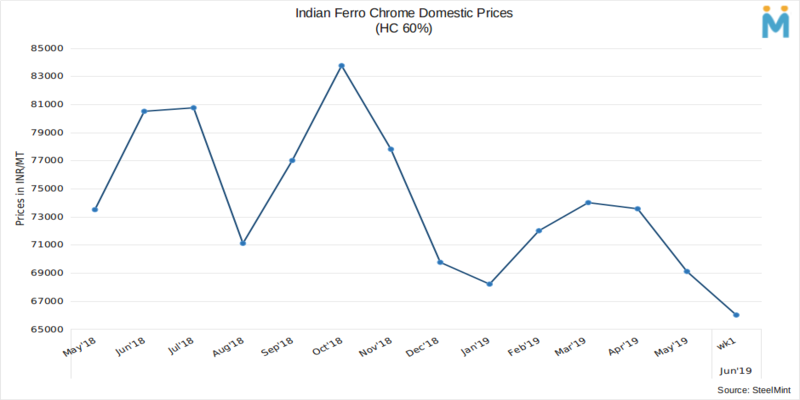

Indian Ferro Chrome Price Sinks Amid Trade Concluded at Lower Levels

China is procuring Chrome Ore from South Africa at a lower cost and is producing Ferro Chrome at ample amount. Due to this, the pressure is building up on the sellers for selling the product. Indian major Ferro Chrome producers reported that there are very few inquiries from the global market and they are also demanding material at much lower prices. Most market participants believe that the market in the present scenario is a buyer’s market, and the buyers are aggressively bidding at lower levels. SteelMint learned that the producers are stressed as they fear that if the prices continue to fall at this pace, they may have to switch to other commodities.

Domestic price for Ferro Chrome in India is assessed to at around INR 66,000/MT Ex-Jajpur. Export prices for CNF South Korea (10-50mm, HC 60%) is 75 cents/lb, for CNF Japan (10-50mm, HC 60%) is 76 cents/lb and for CNF China (10-150mm, HC 60%) is around 72 cents/lb.

On the future outlook, there is a very little chance of Ferro Chrome market to rebound. Deals are being concluded at lower than the cost to keep up with the market. Such a fall in prices is attributed to the supply-demand dynamics. Market sources believe that the prices may go further down due to the lowered Chinese Prices of Ferro Chrome and willingness by Ferro Chrome producers to cut offers to conclude deals.

Newmont nets $100M payment related Akyem mine sale

First Quantum scores $1B streaming deal with Royal Gold

Caterpillar sees US tariff hit of up to $1.5 billion this year

Gold price rebounds nearly 2% on US payrolls data

Goldman told clients to go long copper a day before price plunge

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Copper price posts second weekly drop after Trump’s tariff surprise

One dead, five missing after collapse at Chile copper mine

Idaho Strategic rises on gold property acquisition from Hecla

Codelco seeks restart at Chilean copper mine after collapse

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

US slaps tariffs on 1-kg, 100-oz gold bars: Financial Times

BHP, Vale offer $1.4 billion settlement in UK lawsuit over Brazil dam disaster, FT reports

NextSource soars on Mitsubishi Chemical offtake deal

Copper price slips as unwinding of tariff trade boosts LME stockpiles

SAIL Bhilai Steel relies on Danieli proprietary technology to expand plate mill portfolio to higher steel grades

Alba Discloses its Financial Results for the Second Quarter and H1 of 2025

Australia weighs price floor for critical minerals, boosting rare earth miners

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge