Is Mega Merger on its Way in Chinese Steel Sector?

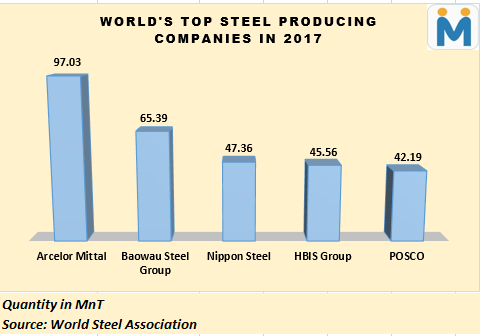

Baowau Steel is China’s largest steel manufacturer whose steel output in 2017 stood at 65.39 MnT in whereas Magang Group’s output was recorded at 19.71 MnT making the two companies’ combined output to stand at 85.1 MnT which is just 11.9 MnT below ArcelorMittal’s steel production and higher than U.S.’s total steel output of 81.6 MnT in 2017.

Baowau Steel became China’s top steel producer in 2016 after Baosteel acquired Chinese steel major Wuhan Steel at 2.56 yuan per share by issuing new shares at 4.60 yuan per share, valuing Wuhan at around 3 billion yuan (USD 348 million).

While Baowau Steel is engaged in the production of flat products, Magang Group output is split between both flat and long products. Both producers sell the bulk of their output in the domestic market, although Baoshan Iron & Steel, Baowu’s listed unit, exported 3.8 MnT of steel last year, about 8% of its total output.

According to the market sources, the consolidation talks between both the companies have just started and are beyond the preliminary stage which is why both the companies are tight lipped about any developments that are happening. Due to this, no details on the pricing of the deal is being heard. Individually Baowu Steel Group had total assets worth 745.6 billion yuan at the end of 2017, while Magang Group’s assets were valued at 72.2 billion yuan.

This mega-merger is believed to be reasonable as both the companies are geographically close. Magang is headquartered in Maanshan city in China’s eastern Anhui province, about four hours’ drive from Shanghai, where Baowu Group is based.

If this merger happens, Baowu Steel will come closer to its plan to expand its steel production capacity to 100 MnT by 2021 from current levels of 70 MnT.

China is promoting mergers to tackle the problem of steel overcapacity

China aims to put 60% of its national steel capacity in the hands of its top 10 producers by 2020 in an attempt to deal with the issue of overcapacity. Special funds to promote mergers and acquisitions within the steel industry are also being considered by Chinese policymakers to enhance the overall competitiveness of the sector.

In 2017, the combined market share of the 10 largest steel enterprises in China was 37% while crude steel production of the largest enterprises in South Korea and Japan took up 55 and 43% of their country's total crude steel production.

China accounts for nearly half of the world's annual steel production but its development has been hampered by cutthroat competition and structural imbalances due to low industry concentration. The goal for policymakers in the last few years has been to rid the industry of its excess overcapacity and structural optimization.

A guideline in late 2016, issued by the MIIT (Ministry of Industry and Information Technology) encouraged cross-regional and inter-industrial M&As in steel-related enterprises, be it State-owned or in the private sector, and pointed out that about 60 to 70% of the steel production should be concentrated in the top 10 enterprises by 2025.

According to the industry experts, China’s total steel capacity is forecasted to drop to 980 million tonnes by 2018-2020 from 1.1 billion tonnes in 2015. Apart from linking its big steel companies, China has been shutting small, polluting and inefficient mills to address a years-long steel glut.

Uzbek gold miner said to eye $20 billion value in dual listing

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

OceanaGold hits new high on strong Q2 results

Adani’s new copper smelter in India applies to become LME-listed brand

Australia to invest $33 million to boost Liontown’s Kathleen lithium operations

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Antofagasta posts biggest profit margins since 2021

Gold Fields nears $2.4B Gold Road takeover ahead of vote

US startup makes thorium breakthrough at Department of Energy’s Idaho National Lab

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift