earnings beat

A Danieli greenfield project for competitive, quality rebar production

China limits supply of critical minerals to US defense sector: WSJ

Alba Hits 38 Million Safe Working Hours Without LTI

Advanced cold-rolled strip for China’s New Energy Vehicle market

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times