Aluminium pricing tensions mount as alumina surges again

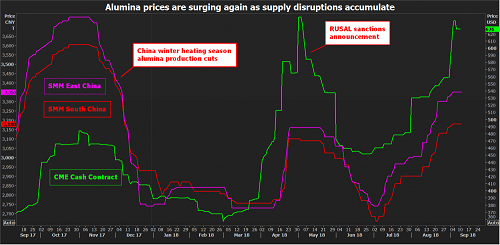

The CME cash contract, indexed against Platts' assessment of the Australian price, is currently quoted at $626 per tonne, just shy of the record $643 seen at the start of May.

In China spot prices are at their highest since December last year, according to Shanghai Metals Market.

A walk-out by unionised workers at three Australian alumina refineries has injected yet more uncertainty into an already problematic supply equation.

What has historically been a highly efficient part of the aluminium production chain is experiencing an unprecedented degree of turmoil this year.

There is the potential for short-term relief if the strike at AWAC's facilities ends and Norwegian producer Hydro can persuade the Brazilian authorities to allow full operations at its Alunorte refinery.

However, a looming deadline for the lifting of sanctions on Russian producer Rusal is fast approaching and China's alumina production sector is being rocked by environmental crackdowns.

It seems unlikely that the supply disruption premium is going to unwind fully any time soon.

That in turn poses hard questions for aluminium smelters, given the impact of such a high input price on operating margins.

Graphic on CME and Chinese alumina prices:

Another supply hit

The Aug. 8 strike by around 1,500 workers at two bauxite mines and three alumina refineries operated by AWAC, owned by Alcoa and Alumina Ltd, is the new disruptor in an already disrupted supply chain.

The walk-out is now in its second month after members of the Australian Workers Union voted late last week to reject a new proposed workplace agreement.

AWAC has contingency plans to keep the operations running but conceded in a Sep. 7 statement that the action had cost around 15,000 tonnes of lost alumina output in August, a figure that is only likely to rise as the strike continues.

The supply hit would have had little impact on a near 120-million tonne market in other years.

But this year the market has already been roiled by the partial closure of Alunorte, which with annual capacity of around six million tonnes is the world's largest single alumina refinery.

Ordered by a Brazilian court in February to cut run-rates by half, Hydro appears to be inching towards a resolution of the dispute over alleged pollution.

It has signed two agreements with the state government of Para, the site of the refinery, covering extra investments for local communities.

The olive branch should be "an important step towards resuming operations", the company said, albeit without confirming any restart timeline.The olive branch should be "an important step towards resuming operations".

If the green light is given, it would take Alunorte around one month to return to full-capacity operation.

Structural tensions

While one supply source of alumina disruption edges towards resolution, another one is returning.

The trigger for the super-charged rally of April and May was the imposition of U.S. sanctions on Oleg Deripaska and his Rusal empire.

Although Rusal appears to be vertically integrated from bauxite through alumina to aluminium, the market found out that the company's internal supply chain is a lot more complex.

Specifically, the Aughinish refinery in Ireland runs on bauxite supplied by Rio Tinto, which in turn takes a sizeable part of the refinery's alumina to supply smelters in Western Europe.

It was the potential unravelling of that tolling arrangement that triggered the rally to above $600 per tonne.

Things were calmed when the United States extended its sanctions deadline until Oct. 23. Things were calmed when the United States extended its sanctions deadline.

But the clock is now ticking and although the U.S. authorities have made soothing noises, the sanctions remain in place.

This is already posing problems for the company's metal customers as they negotiate 2019 contracts, but it must be focusing minds at Rio Tinto as well.

China, meanwhile, is playing a key balancing role, exporting higher than usual amounts of alumina to help plug the gaps in the rest of the world.

But China's alumina refineries are themselves experiencing structural tensions rooted in the country's clean-skies pollution measures.

Chinese bauxite flows have been disrupted by environmental inspections while there is an increasingly hostile public reaction to building new plants. The province of Liaoning cancelled five potential projects with cumulative capacity of almost 30 million tonnes last month.

Moreover, there is the potential for more capacity curtailments over the coming winter heating season.

Production disruption during last year's winter smog restrictions sent Chinese alumina prices soaring and they too are now marching higher.

Pressure on smelters

Alumina is the key metallic input to the aluminium smelting processing. A rough rule of thumb is that it takes two tonnes of alumina to make a tonne of refined metal.

Alumina is now around 30 percent of the price for aluminium, currently quoted at $2,075 per tonne on the London Metal Exchange.

That ratio has historically been in the high teens, placing an extraordinary amount of pressure on smelter margins.

"Chinese producers are barely breaking even and ex-China marginal producers are losing money," according to analysts at Goldman Sachs. ("Metals Monitor", Sept. 10, 2018)"Chinese producers are barely breaking even and ex-China marginal producers are losing money."

The current divergence between a high and rising alumina price and a largely stagnant metal price looks unsustainable.

Either the alumina price will have to come lower or the aluminium price will have to start rising to reflect rising costs.

Goldman is betting on the latter, arguing that "poor profitability should slow new smelters coming online and cost-push should drive aluminium prices higher in the near term."

The bank, which is forecasting the price to average $2,300, $2,200 and $2,000 over three-month, six-month and 12-month periods respectively, likes "aluminium the most among the base metals over the next few months".

Of course, things could change quickly, if the AWAC strike ends, Alunorte returns to full capacity and the United States drops its sanctions on Rusal.

But this is the year that the alumina supply change has been really tested for the first time in decades and it has proved to be much more brittle than thought.

The alumina price may lose some of its heat if the unusual cocktail of one-off supply hits is dispersed, but structural shifts in China may translate into a higher and more volatile "fair value" price than has been seen in the past.

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Peabody–Anglo $3.8B coal deal on the brink after mine fire

SSR Mining soars on Q2 earnings beat

Minera Alamos buys Equinox’s Nevada assets for $115M

Century Aluminum to invest $50M in Mt. Holly smelter restart in South Carolina

A global market based on gold bars shudders on tariff threat

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Samarco gets court approval to exit bankruptcy proceedings

US eyes minerals cooperation in province home to Reko Diq

Allegiant Gold soars on 50% financing upsize

Explaining the iron ore grade shift

Metal markets hold steady as Trump-Putin meeting begins

Trump to offer Russia access to minerals for peace in Ukraine

Gemfields sells Fabergé luxury brand for $50 million

Gold price stays flat following July inflation data

Eco Oro seeks annulment of tribunal damage ruling