Gaslog’s spot market exposure to increase in 2020

If the firm cannot secure term charters for the vessels, Gaslog's spot charter exposure could rise from the six vessels already in its spot carrier fleet to 13 vessels.

The first vessel, the 145,000m³ Methane Alison Victoria, has already finished its term charter and is now operating on the spot market.

And all but one of the seven vessels are older steam turbine vessels, with one tri-fuel diesel-electric (TFDE) carrier. Advances in propulsion technology mean that Gaslog may be unable to secure charters for the steam turbine vessels at "attractive rates" and could lower utilisation, the firm said.

But current charterers of some of the vessels do have options to extend their charters, which could curb the increase in Gaslog's vessels operating on the spot market. But these firms may seek to instead sign term charters with newer TFDE or two-stroke vessels, which typically have lower fuel consumption and boil off rates, and greater storage capacity.

The global LNG shipping market coalesced around the TFDE design in 2013, but has moved to the two-stroke model in recent years, with most of the global orderbook made up of such vessels with a storage capacity of about 174,000m³.

Gaslog's fleet, including subsidiary Gaslog LNG, is composed of 28 carriers, with seven newbuilds ordered. All of the firm's newbuilds are scheduled to be delivered in 2020-21 and are two-stroke vessels with a 174,000-180,000m³ capacity. The seven vessels are tied to long-term charters with US operator Cheniere, UK utility Centrica and Japanese firm Jera.

By Samuel Good

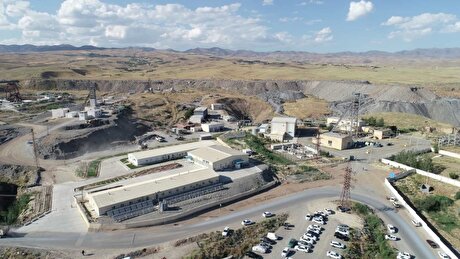

Navoi saw first half output value double on higher gold prices

BHP to explore battery partnerships with CATL, BYD

Fatalities rise for second year in global mining sector

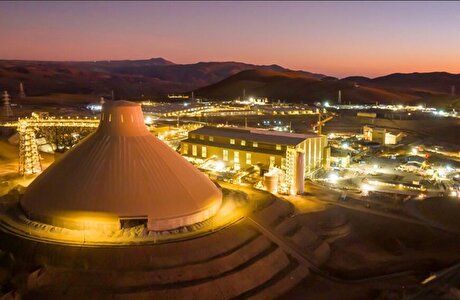

Smelter mishap stokes shutdown push at Codelco

CHART: Nvidia hits $4 trillion – how do mining stocks stack up?

Gold price forecast gets 15% upgrade for 2025: LBMA poll

Copper mine output to rise 2.9% annually over next decade, says Fitch’s BMI

Silver price surges to 14-year high amid mounting trade tensions

Taseko more than doubles value of Yellowhead project near Gibraltar

BHP delays Jansen potash project as costs surge; logs record copper output

Northern Dynasty shares plunge 55% on insider selling

Burgundy halts Ekati pit mining, lays off hundreds

US set to impose 93.5% duty on China battery material

Aura Minerals makes US listing debut

Newmont nets $470M from selling Greatland, Discovery Silver stakes

Rinehart urges Rio Tinto to shift main office to Australia

Rio Tinto picks iron ore boss Simon Trott as new CEO

Gold price forecast gets 15% upgrade for 2025: LBMA poll

Apple invests $500M in Pentagon-backed MP Materials

Rinehart urges Rio Tinto to shift main office to Australia

Northern Dynasty shares plunge 55% on insider selling

Burgundy halts Ekati pit mining, lays off hundreds

US set to impose 93.5% duty on China battery material

Newmont nets $470M from selling Greatland, Discovery Silver stakes

Rio Tinto picks iron ore boss Simon Trott as new CEO

Apple invests $500M in Pentagon-backed MP Materials

Namib to spend up to $400M to restart Zimbabwe gold mines

Trump’s 50% copper tariffs jolt US market as buyers slash imports and delay orders