Rio Tinto to start building massive Koodaideri iron ore mine in 2019

The miner also said it would mine its first tonnes from the project, which it says it’s one of the world’s most technologically advanced, in 2021.

“The Koodaideri orebody is 50 kilometres long and 5 kilometres wide. It will be a new production hub which will be a key feature for the Pilbara for many years to come,” iron ore chief executive Chris Salisbury said in a presentation at Rio’s investor day.

He noted the mine would be the first one to take full advantage of automation in trucking and drilling.

Rio will begin operating its long-delayed AutoHaul robot rail system by the end of the year, which will remove the logistical bottleneck the miner faces in getting iron ore from the pit to the port.

The announcement comes on the heels of BHP’s decision to invest $2.9bn for the development of the South Flank iron ore project in the central Pilbara, which will replace depleting resources at the mining giant’s Western Australian operations and up its average grade from the region in the process.

It also follows a decision by Fortescue Metals Group last month to go ahead with its $1.3-billion Eliwana project, also in the iron-ore rich Pilbara.

Rio also said that Pilbara sustaining capital would be about $1 billion over each of the next three years, including replacement mines at West Angelas, Robe Valley and Koodaideri, with the latter still to be formally approved.

Salisbury noted that Rio’s autonomous rail project AutoHaul was on schedule to be implemented by the end of the year, adding it was already providing benefits from an uplift in rail capacity.

“Removing our bottleneck in rail and increasing flexibility remain a key priority (…) Importantly, capacity is not the same as tonnes shipped. How we use the capacity of our integrated system will be dynamic, in line with a strict value-over-volume approach,” he said at the presentation.

Future remains rosy

Despite increased volatility and uncertainty around the globe, Salisbury said the general outlook remains solid, particularly when looking at its bigger customer — China.

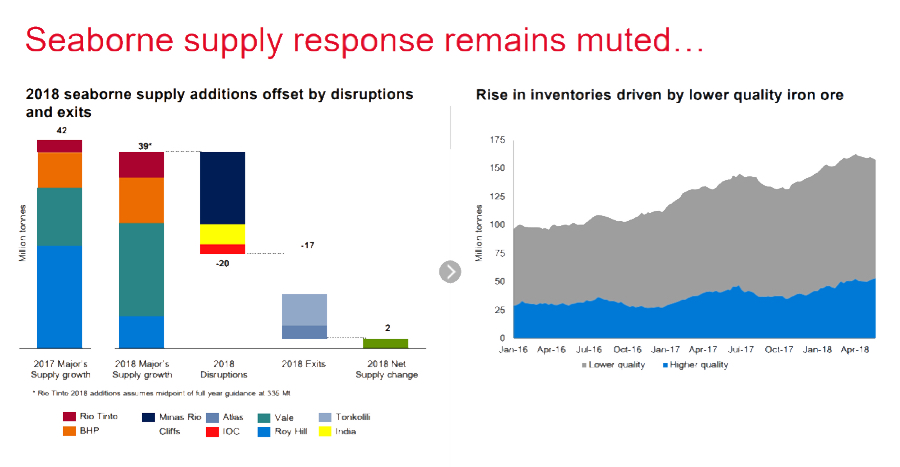

Rio sees Beijing’s supply-side reforms and environmental policy improvements lifting demand for high quality iron ore.

“China's steel industry is undergoing a structural change. Removal of less efficient steel-making capacity and strong demand is supporting steel pricing and currently provides a robust backdrop for high quality iron ore,” the company said.

Rio Tinto's Australian iron ore exports guidance for 2018 remained at between 330 million and 340 million tonnes.

The price for benchmark 62% iron ore fines last traded at $68.49 a tonne, according to the Metal Bulletin.

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Southern Copper eyes $10.2B Mexico investment pending talks

Copper price collapses by 20% as US excludes refined metal from tariffs

First Quantum scores $1B streaming deal with Royal Gold

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Caterpillar sees US tariff hit of up to $1.5 billion this year

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Australia pledges $87M to rescue Trafigura’s Nyrstar smelters in critical minerals push

Fresnillo lifts gold forecast on strong first-half surge

Why did copper escape US tariffs when aluminum did not?

Fortuna rises on improved resource estimate for Senegal gold project

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine