Turkey: Steel Mills Continue Booking Scrap Cargoes

However, depreciated currency and slow-recovery in finish steel exports from the country continue to remain a matter of concern for most of the buyers.

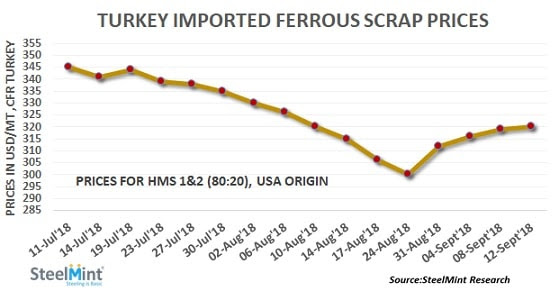

Importers remain hesitant to pay above USD 320/MT,CFR levels for HMS 1&2 (80:20) but prices are less likely to come down sharply anymore and Turkish local scrap prices rose further to stand in line with imported scrap now.

According to SteelMint’s assessment, the recent deals heard have kept price assessment for USA origin HMS (80:20) scrap stable at around USD 319-320/MT, CFR Turkey. However, as against the report last week the assessment has increased by USD 3-4/MT from USD 315-317/MT levels. Premium of USA HMS 1&2 (80:20) over European origin stands at USD 9-10/MT.

Two deals have confirmed as the importers booked more materials for October shipments. Two more trades heard to have sold at range bound prices in the market however confirmation on these deals has not received till the publication of this article.

Notably, the price gap between Shredded and HMS 1&2 (80:20) has widened again to the levels of USD 8-10/MT in the recent deals.

Trade Wise -

1. In the recent deal concluded, a steel producer based in the Marmara region booked a USA cargo, containing total 40,000 MT ferrous scrap comprising 20,000 MT HMS 1&2 (80:20) at USD 319/MT, 15,000 MT Shredded at USD 324/MT and 5,000 MT of Bonus at USD 329/MT, CFR.

2. A northern European recycler sold 40,000 MT cargo to Marmara based leading importer comprising 15,000 MT HMS 1&2 (80:20) at USD 318/MT, 20,000 MT Shredded at USD 328/MT, CFR and 5,000 MT of Bonus at USD 330/MT, CFR Turkey.

3. Another steel maker based in the Samsun region booked a USA cargo, comprising 13,000 MT of HMS 1&2 (80:20), 15,000 MT of Shredded, 3000 MT Bonus and 1000 MT Busheling at an average price of USD 330.5/MT,CFR.

4. In the deal confirmed in the beginning of this week, a cargo sold comprising 30,000 MT of Shredded, 15,000 MT HMS 1&2 (90:10) and 5,000 MT of P&S at an average price of USD 327/MT,CFR. The HMS 1&2 (80:20) price from this cargo was gauged at around USD 321-322/MT, CFR.

Lira remains depreciated affecting demand for finish steel - Turkish currency lira remained weak against USD. Today USD/TRY is trading at 6.40 levels, however, participants expect that exports may rise in upcoming days on weak Lira.

Rebar export prices move up on slight improvement in the demand – After hitting very low levels rebar export prices have turned up this week in Turkey and assessed in the range of USD 510-515/MT, FoB Turkey, up USD 10/MT W-o-W. Domestic rebar demand improved slightly with limited movement. Few mills continued to resist scrap purchasing so as to put downward pressure on prices, because the demand for finished steel products was soft in the export markets.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

A global market based on gold bars shudders on tariff threat

Minera Alamos buys Equinox’s Nevada assets for $115M

SSR Mining soars on Q2 earnings beat

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Cleveland-Cliffs inks multiyear steel pacts with US automakers in tariff aftershock

Bolivia election and lithium: What you need to know

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million