Domestic Steel Prices Improve; Imported Scrap Offers Range Bound

After remaining close for religious holidays (Muharram) towards closing of last week, participants are returning back into the market slowly with the signs of improvement in the local steel demand this week.

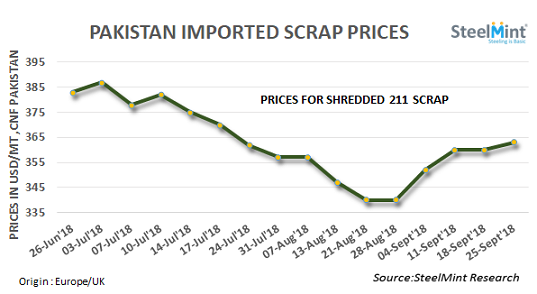

No major fresh deal was concluded in the market as global scrap offers remain strong amid tight supply. However, few buyers seem actively looking for competitive prices on limited inventories in hand. Offers for containerized Shredded scrap heard in the range of USD 360-365/MT, CFR Qasim for Europe and UK origin, which remain almost stable on W-o-W basis.

UAE based suppliers remain holding offers for HMS 1 high at around USD 358-360/MT, CFR Qasim. Offers from Dubai for HMS scrap have moved up by USD 3-5/MT W-o-W amid decent demand from Indian buyers. However, Pakistan based scrap importers have stayed away from booking significant volumes of HMS 1&2 from Dubai and UK at the moment.

Offers for HMS 1&2 (80:20) assessed in the range of USD 355-360/MT, CFR depending on origin like South Africa, UK and Europe.

“Few enquiries for bulk scrap vessels are being made however the booking will be done only if prices come into the competitive range.” shared a one of the leading scrap importers in Pakistan.

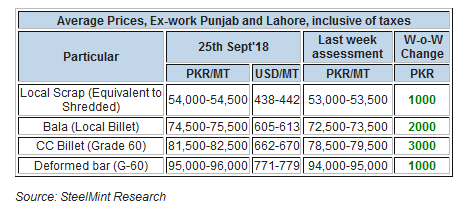

Local steel prices assessed as on 25th Sept’18

Local steel demand likely to go up with announcements of projects - According to sources, local steel prices likely to move up further with announcements of new plans of government in their mini budget. However, the surprising result of mini budgets is forcing many of the participants to wait-and-watch market movements in order to evaluate future pricing. Prices for CC billet and Bala billet moved up by 2000-3000/MT, while rebar prices climb PKR 1000/MT on W-o-W.

Amreli Steel’s premium rebar prices in Southern Pakistan assessed at around PKR 104,000/MT, ex-works.

Local scrap remains cheaper over imported - Local scrap prices learned to have moved up by PKR 1000/MT on W-o-W basis. However, local scrap remains cheaper over imported by around PKR 2,500-4,000/MT (USD 20-32) depending on the quality and location. Local pure super toke scrap equivalent to Shredded is assessed at around PKR 54,500/MT, ex-works and local HMS scrap assessed at PKR 48,500-49,500/MT, ex-works.

Ship cutting steel plate prices assessed stable at PKR 75,000/MT while ship breaking market witnessed another sale of VLCC containing 42,120 LDT volumes at massive price of USD 450/LT LDT with indication of resurgence in Gadani’s market.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling