Stornoway Diamond dealt another blow

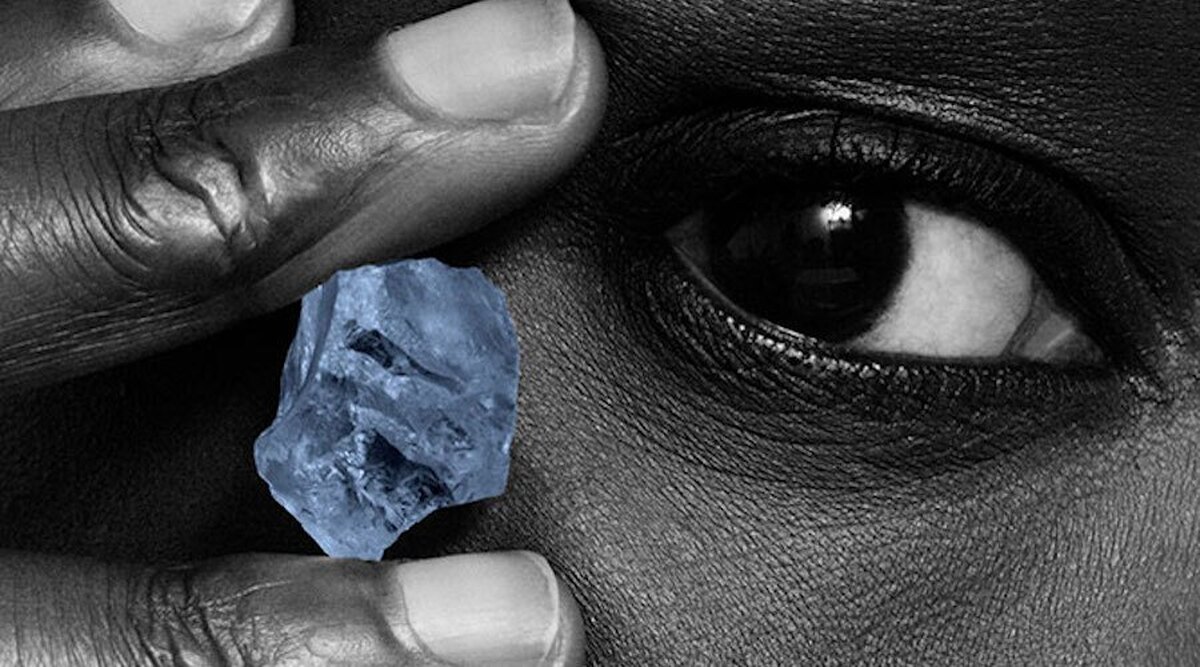

The beleaguered Canadian miner, originally co-founded by Eira Thomas, has been facing financial storms since late 2016, but its share price was holding at C20 cents in March, since declining nearly 90%.

In April, Stornoway halted operations at Renard, which is the province of Quebec’s first diamond mine, and Stornoway’s primary asset.

Stornoway has been exposed to the low quality end of the market, and those diamonds have been selling for much less, due to an unforeseen oversupply.

Things were looking up in June, when Stornoway and its subsidiaries arranged bridge financing to keep the Renard mine operating while the company undertook a strategic review with the aim of restructuring its finances.

But Stornoway since released grim financial results from the three months leading to June 30. The miner reported a net loss of over C$394 million, and said that management forecasts cash flows “will not be sufficient to meet the corporation’s obligations, commitments and budgeted expenditures through June 30, 2020 based upon current market diamond prices.”

Stornoway is now being reviewed under the TSX’s remedial review process and has been granted 120 days to comply with all requirements for continued listing.

If Stornoway cannot demonstrate that it meets all TSX requirements on or before December 20, 2019, the Corporation’s securities will be delisted 30 days from that date.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook