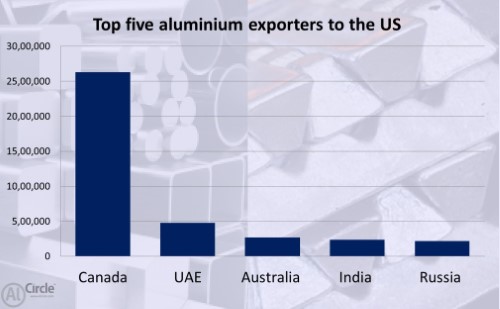

Top five aluminium exporters to the US in 2019

Canada continued to be the leading source of imported aluminium materials, supplying 46% of all aluminium imports during 2019, followed by the United Arab Emirates (8%), Australia (5%), India (4%), and Russia (4%).

Canada exported 2.63 million tonnes of total aluminium to the US in 2019, from 2.76 million tonnes exported in 2018. Canada accounted for 55% of crude metal, 14% of semi-finished products, and 63% of scrap. Exports of crude metals and alloys, semi-finished products, and scrap were down 1.41%, 20.87%, and 12.94% YoY to stand at 2.1 million tonnes, 182,000 tonnes, and 350,000 tonnes respectively in 2019.

UAE stood second with the export of 476,000 tonnes of aluminium in 2019, down 19.59% year-on-year. Exports of crude metals and alloys, semi-finished products, and scrap were 473,000 tonnes, 2,760 tonnes, and 134 tonnes last year. That was down 19.42%, 17.37% %, and 93.43% YoY.

Australia stood third in the list with the export of 269,000 tonnes. Exports jumped 82.99% from 147,000 tonnes in 2018. Exports of crude metal and alloys, semi-fabricated products, and scrap were 268,000 tonnes, 971 tonnes, an increase of 86.11% and 15.87% YoY. But scrap exports decreased by 83.01% to 389 tonnes.

India exported 233,000 tonnes of aluminium to the US in 2019, an increase of 1.3% from 230,000 tonnes exported in 2018. Exports of crude metals and alloys, semi-finished products, and scrap were 183,000 tonnes, 50,400 and 26 tonnes.

Russia’s exports of aluminium to the US stood at 218,000 tonnes in 2019, down 40.92% YoY. Exports of crude metals and alloys and semi-finished products were 205,000 tonnes and 12,500 tonnes, from 347,000 tonnes and 22,100 tonnes in 2018.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts