Chinese GE Major Fangda Carbon registers dramatic Fall in Profits amid Slashed Prices

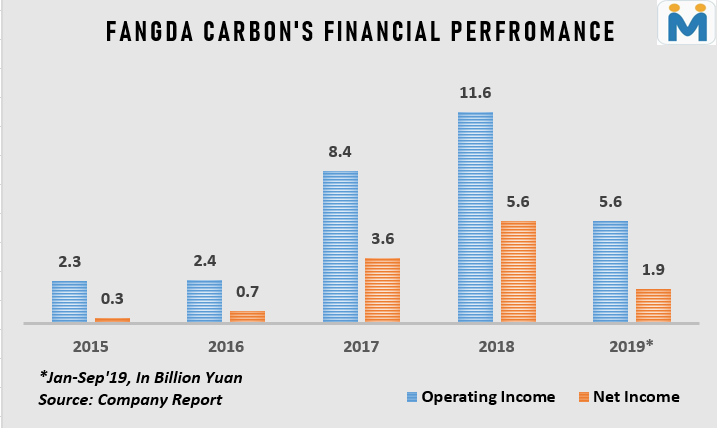

According to company’s financial statement, during Jan to Sept’19, the company has achieved an operating income of RMB 5.64 billion (USD 93 million), registering a y-o-y decrease of 39% and a net profit of RMB 1.93 billion (USD 27 million), a y-o-y plunge of 57%. The company’s net cash flow from operating activities was RMB 3.71 billion (USD 53 million), down by 21% y-o-y basis.

On quarterly basis, the company has achieved an operating income of RMB 1.70 billion (USD 24 million) in the third quarter (Jul-Sep’19), down by 45% against Q3 2018 and net profit stood at RMB 485 million down by 64% y-o-y basis.

According to the historical data, in 2017 and 2018, Fangda Carbon had realized an operating income of RMB 8.35 billion and 11.651 billion yuan respectively, thus recording an increase of 249% and 40%. During same time period, net profits of the company have been recorded at RMB 3.62 billion and RMB 5.59 billion, up by 5,268% and 54% respectively.

Benefiting from the impact of national supply-side reforms, de-capacity in the steel industry, and environmental protection, China’s electric steelmaking ratio in 2017 soared resulting in higher demand and prices of graphite electrodes. This high trend continued for almost a year but in 2019, although the demand for electrodes remained high, the capacity restrictions policy weakened, resulting in demand-supply imbalance and fall in GE prices. As a result, although the company's graphite electrode output continued to grow, the sharp drop in prices caused the company's revenue and net profit to fall sharply.

With the further expansion of Fangda Carbon’s production capacity, company’s inventory over past two years grew relatively fast, but has slowed down significantly during Jan-Sep’19.

Carbon industry encounters bottleneck

As a leading company in China's carbon industry, Fangda Carbon's performance report reflects the trend and current situation of the entire industry environment. The decline in both revenue and net profit also seems to indicate that the industry is experiencing development bottlenecks.

As per the industry experts, with the increase in demand for ultra-high power arc furnaces, UHP grade graphite electrodes are going to have higher demand in the coming future against non-UHP grade electrodes.

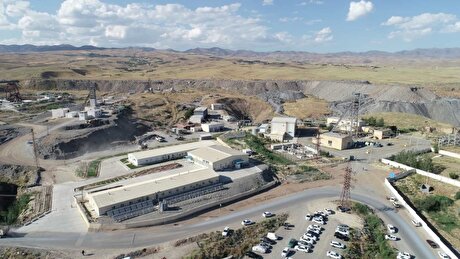

At present, there are already some enterprises have stalled their production. However, with respect to Fangda Carbon, the company has jointly invested RMB 2.7 billion with Baowu Carbon Materials to build a UHP grade GE plant with an annual output of 100,000 tonne in Honggu Park, Lanzhou Economic and Technological Development Zone which is expected to be completed and put into production by the end of 2020.

Mali to sell $107M in gold from Barrick to fund mine restart

Northern Dynasty in talks to settle EPA litigation, shares hit 5-year high

Gold price retreats to one-week low on US tariff delay

Copper price soars to record as Trump announces 50% tariff

Guinea bauxite exports up 36% on Chinese demand

EU prepares to stockpile critical minerals in case of war: FT

Japan to test mine seabed mud for rare earths

McFarlane Lake expands portfolio with $22M buy from Aris

Summit Royalty to go public in deal with Eagle Royalties

Troilus lands second offtake deal with major European copper producer

Copper mine output to rise 2.9% annually over next decade, says Fitch’s BMI

Navoi saw first half output value double on higher gold prices

Fatalities rise for second year in global mining sector

Taseko more than doubles value of Yellowhead project near Gibraltar

McFarlane Lake expands portfolio with $22M buy from Aris

Smelter mishap stokes shutdown push at Codelco

Copper output at Ivanhoe’s Congo mine jumps in second quarter

Gold ETFs drew largest inflow in five years during first half of 2025, WGC says

Glencore to sell Philippine copper smelter to Villar family

Copper mine output to rise 2.9% annually over next decade, says Fitch’s BMI

Navoi saw first half output value double on higher gold prices

Fatalities rise for second year in global mining sector

Taseko more than doubles value of Yellowhead project near Gibraltar

McFarlane Lake expands portfolio with $22M buy from Aris

Gold ETFs drew largest inflow in five years during first half of 2025, WGC says

Mali to sell $107M in gold from Barrick to fund mine restart

EU prepares to stockpile critical minerals in case of war: FT

Dundee receives environmental OK for underground gold project in Ecuador