China's iron ore imports slip in November

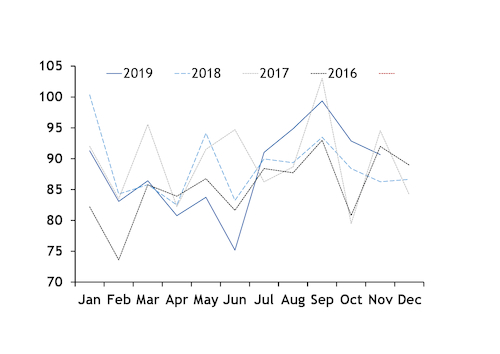

January-November iron ore imports were down by 0.7pc from the year-earlier period to 970.69mn t but they are on course to exceed 1bn t for a third successive year, according to customs data.

Portside stocks of imported iron ore at major Chinese ports were down by 3.53pc on 30 November to 123.83mn t, according to the China iron and steel association Cisa.

Tight portside stocks of mainstream medium-grade fines have lifted prices since mid-November, with the Argus ICX 62pc index assessed at $89/dry metric tonne (dmt) on 6 December, close to the $90/dmt resistance level that has not been breached in the physical market since 15 October.

Steel demand in China was robust in November, nearly doubling mill profits from late-October levels. High profits have provided mills with incentives to use more medium- and high-grade ores to keep producing at near-peak levels.

Steel demand seasonally falls in December, although it is unlikely to be a sharp drop. This may affect demand for iron ore later this month. But several mills may soon start booking cargoes to stock up for the lunar new year holiday in January, supporting prices.

Winter steelmaking and sintering restrictions — which usually lead to a reduction in demand for iron ore fines — may be less severe in 2019-20 compared with previous years as most cities seem to be imposing short-term steelmaking and sintering restrictions during periods of heavy pollution rather than blanket cuts from November-March.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Barrick’s Reko Diq in line for $410M ADB backing

Nevada army depot to serve as base for first US strategic minerals stockpile

Tailings could meet much of US critical mineral demand – study

Viridis unveils 200Mt initial reserve for Brazil rare earth project

SQM boosts lithium supply plans as prices flick higher

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts

Texas factory gives Chinese copper firm an edge in tariff war

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook

First Quantum drops plan to sell stakes in Zambia copper mines

Ivanhoe advances Kamoa dewatering plan, plans forecasts