Turkish nickel bull plans $2 billion M&A spree to rival China

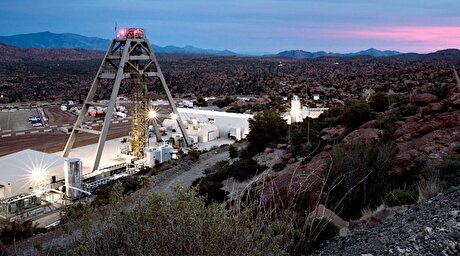

According to me-metals cited from mining.com, After making his fortune in chrome and shipping under family conglomerate Yildirim Holding AS, he spun off those businesses this year into CoreX Holding. The new venture already has some nickel-processing facilities, and with prices near a multiyear low, Yildirim sees now as a good time to scale up.

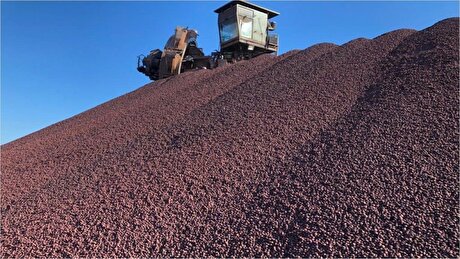

Nickel has slid as Chinese firms ramped up output in Indonesia, leading to fire sales from some major miners as their higher-cost assets struggle to compete. Yildirim thinks he can make such assets profitable by improving operations, and initially focusing on products with higher nickel content than Chinese nickel pig iron. He expects nickel prices to recover in the next two to three years.

“We want to come to the nickel market when people are exiting,” the 65-year-old said in an interview in his Istanbul office. “Eventually it will come up and find an equilibrium.”

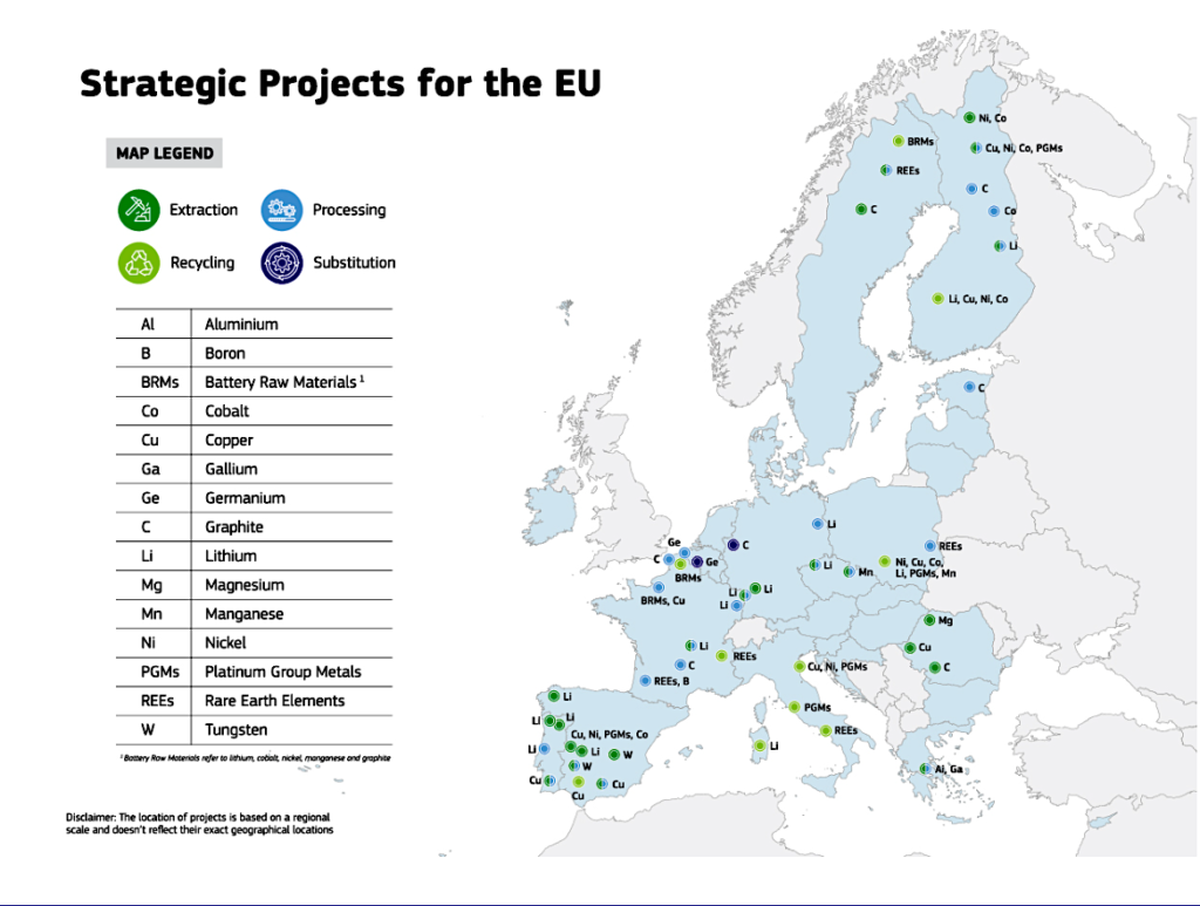

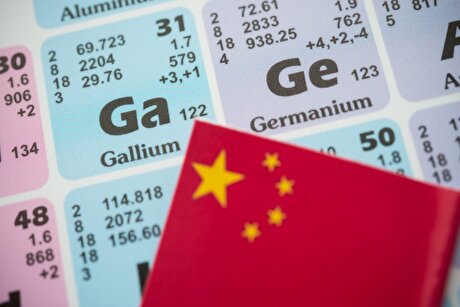

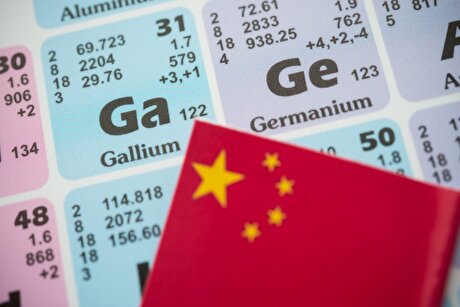

His foray into nickel also comes at a time when critical metals are increasingly under the spotlight as Western nations view supplies as a matter of national security, especially as the global energy transition stokes fears of potential future shortages. China is the key player in the nickel market, both through its own domestic industry and investments by its firms in places like Indonesia.

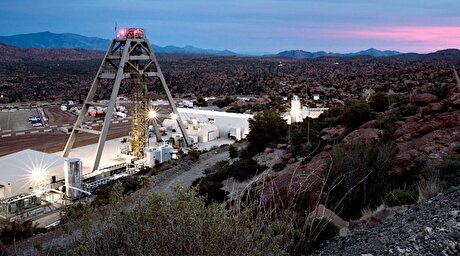

He has put about $500 million into the nickel push so far, which includes CoreX’s first acquisition — a majority stake in Ivory Coast miner Compagnie Minière Du Bafing SA in December — and ferronickel plants in North Macedonia and Kosovo that were transfered from the family holding firm. Other parts of his existing metals business include ferroalloy plants in Sweden and Russia, a US chrome and chemicals unit and mining companies in Kazakhstan.

With $2 billion earmarked for more deals, Yildirim said he’s in talks to buy six mines in Colombia, Guatemala and Africa, without elaborating. As the portfolio grows, he plans to order newbuild vessels to cover the supply chain from production to shipping.

The aim is to offer nickel buyers in Europe and the US an alternative to Chinese-supplied products. That will initially be in the stainless steel industry due to the crossover with Yildirim’s chrome business, before expanding to nickel used in batteries, and then to metals including copper, gold and zinc.

China has become a leader in many critical minerals used in everything from electric-vehicle batteries to wind turbines. Western governments are trying to reduce their dependence on those supplies — including through boosting domestic output and striking trade alliances.

To help fund the nickel deals, the billionaire has started talks with long-term investors, and is targeting those including infrastructure and sovereign wealth funds, private equity and family offices.

“I’m not young, I don’t have too much time to waste,” Yildirim said. “So I need to focus on the mid-size or big size projects.”

Anglo-MMG deal

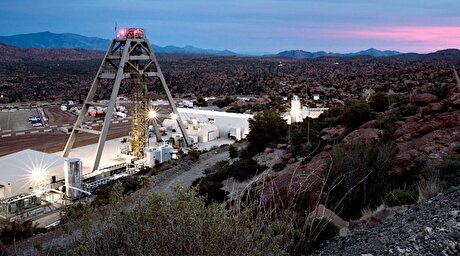

CoreX had its first major setback earlier this year, when it lost out to MMG Ltd. in a bid to buy Anglo American Plc’s nickel business in Brazil. Yildirim said he offered $900 million with financing from UBS Group AG — much higher than the transaction value — and got as far as negotiating the terms of a deal, but Anglo hasn’t explained to why his offer was rejected.

When disposing of assets, it’s not uncommon for sellers to prefer more established miners where there’s more certainty around financing. MMG, controlled by state-owned China Minmetals Corp., has mines across the globe, including the giant Las Bambas copper mine in Peru.

Yildirim bemoaned the decision, calling it a “game-changer in nickel history.” Anglo said it can’t discuss those involved in the process.

“China has grabbed this very important asset from the West to take to China and Anglo is the company letting this happen,” Yildirim said.

source: mining.com

Impossible Metals seeks mining lease near American Samoa

Alcoa reports $20 million tariff hit on imports from Canada

China’s aluminum makers say tariffs won’t deter overseas growth

AUCTION SJSCO D140306

B2Gold to cut 300 jobs in Namibia this year

Trump to fast-track permitting for 10 mining projects across US

MP Materials halts exports to China

Trump to approve land swap for Rio Tinto copper mine opposed by Native Americans

New Jersey warehouse filled with copper shows Trump tariff risk

US Antimony restarts Mexico smelter plant after over a year

Nornickel maintains 2025 nickel production forecast

Ensuring the deepest coolant cleaning for quality rolling

Russia’s VEB to invest $13.4B in copper mine in country’s far east

China’s export controls are curbing critical mineral shipments to the world

Turkish nickel bull plans $2 billion M&A spree to rival China

MP Materials halts exports to China

Trump to approve land swap for Rio Tinto copper mine opposed by Native Americans

Iron ore price set for second weekly loss as tariff turmoil weighs

Trump to approve land swap for Rio Tinto copper mine opposed by Native Americans

US Antimony restarts Mexico smelter plant after over a year

Nornickel maintains 2025 nickel production forecast

Russia’s VEB to invest $13.4B in copper mine in country’s far east

China’s export controls are curbing critical mineral shipments to the world

Turkish nickel bull plans $2 billion M&A spree to rival China

MP Materials halts exports to China

Trump to approve land swap for Rio Tinto copper mine opposed by Native Americans

Iron ore price set for second weekly loss as tariff turmoil weighs

Trump to approve land swap for Rio Tinto copper mine opposed by Native Americans