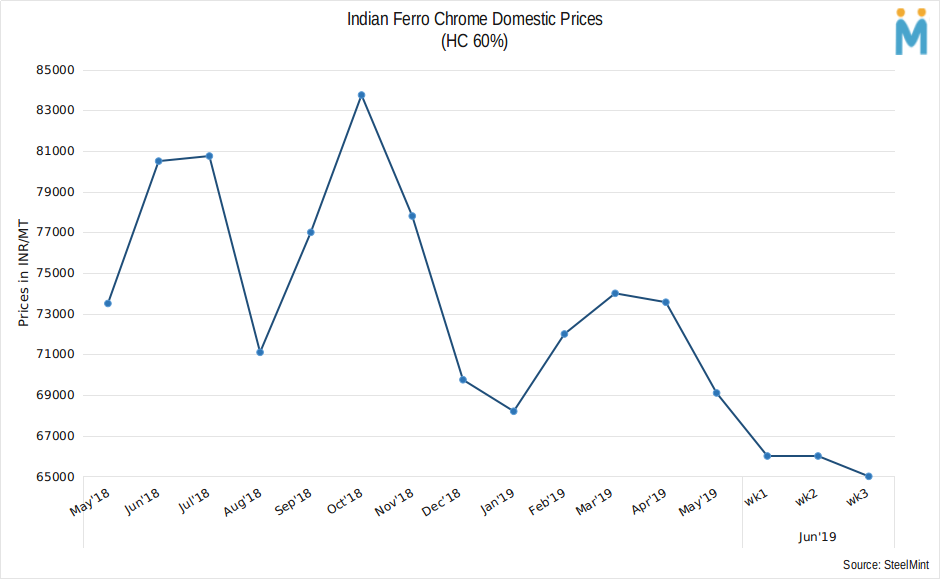

India: Ferro Chrome Prices Down Owing To Tepid Demand

Most market participants are now waiting for the Ferro Chrome tenders from major Chinese Stainless Steel mills. Ferro Chrome prices are under tremendous pressure as the market is now majorly dependent on the negotiation levels of the buyers. With the overall Chrome Ore prices coming down, buyers are quite aggressive at trading. Many sellers are reducing their prices to sell the material, which however is pulling down the market. An Indian producer stated that with the bearish Stainless Steel Market conditions, the redemption of prices is highly unlikely.

Domestic price for Ferro Chrome in India is assessed to at around INR 65,000/MT Ex-Jajpur. Export prices for CNF South Korea (10-50mm, HC 60%) is 75 cents/lb, for CNF Japan (10-50mm, HC 60%) is 76 cents/lb and for CNF China (10-150mm, HC 60%) is around 72 cents/lb. No deals took place in Japan and South Korea, and therefore the prices remained unchanged owing to no trade.

Chinese Market:

Ferro Chrome Production in China is still relatively high at the moment, so it is unlikely that Chinese mills will have any concerns about the supply of Ferro Chrome. Ferro Chrome Prices in China have halted for the time being as the sellers are waiting for the next tenders and are not willing to reduce prices to further low. China-based Producer believed that rise in prices is only possible if the major suppliers in China and overseas cut production significantly, but such an event is highly unlikely to occur because the market conditions are bad but it's still operable.

On the future outlook, there is a very little chance of Ferro Chrome market to rebound. Such a scenario is attributed to supply-demand dynamics. Market sources believe that the prices may go further down as some sellers are bringing the prices down by trading at a lower cost. Meanwhile, Indian Producers are waiting for the Chinese tenders.

Trump weighs using $2 billion in CHIPS Act funding for critical minerals

Codelco cuts 2025 copper forecast after El Teniente mine collapse

Electra converts debt, launches $30M raise to jumpstart stalled cobalt refinery

Barrick’s Reko Diq in line for $410M ADB backing

Abcourt readies Sleeping Giant mill to pour first gold since 2014

Nevada army depot to serve as base for first US strategic minerals stockpile

SQM boosts lithium supply plans as prices flick higher

Viridis unveils 200Mt initial reserve for Brazil rare earth project

Tailings could meet much of US critical mineral demand – study

Kyrgyzstan kicks off underground gold mining at Kumtor

Kyrgyzstan kicks off underground gold mining at Kumtor

KoBold Metals granted lithium exploration rights in Congo

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Kyrgyzstan kicks off underground gold mining at Kumtor

Freeport Indonesia to wrap up Gresik plant repairs by early September

Energy Fuels soars on Vulcan Elements partnership

Northern Dynasty sticks to proposal in battle to lift Pebble mine veto

Giustra-backed mining firm teams up with informal miners in Colombia

Critical Metals signs agreement to supply rare earth to US government-funded facility

China extends rare earth controls to imported material

Galan Lithium proceeds with $13M financing for Argentina project

Silver price touches $39 as market weighs rate cut outlook