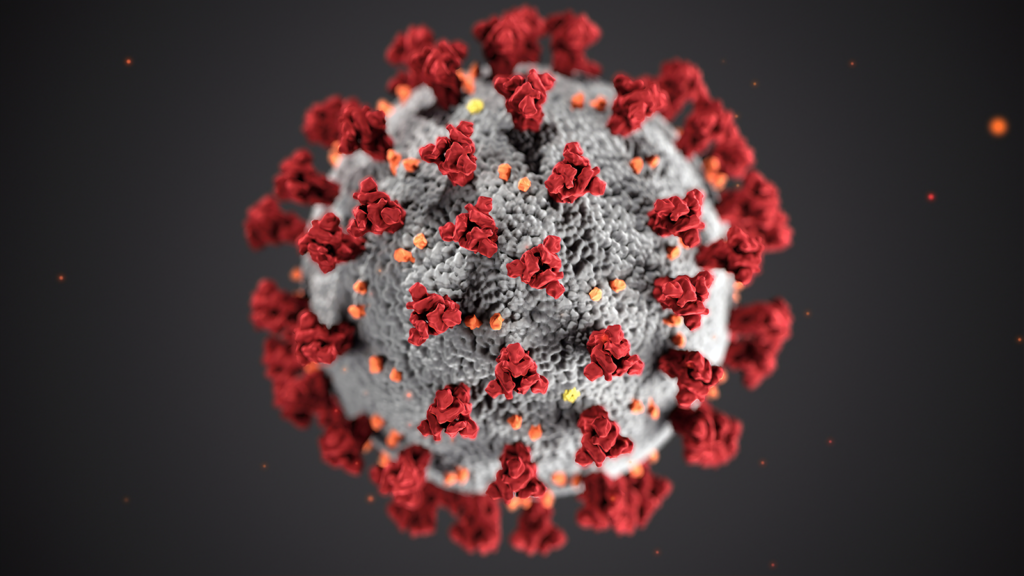

ICCIMA calls government’s coronavirus support package ‘inefficient’

Lack of a clear strategy for industrial development, lack of adequate monitoring over the implementation of the support programs, and thus the creation of rent and corruption in the process, were among the issues pointed out by the representatives of the private sector.

As reported by the ICCIMA portal on Sunday, the committee believed that like the previous government programs, the support packages announced by the government during the coronavirus outbreak fell short, especially in other provinces, mainly due to the lack of executive guarantees.

The committee members criticized the performance of the Central Bank of Iran (CBI), Iranian National Tax Admission Organization and Social Security Organization in dealing with the problems of the industry sector, especially during the pandemic recession, and called for the strict implementation of the resolutions of the National Coronavirus Combat and Prevention Headquarters.

According to Abolfazl Roghani, head of the ICCIMA Industry Committee, after the outbreak of the virus and its direct and indirect impacts on various businesses, the expectations of the private sector from the government were sent to all officials in a 30-item statement.

“Although a significant number of clauses in the statement were discussed at the National Headquarters for Combating Coronavirus, the resolutions did not materialize,” he said.

Back in April, Head of Iran Chamber of Commerce, Industries, Mines and Agriculture Gholam-Hossein Shafeie had written a letter to President Hasan Rouhani, suggesting ways for supporting domestic production against the economic impacts of the coronavirus pandemic.

In the letter, Shafeie stressed that the cabinet's decision to support 10 major business categories did not include the production sector and this sector was largely neglected.

Extension of the tax deferrals offered by the government, returning of at least 50 percent of the value-added tax that exporters paid in the previous year, granting tax exemption or tax reduction of at least 5 percent for the previous year, and extension or renewal of all business licenses without the need to obtain a tax certificate subject to Article 186 of the Law on direct taxes, were some of the supportive measures suggested by the ICCIMA head.

The suggestions also included providing working capital facilities with easy conditions and low rates for those production units and production support services that have been unable to pay their debts and settle their payments due to reduced sales, releasing a part of the deposits that have been blocked in the banks as guarantees and receiving non-cash guarantees by the banks, and obligating the executive bodies to adjust the duration and amount of their contracts with the production units in accordance with force majeure conditions to protect them and prevent them from bankruptcy.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook