India: Imported Scrap Market Turns Silent, Domestic Scrap Remains Preference

In conversation with industry participants, SteelMint learned that imported scrap offers to South Asia declined further this week on limited demand. Afore moving towards the closure on account of Eid holidays, Pakistan and Bangladesh observed minor trade activities depending on the requirement, however, Indian importers continue to remain on sidelines amid fearful domestic steel industry situation. Suppliers turn less interested in offering amid no buying enquires being made.

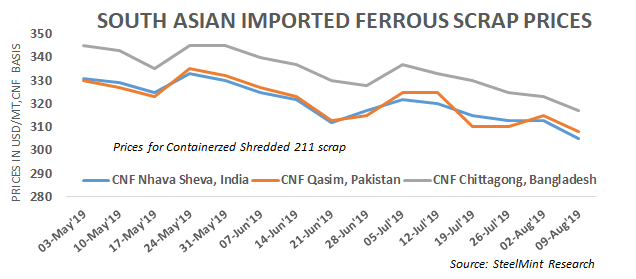

SteelMint’s assessment for containerized Shredded from UK, Europe and USA stands at USD 300-305/MT, CFR Nhava Sheva, moving down further by USD 5-10/MT against last week’s report. Strains of US-China trade war weakened demand further pulling offers from traders down. However, recycling yards in US and Europe were targeting higher levels on increased collection costs and better domestic demand.

Minor trades in containers reported earlier this week at USD 308-312/MT, CFR Nhava Sheva. While a Southern region based leading trader sold Shredded at USD 315-316/MT, CFR Vizag.

Most of the buyers are expected to remain in ‘wait and watch’ mode until returning from Eid holidays 19th August after when the real picture of the market can be drawn. Market remained in ambiguity about the price direction once Turkey steel makers resume remaining shipments.

Availability of offers of HMS scrap from Dubai turned very less as most of the suppliers remain in holiday’s mood while other few look to sell scrap domestically. HMS 1 assessed flat at USD 275-285/MT and HMS 1&2 scrap at around USD 270-275/MT, CFR Nhava Sheva amid no news of significant trades.

South African origin HMS 1 offers stand at around USD 290/MT, CFR Nhava Sheva and USD 295/MT, CFR Qasim. While West African HMS 1&2 (80:20) assessment stand at around USD 270-275/MT, CFR depending upon quality and container size varying from 20-24 MT loading.

Domestic scrap remains a preference - Indian domestic scrap prices observed successive correction since last two months, falling around INR 4,000/MT (USD 55), on the other hands, the gap between average quality imported HMS and domestically available HMS scrap has been increased to as high as INR 2,000-2,500/MT keeping domestic scrap the priority for most of the steelmakers amid lowered production to almost 50% of capacities in order to avoid losses.

The current assessment of local HMS 1&2 (80:20) stands at INR 20,600-20,800/MT (USD 292), CFR Mumbai. Chennai based HMS 1&2 (80:20) is being assessed at INR 20,000-20,200/MT, ex-works marginally down W-o-W. Indian Rupee has depreciated further this week to 70.7 levels today from 69.6 levels a week earlier against USD.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Goldman told clients to go long copper a day before price plunge

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge