Platinum, palladium and rhodium in short supply – Johnson Matthey

Supply shortfalls have driven rapid price gains, with platinum trading at six-year highs and rhodium and palladium close to record levels.

A shortfall is expected for palladium and rhodium this year as well, the third consecutive annual deficit for rhodium and the tenth for palladium, Johnson Matthey researcher Rupen Raithatha said.

Platinum may see a third consecutive annual deficit in 2021, depending on how much metal is stockpiled by investors, he said.

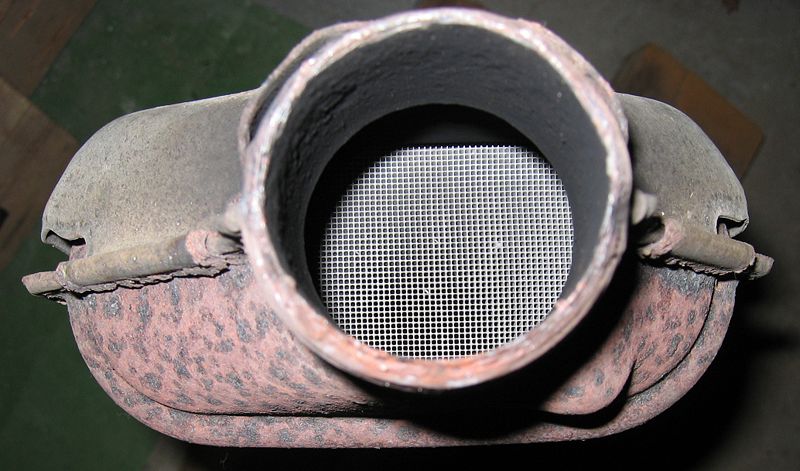

All three metals are used in catalytic converters to reduce harmful emissions, and tightening environmental regulation is forcing auto makers to put more into each vehicle. Platinum is also in demand by other industies, for jewellery and as an investment.

Johnson Matthey is a leading autocatalyst manufacturer.

It said the 7 million-8 million ounce a year platinum market was undersupplied by 390,000 ounces in 2020 after a shortfall of 301,000 ounces in 2019.

The 10 million ounce a year palladium market saw a shortfall of 606,000 ounces, down from 893,000 ounces in 2019. The 1 million ounce rhodium market was undersupplied by 84,000 ounces last year, up from 38,000 ounces in 2019.

The company said its numbers for 2020 were preliminary estimates.

Both demand and supply were curtailed by the coronavirus pandemic, which disrupted mining and recycling and depressed industrial activity and vehicle and jewellery sales.

Supply was particularly hard hit due to the closure for several months of a major processing plant run by Anglo American Platinum (Amplats) in South Africa.

Raithatha said he expected both supply and demand to bounce back strongly this year as the virus is contained.

He said around 1 million ounces of unprocessed inventory had built up while the Amplats plant was closed which would be worked through during 2021 and 2022, adding to supply.

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

Copper price slips as unwinding of tariff trade boosts LME stockpiles

Codelco seeks restart at Chilean copper mine after collapse

NextSource soars on Mitsubishi Chemical offtake deal

Australia weighs price floor for critical minerals, boosting rare earth miners

Uzbek gold miner said to eye $20 billion value in dual listing

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

Hudbay snags $600M investment for Arizona copper project

Zimbabwe labs overwhelmed as gold rally spurs exploration, miner says

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF

Cochilco maintains copper price forecast for 2025 and 2026

Adani’s new copper smelter in India applies to become LME-listed brand

HSBC sees silver benefiting from gold strength, lifts forecast

Mosaic to sell Brazil potash mine in $27M deal amid tariff and demand pressures

Samarco gets court approval to exit bankruptcy proceedings

Hudbay snags $600M investment for Arizona copper project

Discovery Silver hits new high on first quarterly results as producer

Trump says gold imports won’t be tariffed in reprieve for market

AI data centers to worsen copper shortage – BNEF