India: Scrap Importers Turn Less Active After Decent Bookings in Last Weeks

With sufficient bookings made in containers in last couple of weeks and after booking bulk cargoes, less deals were reported this week as importers slowed down a bit in the market.

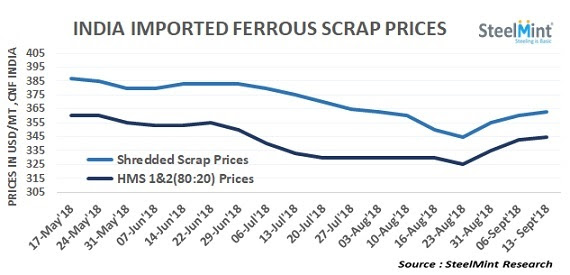

Offers for UK based containerized Shredded heard in the range of USD 360-365/MT, CFR Nhava Sheva with few trades reported at these levels. Less offers from USA suppliers were heard in the market this week. While few trades for European Shredded concluded in the range of USD 357-360/MT, CFR Nhava Sheva.

According to sources, Dubai based suppliers are holding offers in the range of USD 350-355/MT for HMS 1 and South Africa offers remained at around USD 350/MT, CFR. Offers for HMS 1&2 (80:20) heard at USD 340-345/MT from UAE, UK and other origins.

West African HMS in containers of 20-21 MT heard being traded at USD 333-335/MT, CFR Goa and USD 335-340/MT, CFR Nhava Sheva.

Indian sponge iron prices have moved up on tight availability and thus few steelmakers are shifting to its substitute like West African HMS scrap to be mixed with sponge iron for steel-making. Also, currency depreciation remains a concern for Indian importers before making trades.

Indian domestic scrap prices edge up amid improved semis prices - Indian local HMS scrap prices show uptrend in almost all major regions. Prices move up in central region by INR 300/MT W-o-W on high sponge export prices and stand at INR 30,000/MT, ex-Raipur. Currently, HMS 1&2 (80:20) basic prices assessed at INR 27,300-27,400/MT (USD 380-382) up INR 700 W-o-W, ex- Mumbai. At western coastal region prices move up by INR 400-500/MT W-o-W.

The demand from Chennai based importers has increased for imported scrap. Local HMS (80:20) prices assessed at INR 25,800-25,900/MT, up INR 300/MT W-o-W, ex- Chennai.

Ship breaking market remains in ‘Wait and Watch’ mode – Depreciation of Indian Rupee has been a major concern in Indian ship breaking market. On back of declining interest there were no market sales to report. However, average steel plate’s prices assessed at INR 34,300-34,500/MT for (16 mm) up by INR 400-500/MT W-o-W in the Alang market. Ship cutting prices edge down marginally on W-o-W basis and assessed at USD 415/LDT for general dry bulk cargo; at USD 435/LDT for containers and at USD 425/LDT for tankers on CNF India basis respectively.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million