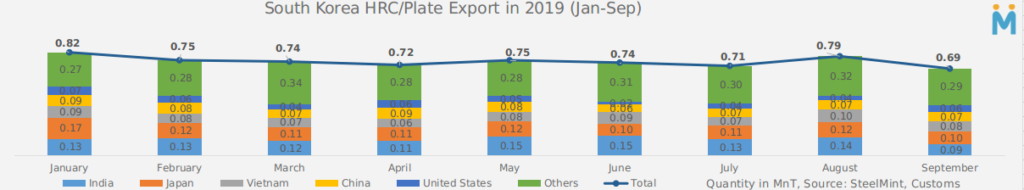

South Korean HRC Exports to India fall 40% in Sept, M-o-M

The principal reason for this decline in Indian HRC imports from South Korea was low bookings of API grade HRC and on rumors of possible safeguard duty by Indian govt (which was later scrapped).

It may be noted that, Indian pipe mills booked American Petroleum Grade (API) grade coils, as several pipe tenders were awarded by Indian oil and gas companies, with ONGC and Gas Authority of India Limited (GAIL) floating the most number of tenders in the month of June/July.

South Korean HRC exports to Japan (the leading Korean HRC importer) too plummeted by around 15% from 120,104 MT in August 2019 to 102,269 MT in September.

India imports about 1.31 million tonnes (MnT) from South Korea every year, which is about 17% of total exports from that country.

Total South Korean HRC exports to India were at 7.9 MnT in financial year 2018-19 (FY19) and till September 2019, are at 6.7 MnT.

According to steel ministry data, South Korea, Indonesia and Japan made up 70% of India’s total steel imports in August. These three countries are able to sell low-priced steels to India as they are exempt from basic customs duties of 10% and 12.5% on long and flat products respectively because of the free trade agreements (FTAs).

HRC was the highest-imported steel product from South Korea and Japan in the April-July period of 2019. Japanese and South Korean car makers based in India, as well as white goods companies, are usually the major buyers of steel from these countries.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook