Indian iron ore pellet exports may slow in near term

Several Indian iron ore mines have rushed to supply low-grade fines to China from major east coast ports such as Dhamra, Paradip, Gopalpur and Gangavaram, lengthening shipping queues.

"Not only are ports congested but getting wagons and trucks to haul pellet from plants to ports is also harder because of the sudden boom in iron ore exports from Odisha," said an executive with a pellet producing company.

A surge in demand for low-grade fines in China since November 2018 has lifted prices of mainstream grades such as SSF fines and Fortescue blended fines, prompting cost-conscious Chinese mills to seek more tonnes of lower-priced Indian low-grade fines.

The Argus 58pc Fe price was assessed at $112.50/dry metric tonnes (dmt) on Monday. While regular exporters of low-grade fines have stepped up overseas sales, even mines that do not usually export much have increased sales to China to cash in on the demand, creating logistical hurdles for pellet exporters.

Offers for 57pc Fe Indian fines were at $94/dmt cfr China today, while an offer for 54pc Fe fines was at $86.50/dmt with mid-July loading dates.

An Odisha-based pellet exporter has stopped taking fresh export orders until the end of the month as it struggles to meet pending deliveries. The eastern state of Odisha is the country's largest iron ore producer, supplying most of the pellet that is sold domestically or exported.

Haulage problems and congestion at ports have created an additional cost of $2/dmt for pellet exporters in recent days. Large exporters are not keen to book new orders because of the hassle of waiting for haulage at plants and ports, said a senior executive at an east India-based producer.

Demand for Indian pellet remains stable in Chinese markets, although there were few seaborne deals this week. Offers were at $137-140/dmt for near-month deliveries.

Iran’s Copper Production Continues without Interruption

Aclara Resources, Stanford University partner on AI-powered rare earth research

Gold price to hit $3,600 this year and next: CIBC

Ultra-rare metal rides AI boom as commodities star performer

Energy Fuels shares surge to 52-week high as it begins heavy rare earth production

SolGold to start mining copper from Cascabel in early 2028

Antofagasta’s copper production up 11% in strong first half

Boliden mine to host world’s deepest marathon at 1,120m

NexMetals receives EXIM letter for potential $150M loan

Gold price eases after Trump downplays clash with Fed chair Powell

Three workers rescued after 60 hours trapped in Canada mine

Saskatchewan Research Council adds full-scale laser sorter to mining industry services

NexMetals receives EXIM letter for potential $150M loan

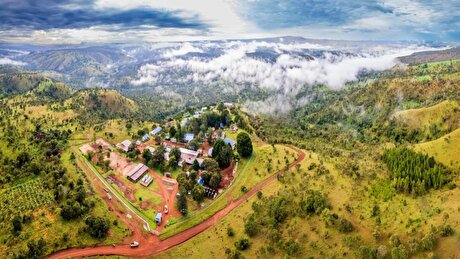

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

KoBold signs Congo deal to boost US mineral supply

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

Spring Valley gold project in Nevada gets federal approval

Gold price to hit $3,600 this year and next: CIBC

China quietly issues 2025 rare earth quotas

Gold price eases after Trump downplays clash with Fed chair Powell

Three workers rescued after 60 hours trapped in Canada mine

NexMetals receives EXIM letter for potential $150M loan

Lifezone Metals buys BHP’s stake in Kabanga, estimates $1.6B project value

KoBold signs Congo deal to boost US mineral supply

Northern Dynasty extends losses as it seeks court resolution on Pebble project veto

China quietly issues 2025 rare earth quotas

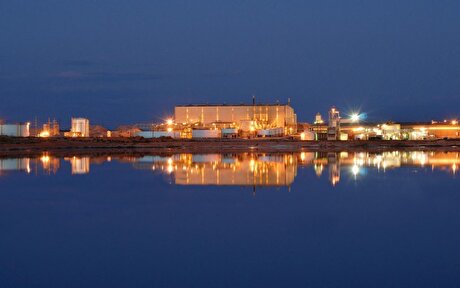

BHP delays Jansen potash mine, blows budget by 30%

AVZ slams Congo-KoBold deal over disputed lithium project