Indian Domestic HRC Prices Slump Further Over Thin Buying

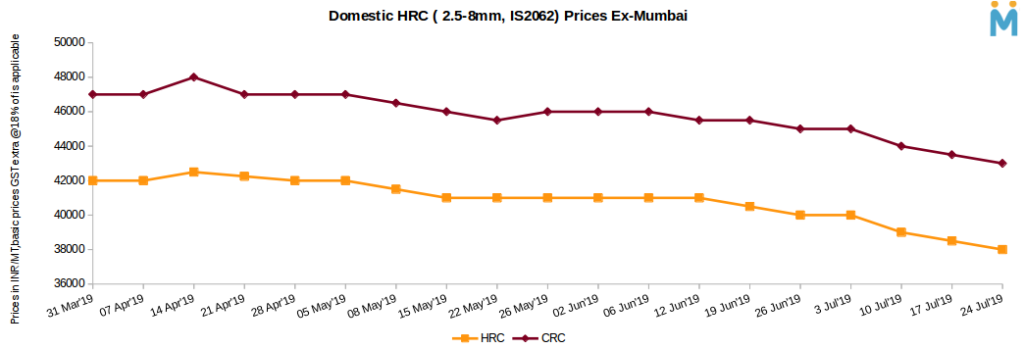

As per SteelMint price assessment trade reference prices for HRC (IS2062, 2.5-8mm) is currently at INR 38,000/MT (Ex-Mumbai), INR 37,000-37,200MT (ex-Delhi) and INR 39,000-40,000/MT(ex-Chennai). Prices mentioned above are basic and extra GST@ 18% will be applicable.

Meanwhile CRC (0.9mm, IS 513) prices also fell by INR 750-1000/MT on weekly basis and are currently hovering around INR 43,500-44,000/MT (ex-Mumbai), INR 41,000-43,500/MT (ex-Delhi) and INR 43,500-44,500/MT(ex-Chennai). Prices mentioned above are basic and extra GST@ 18% will be applicable.

Last week domestic flat steel prices fell by INR 500-1000/MT over sluggish demand.

Indian HRC prices continued to remain under pressure in Jun-Sep as these months experience seasonal slowdown amid ongoing rainy season. Also absence of robust demand from auto sector and delayed funding for major projects continue to drag down HRC prices further in domestic market.

As per SteelMint price assessment, domestic HRC prices started to weaken since mid Apr’19.On an average basis domestic HRC prices stood around INR 42,500/MT (ex-Mumbai) in Apr’19 .Prices have come down by INR 4,200/MT since beginning of this fiscal.

Amid ongoing discussions for safeguard duty, Indian importers have also remained silent and kept themselves away from booking HRC from countries like China, Japan & Korea.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Goldman told clients to go long copper a day before price plunge

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge