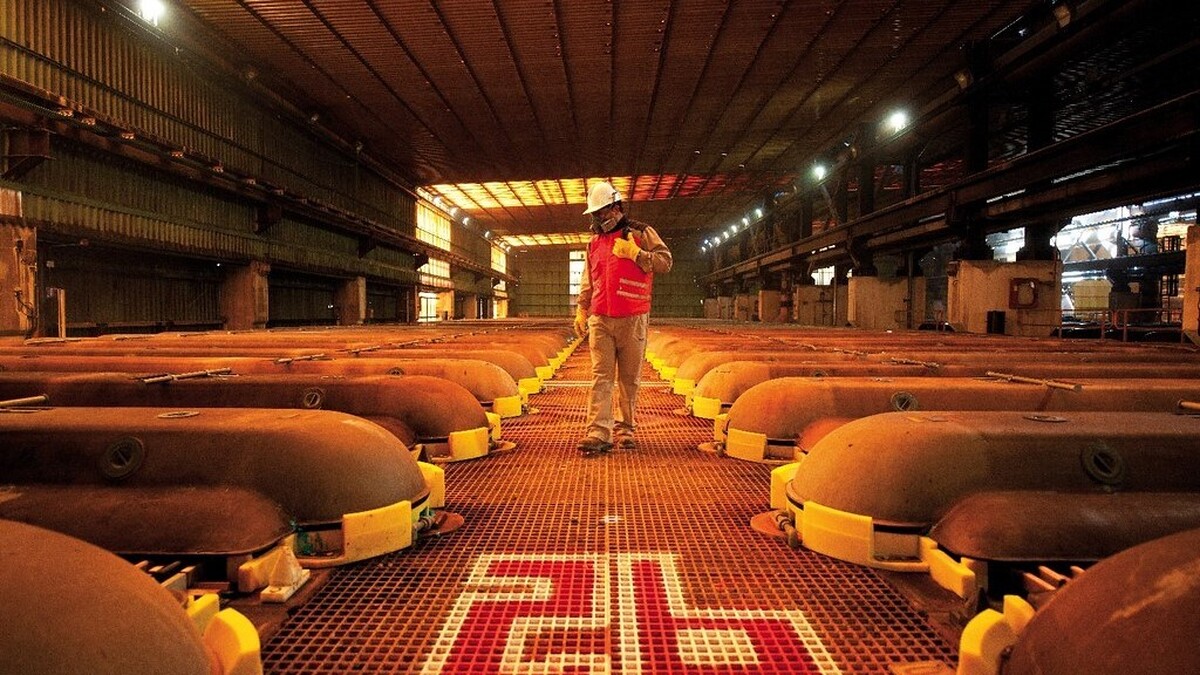

Copper price rises to three‑month high amid supply squeeze and trade optimism

According to me-metals cited from mining.com, Market attention remains fixed on tariffs, which continue to shape global metal flows and prices.

Supply squeeze

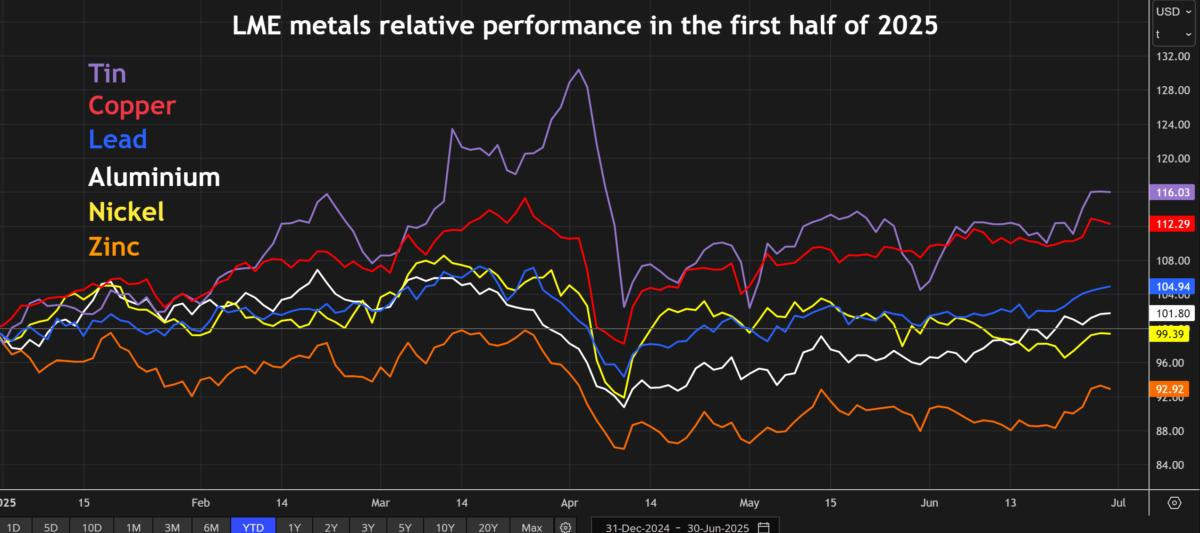

LME copper is set to close out the first half of the year with a gain of 12%, beaten only by the tin market, largely due to the investigation into US copper imports announced by US President Donald Trump in February.

There’s been a rapid drawdown in inventories on the London Metal Exchange and in China recently after traders moved record volumes to the US in a bid to front-run tariffs proposed by the White House.

LME stocks have dropped by about 65 % this year, while CME warehouse holdings more than doubled.

Spot copper contracts traded at steep premiums to those for later delivery, a market structure known as backwardation that indicates tight supply.

The so-called Tom/next spread, the premium of copper due for delivery in one day to contracts expiring a day later, widened again on Tuesday after peaking at $98 a tonne last week, the highest since 2021.

Improved risk sentiment, amid signs of thawing trade discussions between China and the US, helped push prices even higher.

Bullish case

Copper rose 0.9% to $9,960 a tonne on the LME as of 8:39 a.m. local time. It touched $9,984 earlier, the highest since March 27.

Copper for delivery in September rose more than 2.16% to a high of $5.1925 per pound, or $11,423 per tonne, in early trading on the Comex market on Tuesday—approaching the all-time high of $5.277 per pound set in March.

In a recent note quoted by Bloomberg, investment bank Goldman Sachs said it expected LME prices to rise to a 2025 peak of roughly $10,050 a tonne in August, as supplies outside the US continue to tighten.

“The market is expecting Chinese smelters to lift exports to help fill the supply-chain gaps, but until they do the London copper market is a dangerous place for bears,” Reuters columnist Andy Home wrote.

“Everything will change again when the US administration decides whether to impose import tariffs. That presages more turbulence ahead of the November deadline for the Section 232 investigation into US imports to be completed.”

source: mining.com

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Locksley Resources forms US alliances to establish domestic antimony supply chain

El Salvador buys $50M in gold for reserve diversification

Freeport doubles down on Amarc’s JOY project

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Freeport doubles down on Amarc’s JOY project

El Salvador buys $50M in gold for reserve diversification

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Freeport doubles down on Amarc’s JOY project

El Salvador buys $50M in gold for reserve diversification

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Locksley Resources forms US alliances to establish domestic antimony supply chain

India considers easing restrictions on gold in pension funds