Steelmakers Consider Import Tariff Hikes “Insufficient”

The removal of sanctions imposed on Iran over its nuclear program, as part of the July 14 nuclear accord struck with world powers, breathed a new life into domestic industries.

The €6.2 billion deal made between Italian steel firm Danieli Group and Iran’s large-cap mining body Iranian Mines and Mining Industries Development and Renovation Organization, among others, is a testimony to the domestic steel industry’s potential to rise.

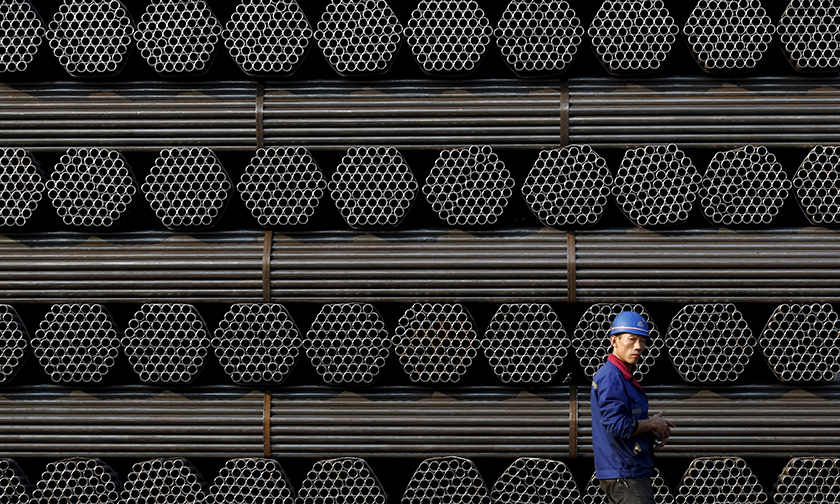

Chinese Factor

The global steel industry’s condition is improving. China has vowed to cut down its steel production overcapacity and reshape its economy by moving away from heavy industries toward a more consumer-based economy as part of a long-term plan. This has helped global steel and iron ore prices recover from their dreadful 2015 lows, buoying Iranian goods along the way.

China, although hard at work to shrink its overcapacity, is still an industrial goliath producing more than half the world’s steel and exporting millions of tons.

Backed by the Chinese government and supported through low-interest loans and incentives, the country’s steelmakers have been aggressively dumping their products into the global markets at significantly cheap prices, disrupting the steel markets’ balance and gradually taking over market share from local producers.

Such practices gave rise to an outcry from every steelmaking country, Iran included. Iranian producers courted government officials for years to raise the steel import tariff bulwark and shield domestic players from the Chinese onslaught.

The government did finally respond. First, steel importers were barred from using the official exchange rate (which is set lower than market rates) during the first months of the previous Iranian year (started March 20, 2015), and in line with a promise made in February, the government raised import tariffs on steel products to a maximum of 20%.

Many steelmakers believe the government took the right measures at the right time, but did not go far enough.

Mohammad Nahavandian, the chief of staff of Iran’s president, addressed domestic steelmakers during the Iranian Steel Market Conference 2016 back in February and said: “Iranian steelmakers have voiced their concerns, and we are planning to take action by further increasing import tariffs and adopting other supportive policies.”

The newly approved import tariffs, based on the government’s approval, include a 5% hike for steel ingots to 15%; 10% jump for hot and rolled sheets to 20%, in addition to a 10% rise for plated steel sheets to 20%.

Stark Contrast

This is while other steel producing countries have imposed massive import tariffs on China. The United States, for instance, slapped duties on the import of cold-rolled steel, used to make auto parts, appliances and shipping containers, from China to the tune of 265% back in March. The move came after ArcelorMittal and US Steel Corp., two of the world’s biggest steelmakers endured one of their worst downturns ever and had to lay off US workers.

Strangely, even China imposed higher import duties than Iran to support its domestic producers. In early April, the industrial giant slapped a 46% import duty on grain-oriented electrical steel imported from the European Union, South Korea and Japan. It justified the move by saying imports were causing substantial damage to its domestic steel industry.

“The announced import tariffs are considerably lower than what we asked for,” Mohammad Reza Modarres, managing director of Khuzestan Steel Company, was quoted as saying by Donya-e-Eqtesad.

Modarres is also a member of Iran Steel Producers Association, who had communicated the steelmakers’ demands to the government.

The industry player called on the government to support the domestic industry, by not only increasing import tariffs, but also providing producers with export incentives.

This week, deputy minister of industries, mining and trade, Mehdi Karbasian, announced that Iranian steelmakers set a record by exporting more than 4.1 million tons of steel products valued at about $7 billion in the last Iranian year, indicating an over 4% rise compared to the previous year.

“The achievement (last year’s record exports) shows that Iranian producers managed to weather the steel crisis amid faltering demand in the domestic construction sector and dumping by China and Russia glutting the global markets,” he was quoted as saying by IRNA.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook