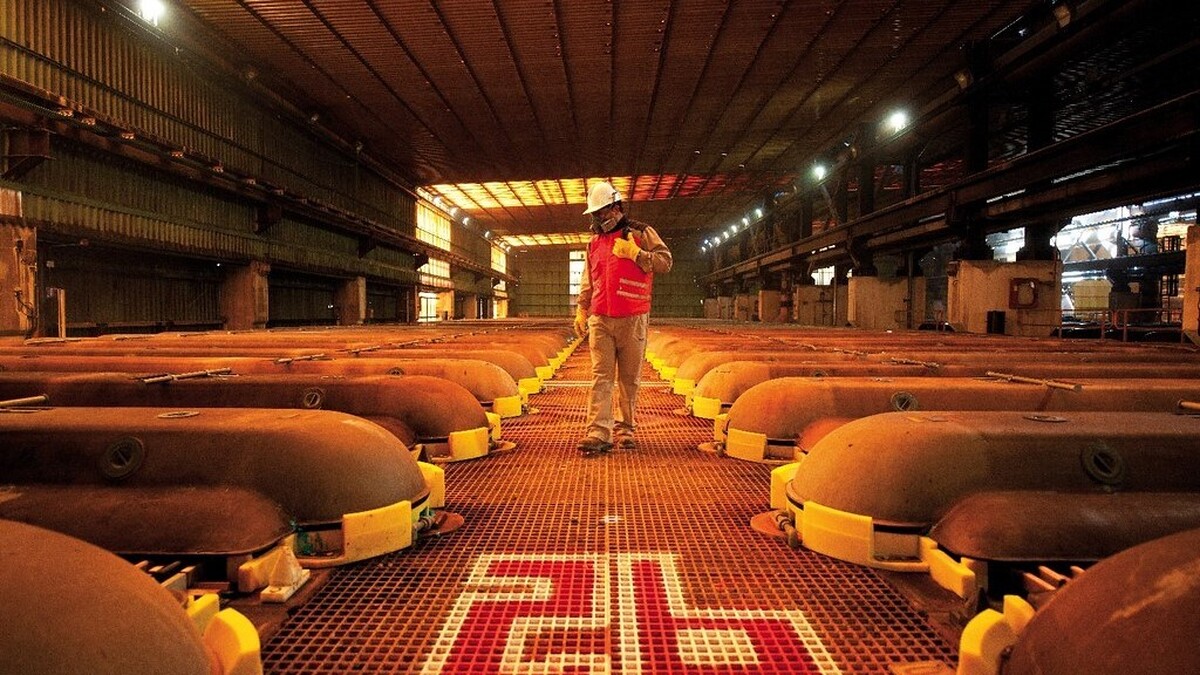

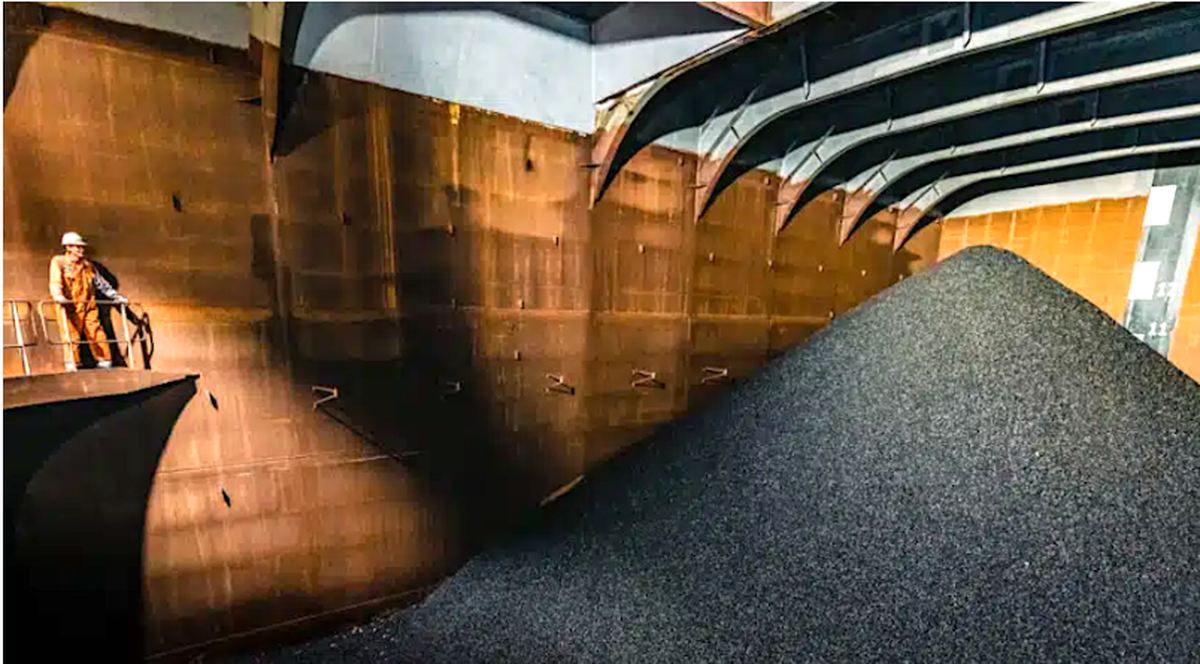

Trade war risks copper investments needed to meet future demand

According to me-metals cited from mining.com, US President Donald Trump’s efforts to re-balance global trade — including a 145% tariff on Chinese imports — and retaliation by Beijing are dimming the outlook for global growth, with credit costs on the rise amid wide bond-market swings. That’s a toxic combination for those tasked with multibillion-dollar decisions on expanding copper supplies.

Although such projects are based on long-term supply-and-demand forecasts, miners and their financiers are gun-shy after getting burned in previous busts.

“Investors, especially in mining, need more certainty, especially with long-term investments,” Antofagasta Plc chief executive officer Ivan Arriagada said during the CESCO Week mining event in Santiago this week. “Therefore, this could reduce investments or delay some decisions.”

Less investment is the last thing the industry needs — assuming the trade war doesn’t have a significant impact on copper demand and the electrification trend helping to underpin it.

Additional demand from the energy transition, power-grid overhauls and an expected US data center boom, means the industry needs to churn out 7.5 million metric tons of copper over the next 10 years from projects that haven’t been sanctioned yet, according to CRU Group estimates.

The industry’s response at this week’s gathering was to stress the importance of collaboration, adopting newer technology, and spinning off or outsourcing ancillary work related to water and energy.

source: mining.com

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

NextSource soars on Mitsubishi Chemical offtake deal

Australia weighs price floor for critical minerals, boosting rare earth miners

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Hudbay snags $600M investment for Arizona copper project

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF