China imported record iron ore in September as steel output curbs start to bite

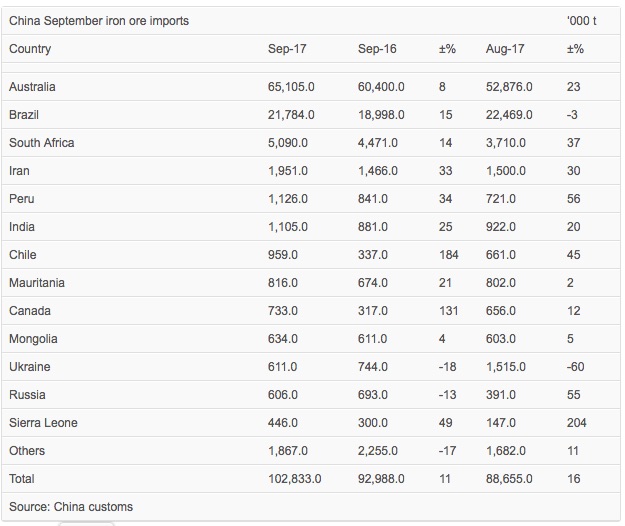

According to Hellenic Shipping News, both Australia and South Africa exported record amounts – 65.1MT and 5.09MT – while Brazil shipped its third highest level at 21.7MT.

Australia is China's largest iron ore importer followed by Brazil and South Africa. The three combined for 91.98MT in September, close to 13MT higher than August, reads a table of Chinese customs data, below. In total Chinese imports of Fe were 102.8MT, which is a 16% increase from August. The last record of 98.3MT was set in December 2015, reports Hellenic Shipping News.

Earlier this month Chinese iron ore futures jumped more than 5%, due to a rally in steel prices, as China's steel mills ramp up production in expectation of a major output cut. Chinese steel output in September rose 5.3% from the year before to 71.8m tonnes; not far off the record 73.2m tonnes produced in August.

But mills in northern Chinese cities including top steel-producing Tangshan have been ordered to slash production due to a government mandate to fight pollution caused by industrial plants. As much as 30 million tonnes could be reduced between October and March.

According to London-based consultants CRU, China is on track to cut 240m tonnes of annual capacity by 2020 from its peak in 2015,

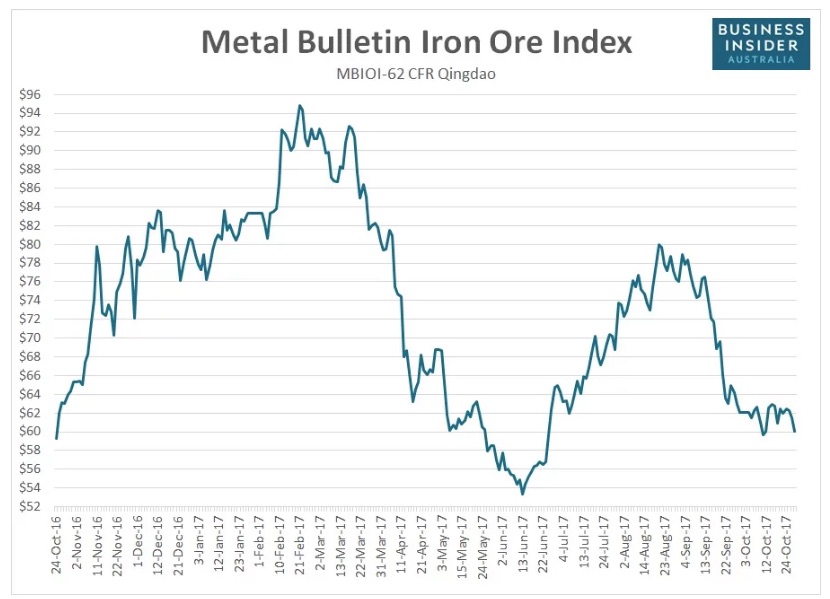

The reality of the cuts (mills have begun reducing rates) are beginning to be reflected in the iron ore price. On Friday the spot price fell for the third straight session, in parallel with reductions in the price of Chinese futures. Via Business Insider Australia, Metal Bulletin reports the steelmaking ingredient (benchmark 62% fines) slid to a new two-week low of $60.08 a tonne Friday, extending its price decline from mid-August to 25%.

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

China quietly issues 2025 rare earth quotas

BHP delays Jansen potash mine, blows budget by 30%

BHP, Lundin JV extends useful life of Argentina copper mine

Gold price eases after Trump downplays clash with Fed chair Powell

KoBold signs Congo deal to boost US mineral supply

Teck approves $2.4B expansion of Highland Valley Copper

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions

Pilot Mountain tungsten project in Nevada gets $6M from Department of Defense

Adriatic boosts output but trims forecast ahead of Dundee deal

Peru mulls green light for $6 billion in mining projects

Majestic Gold halts Chinese mine following fatal accident

Energy Fuels’ rare earth JV in Australia receives regulatory OK

Torex Gold buys Prime Mining in $327M Mexico expansion

US targets mine waste to boost local critical minerals supply

Copper price pulls back sharply ahead of US tariff deadline

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions

Pilot Mountain tungsten project in Nevada gets $6M from Department of Defense

Peru mulls green light for $6 billion in mining projects

Majestic Gold halts Chinese mine following fatal accident

Energy Fuels’ rare earth JV in Australia receives regulatory OK

Torex Gold buys Prime Mining in $327M Mexico expansion

US targets mine waste to boost local critical minerals supply

Copper price pulls back sharply ahead of US tariff deadline