Barrick CEO says miner ‘making progress’ in dispute with Mali

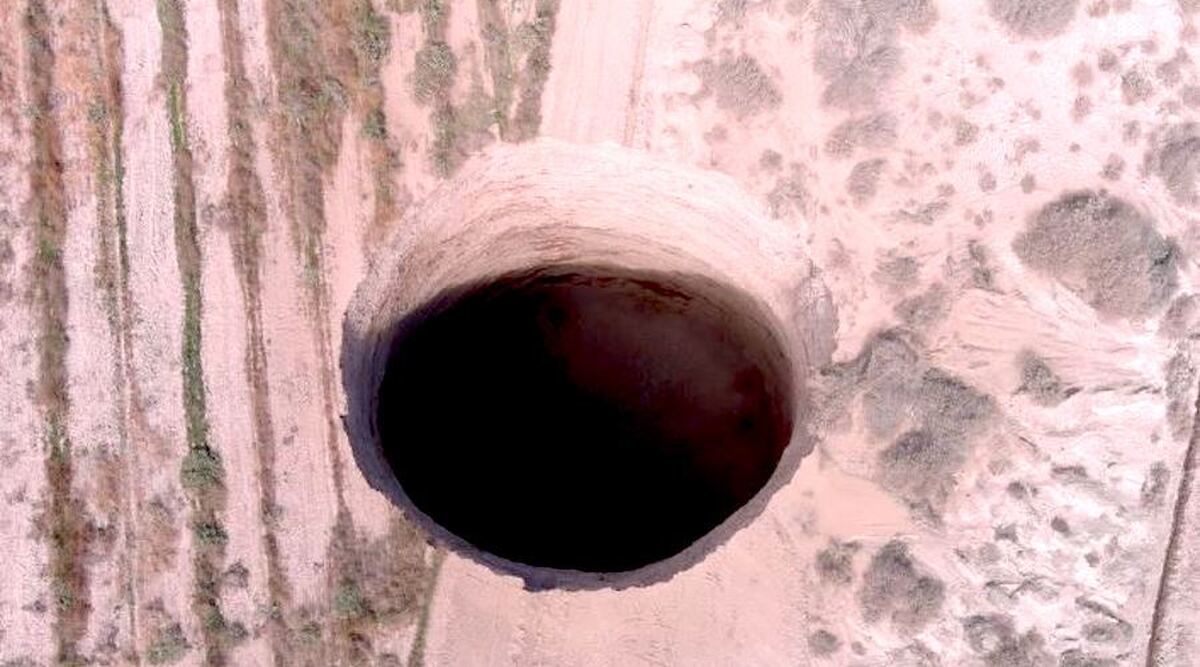

According to me-metals cited from mining.com, The Canadian company last month suspended operations at the vast Loulo-Gounkoto complex in Mali after the government started removing gold from the nation’s biggest mine in the latest escalation of a months-long dispute. Barrick and Mali’s military rulers are locked in a standoff over the distribution of revenue from an asset that’s key for both the company and the government.

The state has blocked Barrick from shipping the precious metal out of the country since November, and put out an arrest warrant for Bristow. The miner has begun arbitration proceedings against Mali.

“Mali has got itself in a position where it is really trying to shake out some short-term cash out of the industry, and this industry is the very foundation of the economy,” Bristow said. “We’re making progress, not as fast as I would expect, but I’m sure everyone is a little cautious.”

The CEO of the world’s No. 2 gold producer also said more consolidation was needed in the mining industry, with too many companies running too few assets. Barrick would continue to grow organically and buy back shares, Bristow said.

The Barrick chief said there’s still “a lot of upside” in gold, which held near a record after US President Donald Trump’s 10% tariffs on China prompted swift retaliation from Beijing, buoying haven demand.

“We are seeing a continuation of de-dollarization, fueled by the actions coming out of Washington and the White House,” Bristow said. “Conflicts on every continent. Gold has really arrived as the ultimate store of value and people are buying the physical.”

source: mining.com

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Locksley Resources forms US alliances to establish domestic antimony supply chain

El Salvador buys $50M in gold for reserve diversification

Freeport doubles down on Amarc’s JOY project

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Freeport doubles down on Amarc’s JOY project

El Salvador buys $50M in gold for reserve diversification

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Locksley Resources forms US alliances to establish domestic antimony supply chain

Critical Metals, Ucore ink 10-year offtake deal to supply rare earths to US plant

Equinox Gold kicks off ore processing at Valentine mine

India considers easing restrictions on gold in pension funds

Luca Mining expands Tahuehueto mine with Fresnillo land deal

Freeport doubles down on Amarc’s JOY project

El Salvador buys $50M in gold for reserve diversification

Construction at Helium Evolution’s Saskatchewan processing plant nearly complete

Ancient rocks in Australia reveal one of world’s most promising new niobium deposits – report

Locksley Resources forms US alliances to establish domestic antimony supply chain

India considers easing restrictions on gold in pension funds