Steel Output Up 13.7%

Iranian steel mills produced 9.947 million tons of steel during the first half of 2017, registering a 13.7% growth compared with last year’s corresponding period, the latest report released by World Steel Association announced.

The report shows Iran’s crude steel output in June stood at 1.78 million tons, indicating a 5.7% rise compared with last year’s similar month and a 0.4% drop compared with the previous month.

Iran produced 8.82 million tons of direct-reduced iron during the six months, up 11.6% YOY, to remain the world’s largest producer of DRI. The June output was up 10.7% to 1.534 million tons. Iran’s closest rival, India, lagged behind as its June output dropped 4.8% to 1.18 million tons.

DRI, also called sponge iron, is produced from the direct reduction of iron ore to iron by a reducing gas made from natural gas or coal. It is most commonly made into steel using electric arc furnaces. About 70-75% of Iranian mills use EAFs.

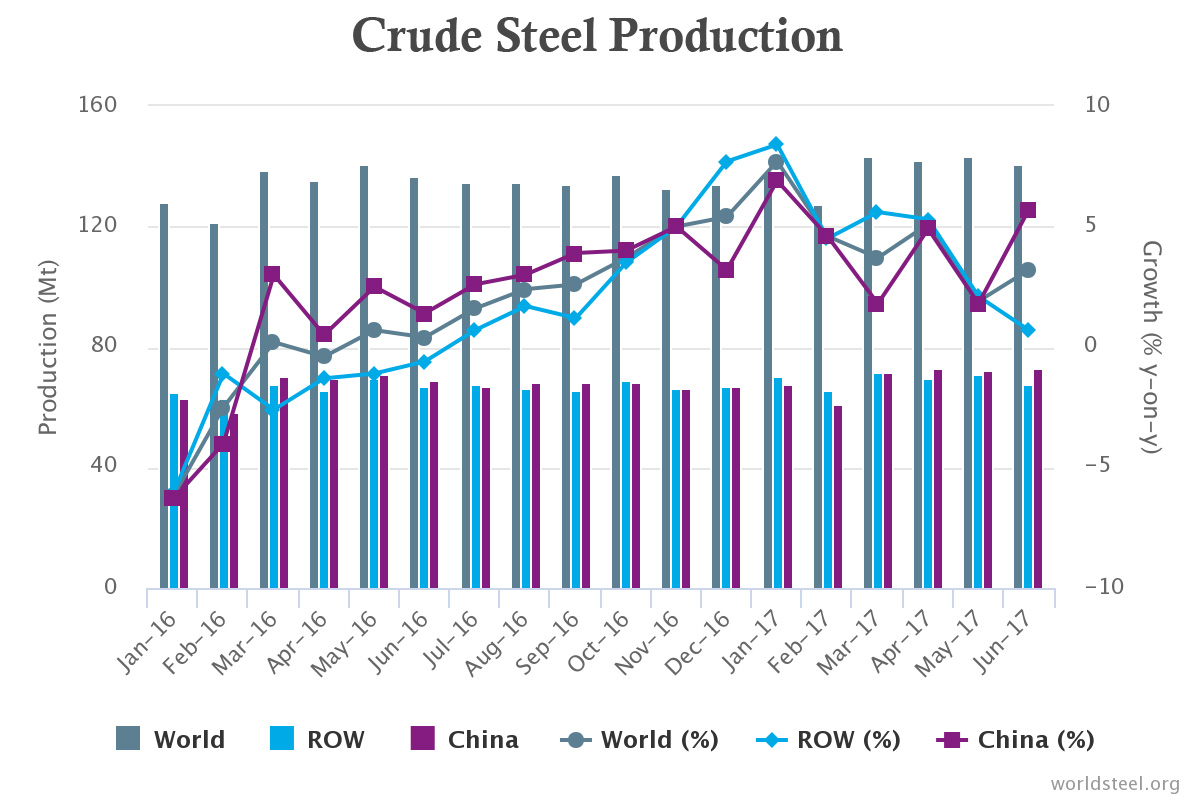

Global steelmakers produced 836.02 million tons of crude steel during the six months, up 4.5% YOY. Their crude steel output stood at 141.04 million tons in June, indicating a 3.2% increase YOY. It shrank 1.5% compared to May.

WSA members account for about 85% of the world’s steel production, including over 160 steel producers with nine of the 10 largest steel companies, national and regional steel industry associations, and steel research institutes.

The global uptrend in output continued robustly on a YOY basis. Most steelmakers recorded slightly lesser outputs compared to May, however.

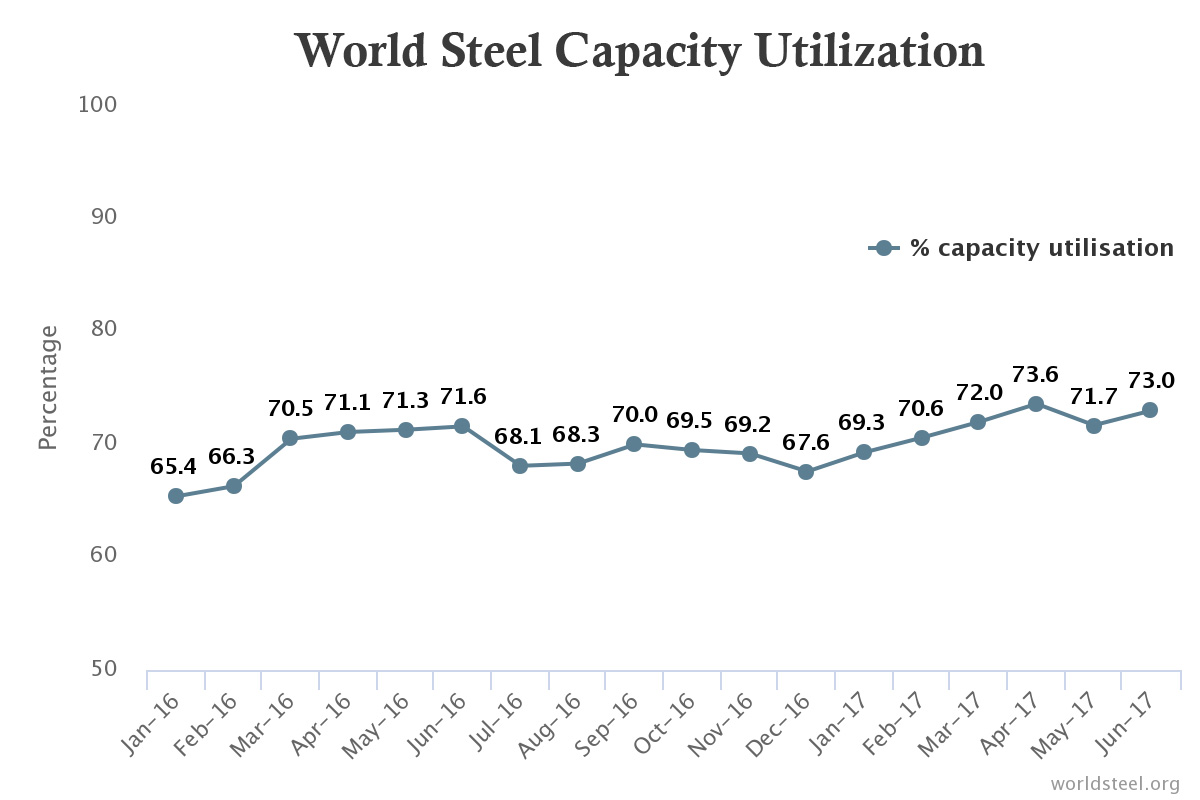

Furthermore, the crude steel capacity utilization ratio of the 67 countries under review was 73% in June. This is 1.4% higher than June 2016. Compared to May, it is 1.3% higher.

China’s steel production hit a record high last month, as it churned out 73.23 million tons, registering a 5.7% increase YOY.

The unprecedented performance from the industrial giant comes, as China’s gross domestic product topped estimates in the second quarter. Chinese mills are in a sweet spot, with larger supplies ramping up output after a crackdown on the informal sector triggered a shortage of some products.

Brazil, France, Italy, South Korea, Taiwan and Iran’s regional rival, Turkey, also recorded upticks in steel production.

China remained the world’s largest producer in H1 2017 with 419.74 million tons of steel output. It was followed by Japan with 52.30 million tons, India with 49.48 million tons, the United States with 40.59 million tons, Russia with 35.34 million tons, South Korea with 34.69 million tons, Germany with 22.22 million tons, Turkey with 18.21 million tons, Brazil with 16.72 million tons, Italy with 12.35 million tons, Taiwan with 11.59 million tons and Ukraine with 10.50 million tons.

Iran remained the world’s 14th largest steelmaker during the period, as it was placed between Mexico (13th) with a 10.03-million-ton output and France (15th) with 7.91 million tons.

Iran’s crude steel output stood at 17.89 million tons in 2016, according to WSA data.

The country aims to become the world’s sixth largest steel producer as per the 20-Year Vision Plan (2005-25), which envisions an annual production of 55 million tons of crude steel and annual exports of 20-25 million tons by the deadline.

Minister of Industries, Mining and Trade Mohammad Reza Nematzadeh said Iranian steel mills have so far materialized about 60% of the capacity target.

The main challenges so far have been to maintain a steady capacity-making growth, balance raw material supply across the spectrum and boost the pace of production and steel usage compared to capacity-making.

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

China quietly issues 2025 rare earth quotas

BHP delays Jansen potash mine, blows budget by 30%

Gold price eases after Trump downplays clash with Fed chair Powell

BHP, Lundin JV extends useful life of Argentina copper mine

Teck approves $2.4B expansion of Highland Valley Copper

KoBold signs Congo deal to boost US mineral supply

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions

Pilot Mountain tungsten project in Nevada gets $6M from Department of Defense

Adriatic boosts output but trims forecast ahead of Dundee deal

Peru mulls green light for $6 billion in mining projects

Majestic Gold halts Chinese mine following fatal accident

Energy Fuels’ rare earth JV in Australia receives regulatory OK

Torex Gold buys Prime Mining in $327M Mexico expansion

US targets mine waste to boost local critical minerals supply

Copper price pulls back sharply ahead of US tariff deadline

Gold price retreats to near 3-week low on US-EU trade deal

China’s lithium markets gripped by possible supply disruptions

Pilot Mountain tungsten project in Nevada gets $6M from Department of Defense

Peru mulls green light for $6 billion in mining projects

Majestic Gold halts Chinese mine following fatal accident

Energy Fuels’ rare earth JV in Australia receives regulatory OK

Torex Gold buys Prime Mining in $327M Mexico expansion

US targets mine waste to boost local critical minerals supply

Copper price pulls back sharply ahead of US tariff deadline