Pakistan: Imported Scrap Prices Fall USD 10 in Recent Deals

Meanwhile, the domestic market continued facing a slowdown in finished steel demand despite almost steady asking rates while billet prices coming slightly come under pressure.

SteelMint’s assessment for containerized Shredded 211 scrap from US, Europe and UK stands at USD 310-313/MT, CFR Qasim, lowering by around USD 10-12/MT against last week’s report with numerous deals being concluded in containers at USD 310-312/MT, CFR.

“Amid increasingly active buying for imported scrap to tackle with documentation issues locally, around 25,000-30,000 MT quantities could have been sold in Pakistan during the last 10 days while prices observed continued downtrend. However, suppliers seem to have turned less desperate now unless Turkey prices soften further” shared one of the leading traders.

The non-exemption of 3% duty on HMS scrap import is putting off the buyer’s interest for imported HMS, with few participants expecting the duty to be removed, while assessment for Dubai origin HMS 1 stands at around USD 305-310/MT, CFR, dropping by USD 5-10/MT on a weekly basis.

UK origin HMS 1&2 assessed at around USD 295/MT, CFR Qasim, as prices remained under pressure. Few deals for bundle scrap and fabrication scrap from Dubai were reported at USD 265/MT and USD 325/MT, CFR Qasim.

Pakistani Rupee continued to depreciate, albeit slightly as the currency stood at around 158-159 levels against USD this week.

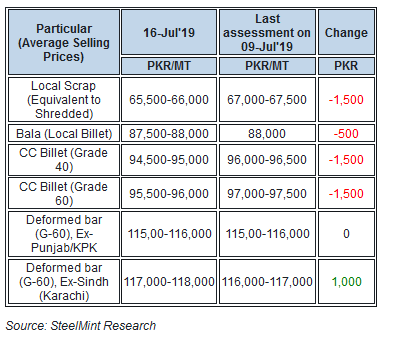

Domestic steel market remains slow, another hike in power tariff is expected - Finished steel demand remained subdued this week amid a persisting slowdown, as offers by steelmakers remained more or less stable this week, while billet prices inched down. Production activities slightly improved against last week, however, report of power tariff increase from Aug’19 concerned the steelmakers as prices likely to increase further.

In Northern region rebar average selling prices assessed at around PKR 115,000-116,000/MT, ex-works (USD 721-727) meanwhile, offers of rebar by Southern (Karachi region) steel mills have increased to around PKR 117,000-118,000/MT, ex-works. SteelMint’s assessment of CC billet G-60 has dropped in the range of PKR 95,000-96,000/MT (USD 595-601), ex-works.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Goldman told clients to go long copper a day before price plunge

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge