Even the iron ore price will bottom

The price dropped 47% during 2014 and declines so far this year come to 39%. Today's price compare to $190 a tonne hit February 2011 and an average of $135 a tonne in 2013.

For an iron ore price below $40 you have to go back to 2007 when annual contract pricing between the Big 3 producers – Vale, Rio Tinto and BHP Billiton – and Chinese and Japanese steelmakers were still the industry norm.

During the 2008 negotiations, the so-called benchmark was upped 68% to $60.80, but the triumvirate continued to lose out on billions under annual contract pricing. Growing Chinese port stockpiles saw action in the industry shift to mills and traders, ushering in the era of rapidly rising and volatile prices based on spot assessments by MetalBulletin and The Steelindex.

The big three producers – Vale, Rio Tinto and BHP Billiton – have been following a scorched earth strategy of raising output and slashing costs to weather low prices and push out competitors.

It's been highly successful. Up to a point.

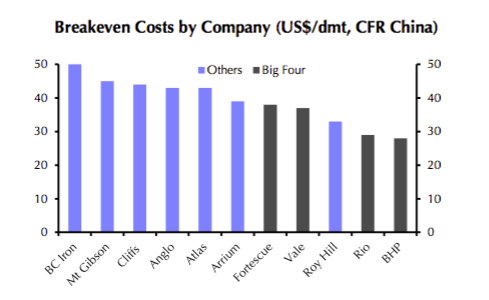

On cash costs basis major producers have been adding capacity in the teens, but breakeven costs including freight, insurance and other costs range between $28 – $39.

The Big 3 (and no 4 Fortescue) have all vowed to cut mining costs even further with Vale boasting recently that it's 90mtpa S11D project in the Amazon will push costs into single digits.

But these cost savings have been largely thanks to a falling currency with the real dropping to record lows this year. A weaker Aussie dollar has also helped Pilbara producers as has falling diesel prices.

Freight rates for Capesize vessels (named so because the ships are too wide for the Panama canal), the predominant carrier used in the 1.3 billion tonnes seaborne iron ore trade fell to just $4,015 a day last week (it topped out a ludicrous $234,000 in June 2008).

But like currencies and crude oil, freight rates can't decline indefinitely.

Capital Economics, a London-headquartered independent researcher, in a note on Friday says that while the price of iron ore may fall below $40 a tonne as more low cost supply (notably S11D and 50mtpa Roy Hill in Australia) is added, it won't stay there for long.

Senior commodities economist John Kovacs says the fact that prices are now approaching the breakeven cost for even the largest miners, coupled with a modest rise in global iron ore demand next year and near term supply losses (BHP-Vale joint venture Samarco will take 9mt off the market and more Chinese mines will close) could spell a gradual recovery.

The closure of high-cost capacity will increase the market power of the larger miners and could provide the impetus for prices to rise argues Kovacs.

Capital Economics sees the price of the steelmaking raw material to rise steadily, reaching $55 a tonne by the end of 2016.

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds