India: Long Steel Price Gap between Primary & Secondary Mills Widen Further

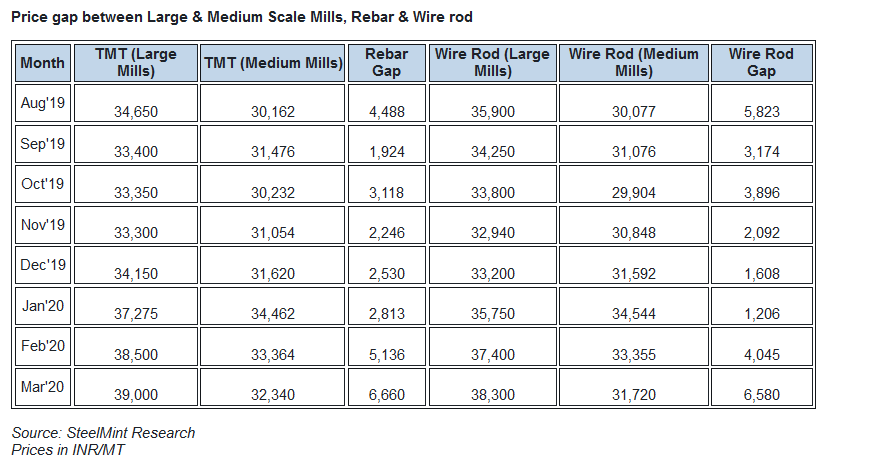

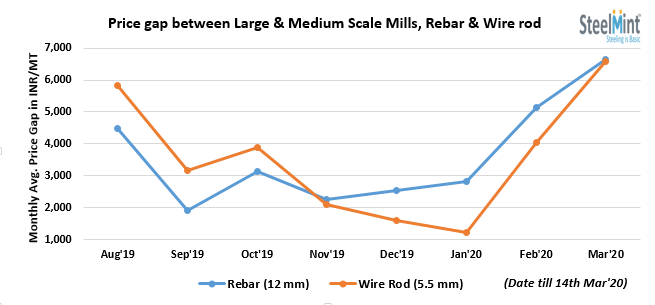

While considering monthly average prices of Durgapur - eastern India, the price gap between large and medium/small scale mills in rebar & wire rod has moved up significantly by INR 2,300/MT and INR 2,800/MT, respectively M-o-M in Feb '20.

Also it increased further by INR 1,500/MT & INR 2,500/MT in Mar’20 (till 14th Mar) in rebar (12 mm) & wire rod (5.5 mm) respectively.

On an average the price gap should be not more than of INR 4,000-4,500/MT between these mills finished steel prices. However currently it is evaluated at INR 5,500-7,500/MT in major locations.

Since Feb'20, the medium/small scale mills have observed limited demand from the local buyers as monthly average rebar prices moved down considerably by 2-4% (upto INR 1,600/MT) in most of the regions. Medium scale mills In India contribute nearly 60-65% share in India's finish long steel production. In central India, capacity utilisation is close to 65-70% considering maximum number of plants.

Most of the trade participants anticipate that medium/small scale mill finish long steel production level might remain under range-bound in near term which is being evaluated at 63.06% and was recorded at 2.51 MnT out of 3.98 MnT in Jan’20.

On the other side, large scale mills raised finished steel prices by INR 500-1,500/MT in Feb’20 and INR 500-1,000/MT in Mar’20. In addition, rebar inventories with large mills has come down by over 6% M-o-M and was registered at 2,45,000 MT in Feb’20 against 2,60,000 MT in Jan’20.

Its possible that price gap might hold the same range considering MoU between large mills and their trade associates (Distributors/Stockist) and witness nominal changes as per regions. They may offer rebates to escalate buying interest.

Also with rising price gap it seems buyers may turn towards mid scale mills long steel rather than primary mills considering lucrative offers.

Column: EU’s pledge for $250 billion of US energy imports is delusional

Anglo American posts $1.9B loss, cuts dividend

BHP, Vale accused of ‘cheating’ UK law firm out of $1.7 billion in fees

Ramaco Resources secures five year permit for Brook rare earth mine in Wyoming

Southern Copper expects turmoil from US-China trade war to hit copper

Trump tariff surprise triggers implosion of massive copper trade

Eldorado to kick off $1B Skouries mine production in early 2026

St Augustine PFS confirms ‘world-class’ potential of Kingking project with $4.2B value

Newmont nets $100M payment related Akyem mine sale

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge

Gold price rebounds nearly 2% on US payrolls data

Caterpillar sees US tariff hit of up to $1.5 billion this year

Uranium Energy’s Sweetwater plant on fast track for in-situ mining approval

Tianqi Lithium Australia JV says it is prioritizing long-term viability of refinery

First Quantum scores $1B streaming deal with Royal Gold

One dead, five missing after collapse at Chile copper mine

Eldorado to kick off $1B Skouries mine production in early 2026

Newmont nets $100M payment related Akyem mine sale

Idaho Strategic rises on gold property acquisition from Hecla

Goldman told clients to go long copper a day before price plunge