Lundin Gold exceeds guidance with record annual production

According to me-metals cited from mining.com, During the fourth quarter, Lundin produced a total of 135,241 oz. of gold, for a 36.2% improvement on the same quarter of 2023, owing to an increase in gold head grades.

Lundin Gold’s shares rose 5.5% to C$32.74 apiece by noon ET following the announcement, taking its market capitalization to C$7.9 billion ($5.5bn). The stock traded between C$14.23 and C$35.89 over the past 52 weeks.

Near-term outlook

Last month, Lundin raised its annual production guidance to 475,000–525,000 oz. for 2025 through 2027 after making progress at expansion projects aimed at improving throughput and recovery.

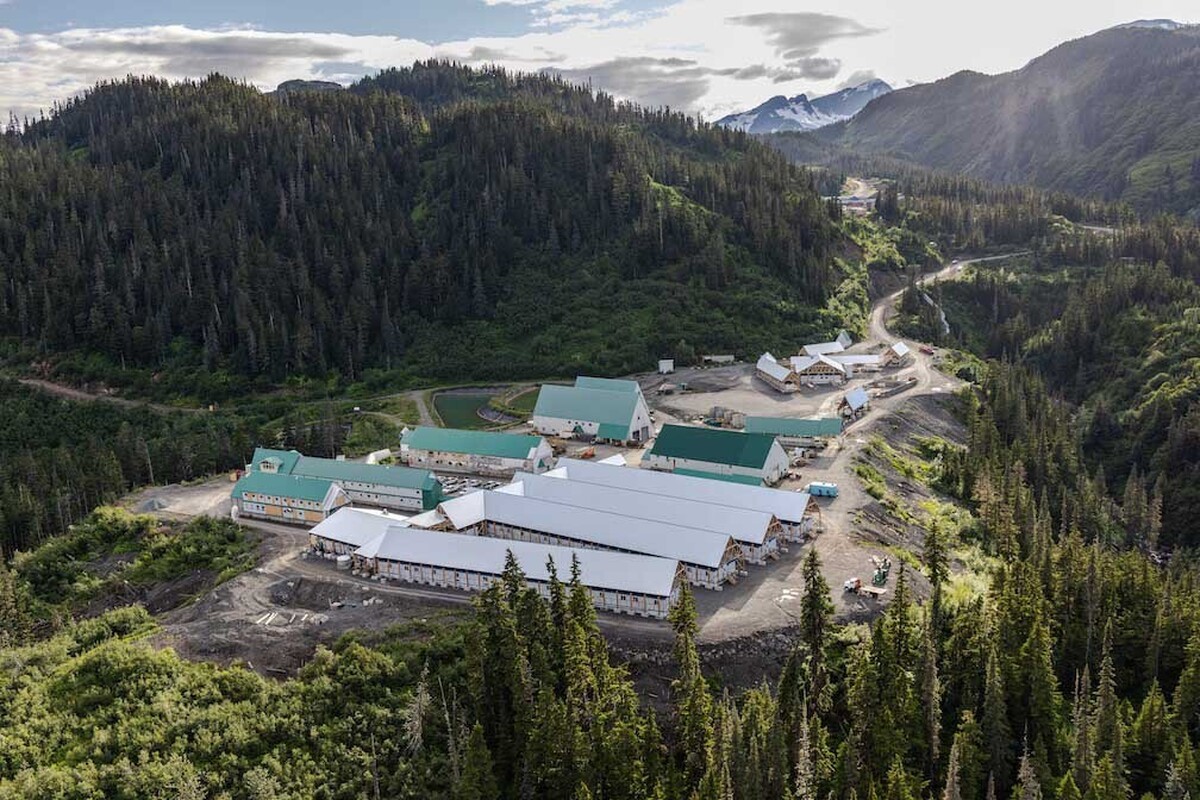

Following the expansion, the Fruta del Norte mill is expected to have a throughput of 5,000 tonnes per day on average, the company has said, adding that further investments are planned to increase that to 5,500 tonnes starting in 2026.

In addition to upgrading the mine operation, Lundin also has a three-year greenfield exploration strategy to boost the Fruta del Norte resources.

The company acquired Fruta del Norte in 2014 from Kinross Gold, which had to halt operations after failing to reach an agreement with Ecuadorian authorities on development terms.

Construction began in July 2017, and the first gold was poured in November 2019. Commercial production commenced in February 2020, making Fruta del Norte Ecuador’s first large-scale gold mine.

Later in 2020, Lundin approved an $18.6 million mine expansion.

source: mining.com

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

Uzbek gold miner said to eye $20 billion value in dual listing

NextSource soars on Mitsubishi Chemical offtake deal

Hudbay snags $600M investment for Arizona copper project

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Australia weighs price floor for critical minerals, boosting rare earth miners

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF